A Better Way To Trade Double Tops

Revamping Old Patterns

In terms of technical setups, the best advice is always to keep things simple. There are plenty of complicated, esoteric chart patterns and technical structures around on the internet. However, the vast majority of traders will often find that it is the classic patterns and the simple structures that tend to give the bets results. However, just because you are using a classic pattern or structure, doesn’t mean you need to trade them in a traditional manner. Sometimes, the best results come from spending some time honing your entry techniques to take full advantage of a technical setup. Double tops are a great example of this.

Double Top Trading Tactics

Double tops are one of the most popular technical patterns in use, employed by beginner and pro traders alike. However, results from trading the pattern tend to vary and many new traders complain that the textbook way in which they trade the pattern, doesn’t seem to work consistently enough.

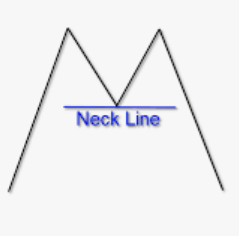

Typically, when trading a double top, the trader is advised to sell as price breaks below the middle peak of the “M” formation (the neckline) for a double top.

The issue with trading the patterns in this manner is that often times, by the time price tests the neckline of the structure, the reversal has already occurred and many times, a fuller reversal won’t take place.

A Better Way

So, a better way to trade the pattern is to look to enter at the second top as it forms. Now, this doesn’t mean that every time price tests a prior level we look to execute a trade as this would obviously be foolish. However, we can look for clues that a double top is going to form and in that regard, technical indicators and simple candle stick reading can be very helpful.

Using Indicators And Candlestick Reading

In the above chart you can see a great example of how we can use technical indicators and simple candlestick reading to gain better entry to double tops. So, as price trades up to test the first peak, alerting us that a potential double top might form, notice how the RSI indicator (which measures momentum) is showing bearish divergence by presenting a lower peak. So, this tells us that bullish momentum is failing and further endorses the view that a double top might form. Next, notice how we see price form a bearish pin bar at the double top level, a solid bearish reversal candle.

So, we now have the RSI showing bearish divergence as well as a bearish pin bar, at a solid resistance level. With this confluence in place, we can anticipate that a reversal is going to take place and we can enter a sell trade targeting a move down to the neckline. Most importantly, notice how as price breaks the neckline, where textbook traders would be entering their sell trade, the move then fails and reverses. Hopefully now you can see just how effective it can be to find new ways to enter old patterns!

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.