Copper Stalling on Weak China Data

On the back of the strong rally we’ve seen recently, copper prices are stalling on Thursday as traders digest the latest data weakness out of China. The October Manufacturing PMI was seen falling further into contractionary territory at 49.4 down from 49.5 last and below the 49.8 the market was looking for. The data serves as the latest evidence of a slow down in the Chinese economy and raises concerns over the copper demand outlook.

Health Concerns Reappear in China

Worrying too, has been the news this week of a fresh outbreak of a pneumonia-related illness in China. The WHO has warned over the outbreak which has seen hundreds of people hospitalised, sparking fears of a potential return to some of the COVID-era measures which, if seen would certainly pull commodities prices lower.

USD Still Key

Still, the main driver for copper prices recently has been the weak US Dollar. With the Fed now widely tipped to stay on hold through year end before cutting rates into next year, USD has undergone a huge repricing, reflected in the almost 8% gain we’ve seen in copper prices this month. Looking ahead today, traders will be focusing on the latest core PCE reading as well as the latest unemployment claims data. If these data points highlight any fresh weakness this should help revitalise upside in copper, weighing on USD.

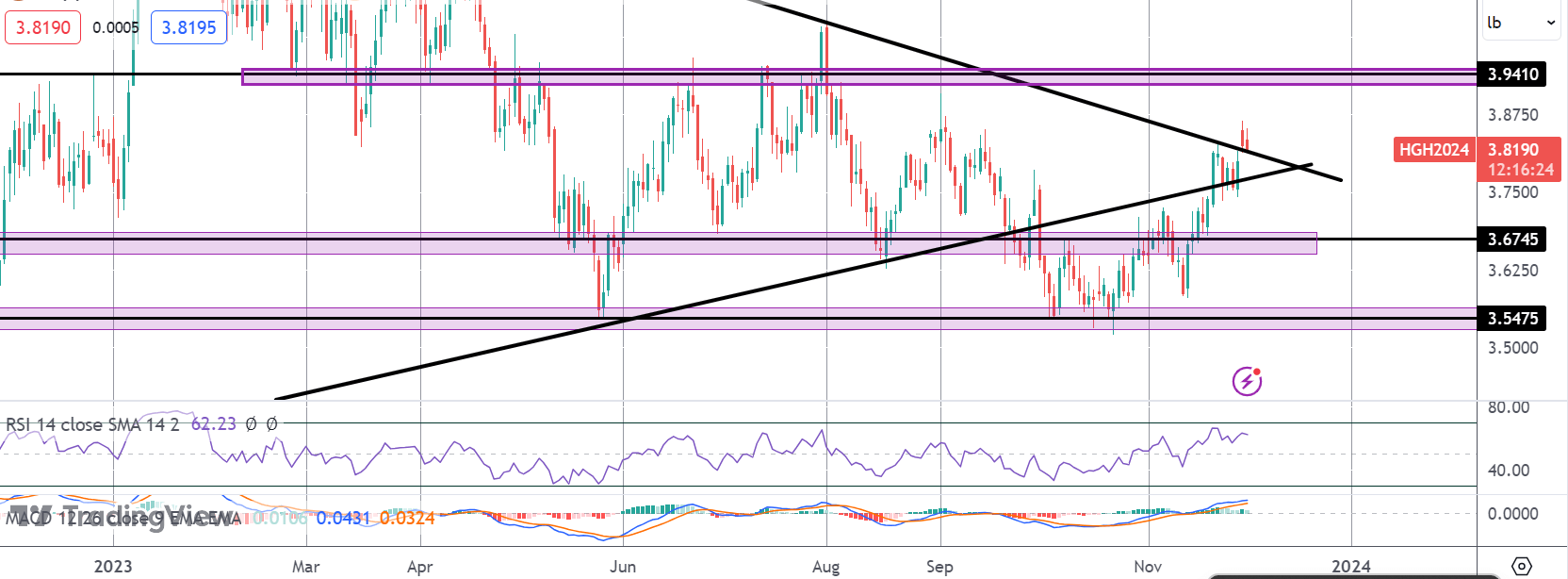

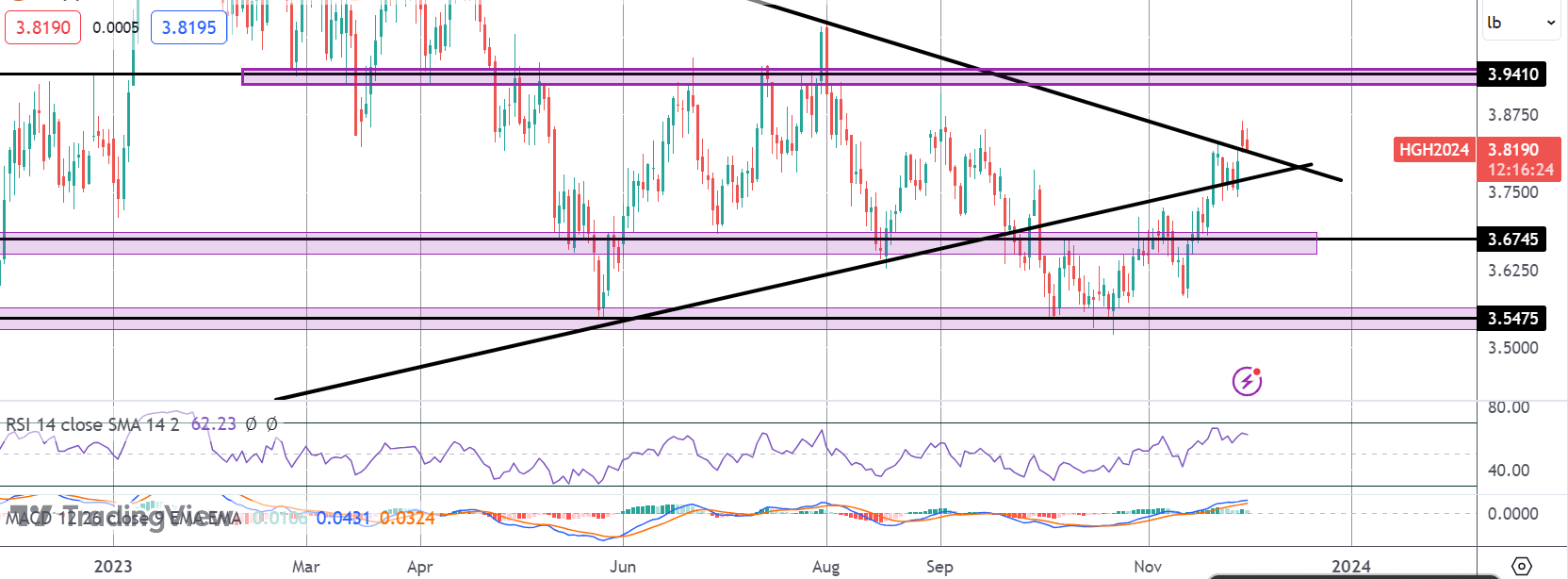

Technical Views

Copper

The rally in copper has seen the market breaking out above the top of the contracting triangle pattern and the bearish trend line from 2022 highs. While above here, and with momentum studies bullish, the focus is on a further push higher and a test of 3.9410 next. To the downside, 3.6745 remains key support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.