The IndeX Files 10-12-2019

Risk Factors Building Up

Global equities benchmarks have seen a loss of upside momentum over recent trading. With the year winding down, the risk factors affecting equities (Brexit, US-Sino trade war, central bank monetary policy) remain at large. The UK elections this week should offer some clarity on how Brexit is likely to be handled with most forecasters suggesting that the Conservative party will win, putting the focus on Johnson’s Brexit deal. This would be positive for both UK and European assets, avoiding the economic fall-out of a no-deal Brexit.

On the US-Sino trade negotiations front, there is still no sign of a deal yet. Furthermore, Trump has been vague about whether he plans to go ahead with a further round of tariffs on December 15th (as originally intended). If a deal is not done by the 15th and Trump does apply fresh tariffs, this would likely be met with a wave of risk aversion, putting downward pressure on asset prices. However, if a deal is done, or if negotiations continue and Trump postpones the tariffs, this should help keep risk sentiment positive, leading equities higher.

The Fed and ECB rate meetings are the key risk events this week. While neither bank is expected to ease further, investors will be paying close attention to the details of the monetary policy statements for any insight into whether further easing is likely to come over Q1 2020. Both the Federal Reserve and the ECB have said that further easing could be warranted if the respective economies suffer any further weakness. With the Fed and the ECB likely to reiterate this message at the upcoming meetings this week, equities are likely to remain supported. Speaking last week, ECB’s Lagarde said that the ECB remains committed to achieving its 2% inflation target. Investors will now be looking for further insight into how the new ECB chief aims to tackle persistently low inflation in the Eurozone.

Technical & Trade Views

DAX (Bullish, above 13155.27)

From a technical and trading perspective. DAX has recovered much of last week’s losses though remains capped by the monthly pivot at 13155.27 for now. With longer-term VWAP still positive a further move higher is likely with momentum studies also showing plenty of scope for a continuation higher.

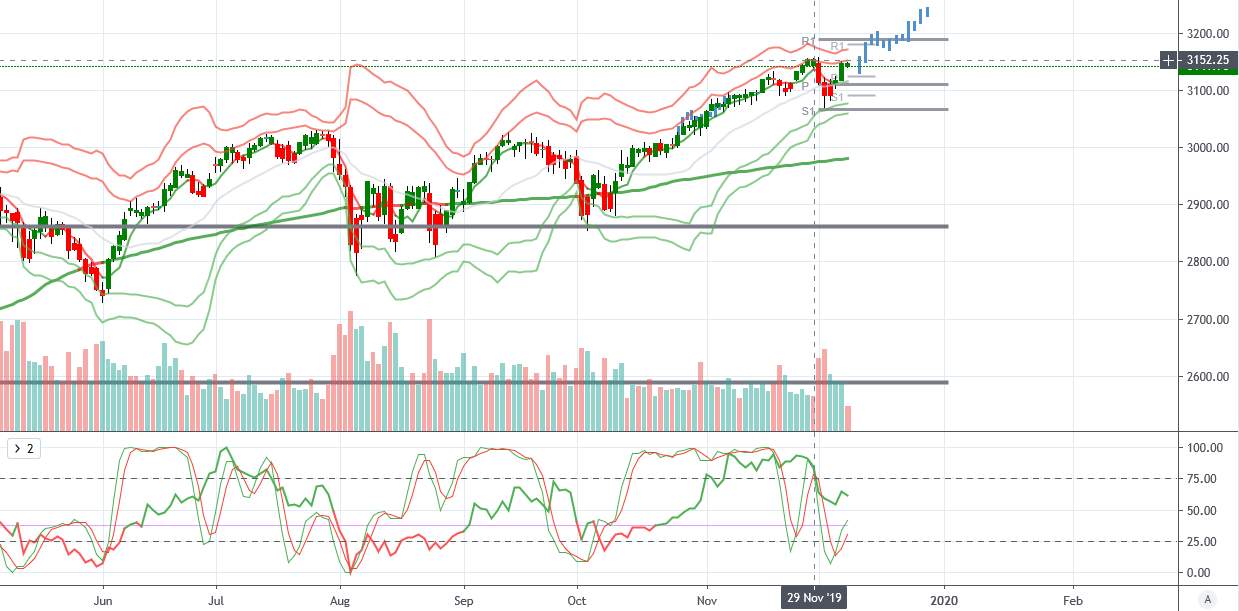

S&P500 (Bullish, above 3109.25 )

S&P500 From a technical and trade perspective. Price action reversed firmly higher from last week’s lows, taking price back above the monthly pivot at 3109.25. With longer-term VWAP positive and plenty of volume seen on the lows, the bias remains for further gains .

FTSE (Bearish below 7338.6)

FTSE From a technical and trading perspective. While below the monthly pivot at 7338.6, FTSE is vulnerable to a deeper move lower here towards the yearly pivot at 7060.9 where stronger bids are likely to be seen. Longer-term VWAP has flipped negative here as the market continues to struggle with direction.

Nikkei (Bullish, above 23242.1)

From a technical and trade perspective. Price continues to consolidate above the yearly R1 at 23333. With longer-term VWAP positive, an eventual break higher seems likely, with price holding above the monthly pivot at 23242.1.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!