Bitcoin Bulls Eye $100k Next

BTC Rally Holds

Bitcoin prices remain on watch ahead of the eek as the market pauses following the recent spike higher. BTC futures are now up around 25% off the YTD lows with a break above the bear trend line from YTD highs giving an encouraging signal that the bull trend is resuming, putting focus on a move back up to YTD highs as the first bull objective.

Better Risk Appetite

The shift higher in BTC comes amidst a general improvement in risk sentiment this week linked to some encouraging comments from Trump on potentially bringing down China tariffs. The US trade war with China has been a key headwind for risk assets this year and the prospect of an end to that standoff is helping drive bullish sentiment in crypto prices.

21 Capital Launches

BTC prices are also benefiting from news of a huge new investment deal in Bitcoin this week. Tether and SoftBank have launched their new BTC investment entity 21 Capital with Cantor as equity partners. The group has launched with a purchase of 42k units of BTC and has a mission to accumulate Bitcoins and grow investor ownership per share. The launch, which is reported to be worth around $3 billion, is seen as a major green flag for BTC bulls and a signal that prices are expected to rise over the long term. Any incoming news of further purchases is expected to act as a bullish driver for BTC going forward similar to the dynamic we saw with MicroStrategy’s BTC purchases.

Technical Views

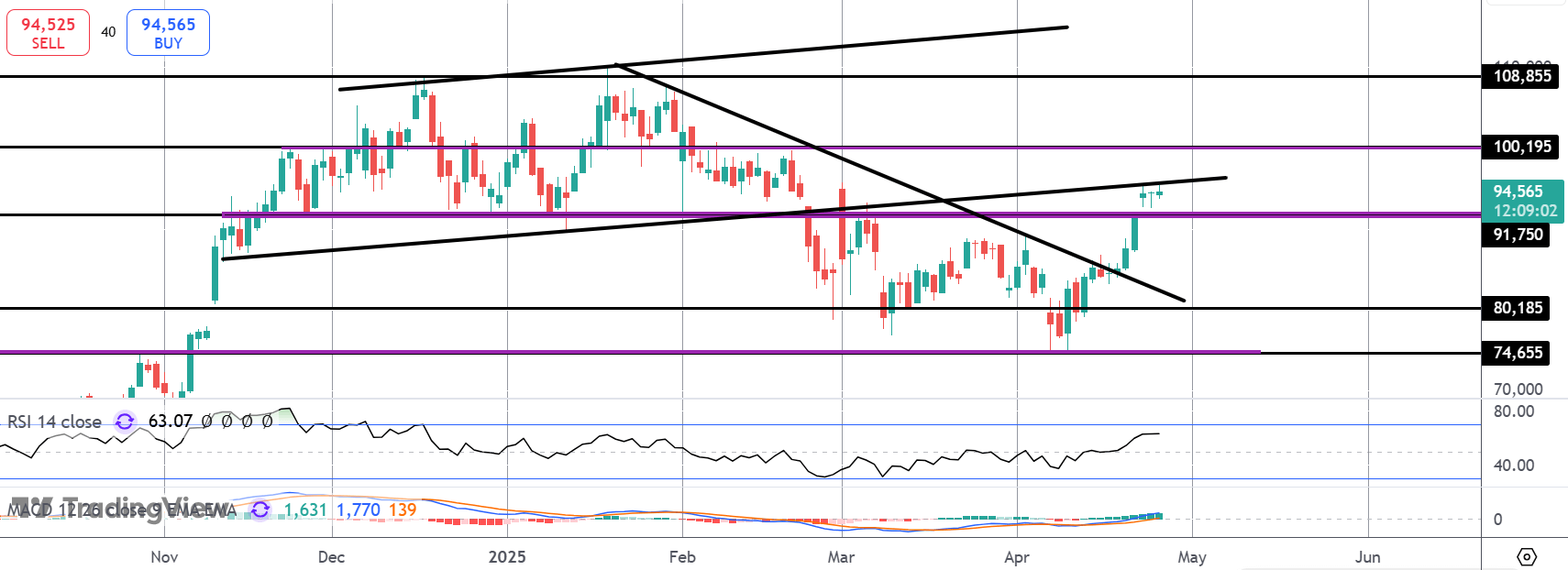

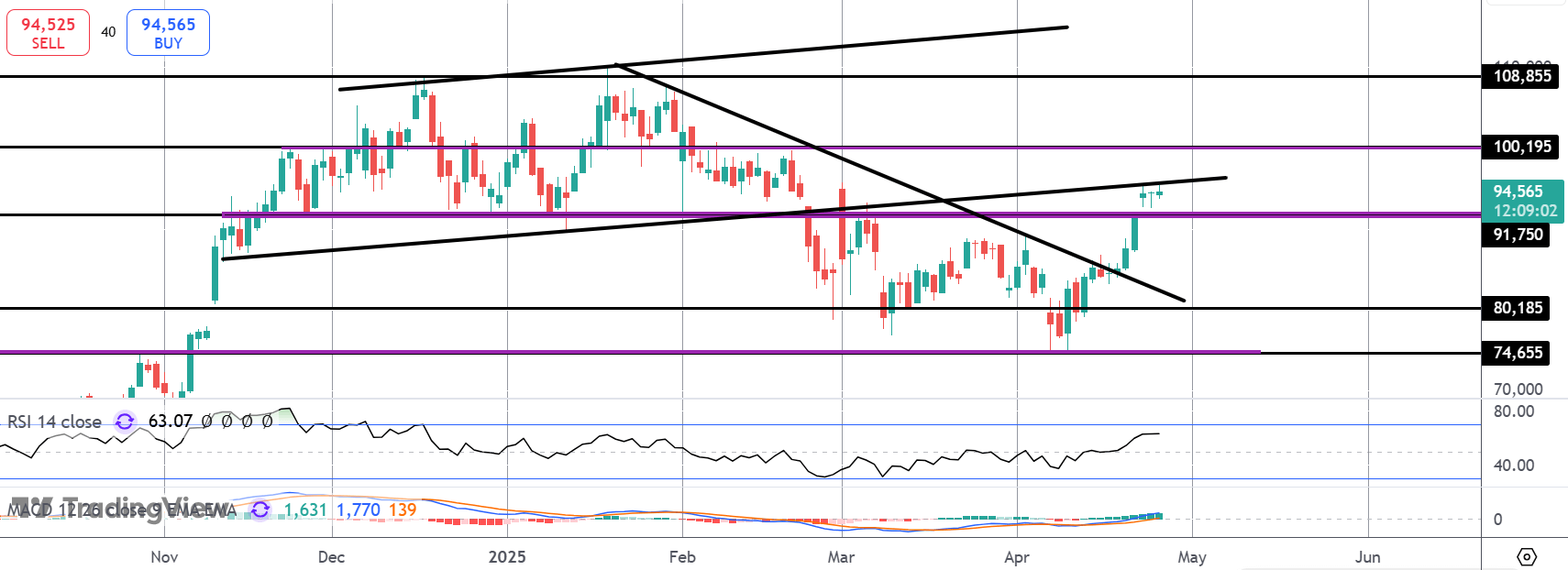

BTC

For now, the rally in BTC has stalled into the retest of the broken bull channel lows. However, while price holds above the $91,750 level, and with momentum studies bullish, focus is on a fresh push higher and a test of the $100k level next, ahead of a return to YTD highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.