AUDJPY Rallying Hard Ahead of RBA

RBA On Watch

The RBA will meet overnight tonight for its August rate decision. Expectations have been heavily divided in the build up to this meeting though, as it stands, the market is currently forecasting a further .25% hike, which would take Aussie rates up to 4.35% from 4.1% currently. On the back of two successive rate hikes at the last two meetings, last week’s quarterly inflation reading posted a decline which many took as a sign that the bank will look to pause on tightening this month.

Scenarios & Market Implications

However, expectations have fallen marginally in favour of a further hike with a Bloomberg economist survey showing 15 in favour of a further hike and 11 in favour of a hold. Given the slim margin here, there is plenty of room for volatility tonight. If the RBA does press ahead with a further hike this should see AUD firmly higher against currencies such as JPY and USD.

However, a further hike at this point will likely be seen as the end of the tightening campaign unless the bank clearly states that it is leaving the door open for further hikes. If the RBA refrains from tightening, this is likely to see AUD under pressure near-term though, again, the outlook and guidance will be important to watch for a longer run directional view.

Technical Views

AUDJPY

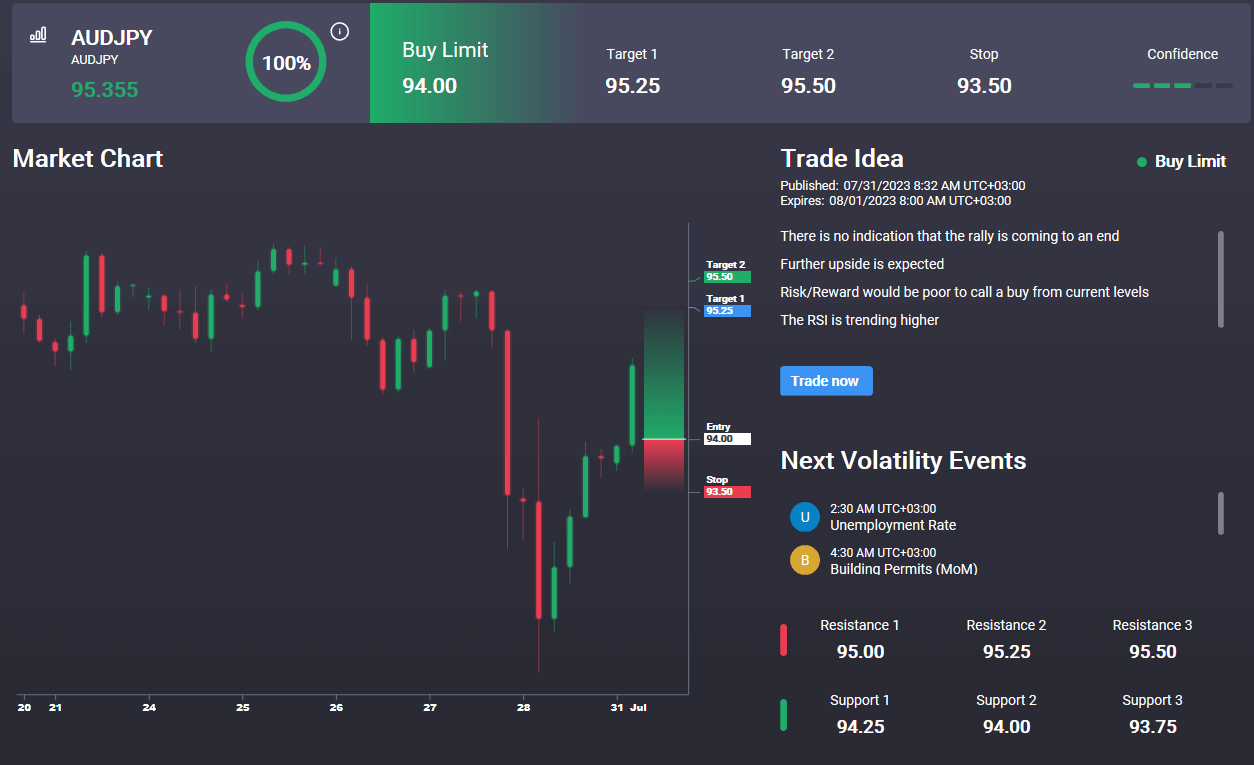

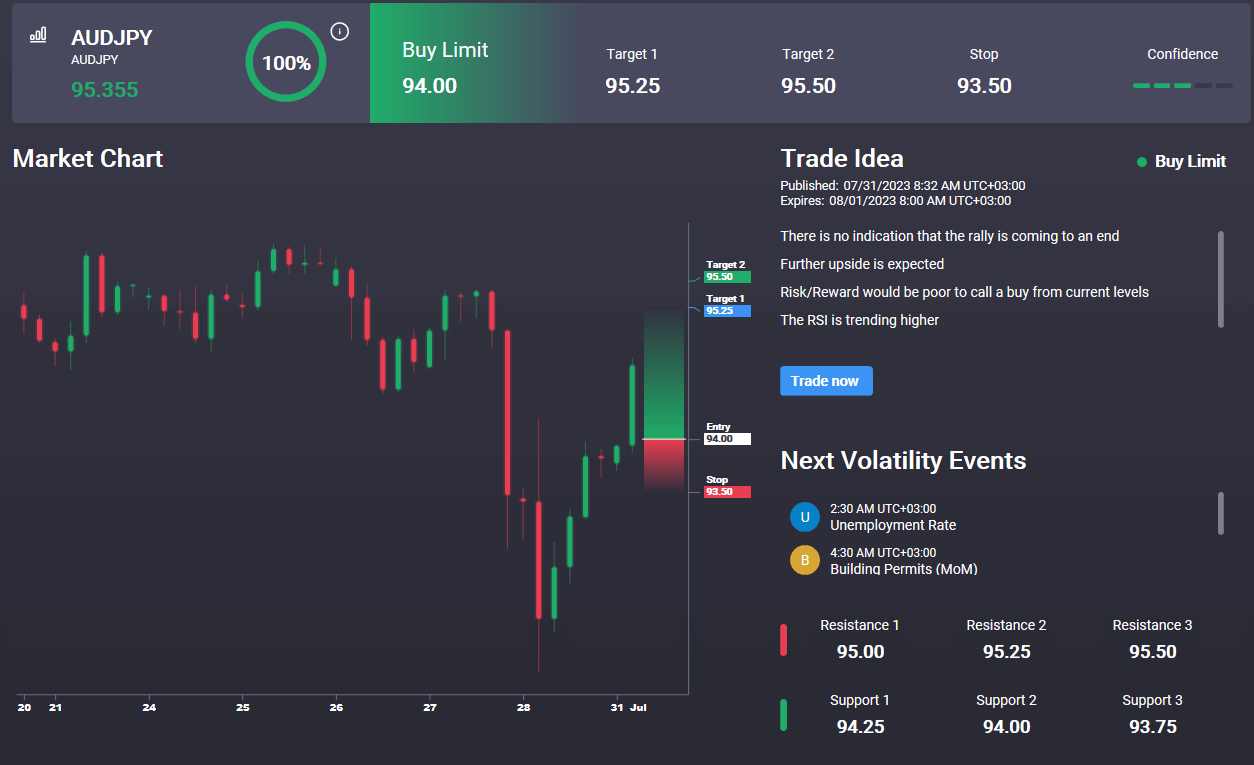

The sell off in the AUDJPY found strong support into a test of the 92.66 level where we had the longer-term bullish trend line and the corrective bear channel lows. Price has turned sharply higher off the level and is now fast approaching a test of the 95.67 and bear channel highs. If bulls break back above here, 98.83 is the next topside objective. Looking at the Signal Centre today, we can see there is an active buy signal from 94, targeting a move up to 95.50.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.