Crude Futures At Key Support Zone

Can Oil Recover from Here?

Oil prices have bene fighting to recover lost ground this week with the futures market establishing a temporary base around the 67.45 level support. Still holding just below the level, sentiment remains weak and bearish risks are noted. However, if bulls can get back above the level near-term, we could see a bottom established to act as a platform for a further recovery higher.

Tariffs Weighing

The market is currently caught between opposing forces. On the one hand, a weaker USD and dovish Fed expectations are underpinning commodities prices here, helping oil stem the declines of recent weeks for now. However, fears over the growing risks linked to Trump’s trade war, including reduced global trade and a possible recession in the US, mean that its hard to carve out a strong case for a rally in crude.

EIA Inventories Rise Again

The latest EIA inventories data yesterday saw US crude stores rising again last week, marking the 6th surplus in the last 7 weeks. The data reflects an ongoing dirge in overall demand. However, some of the sub data was a little brighter with crude prices bolstered by news of a large and unexpected draw in gasoline inventories.

OPEC+ Expectations

Looking ahead, traders will be keeping an eye on supply/demand developments. OPEC+ is widely expected to hike output next month which should create fresh headwinds for oil, leading to lower prices. Similarly, any fresh escalation in the trade war will weigh heavily on prices too particularly if the spat between the US and China deepens.

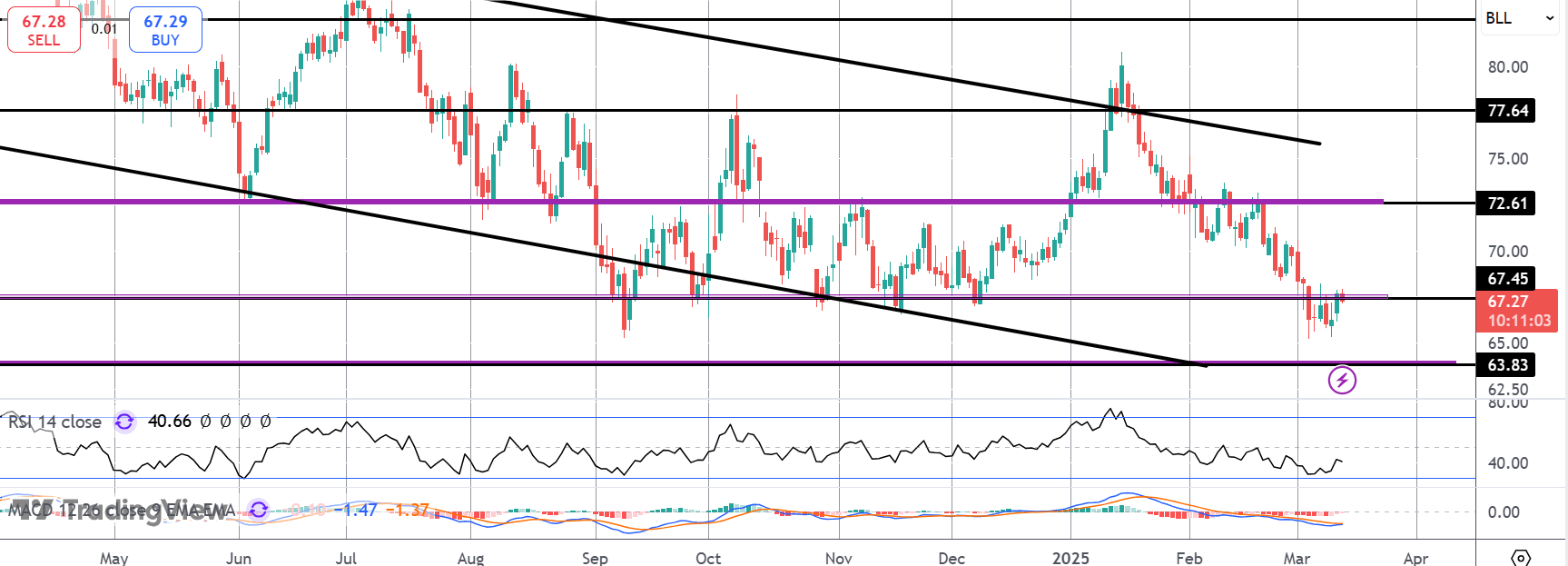

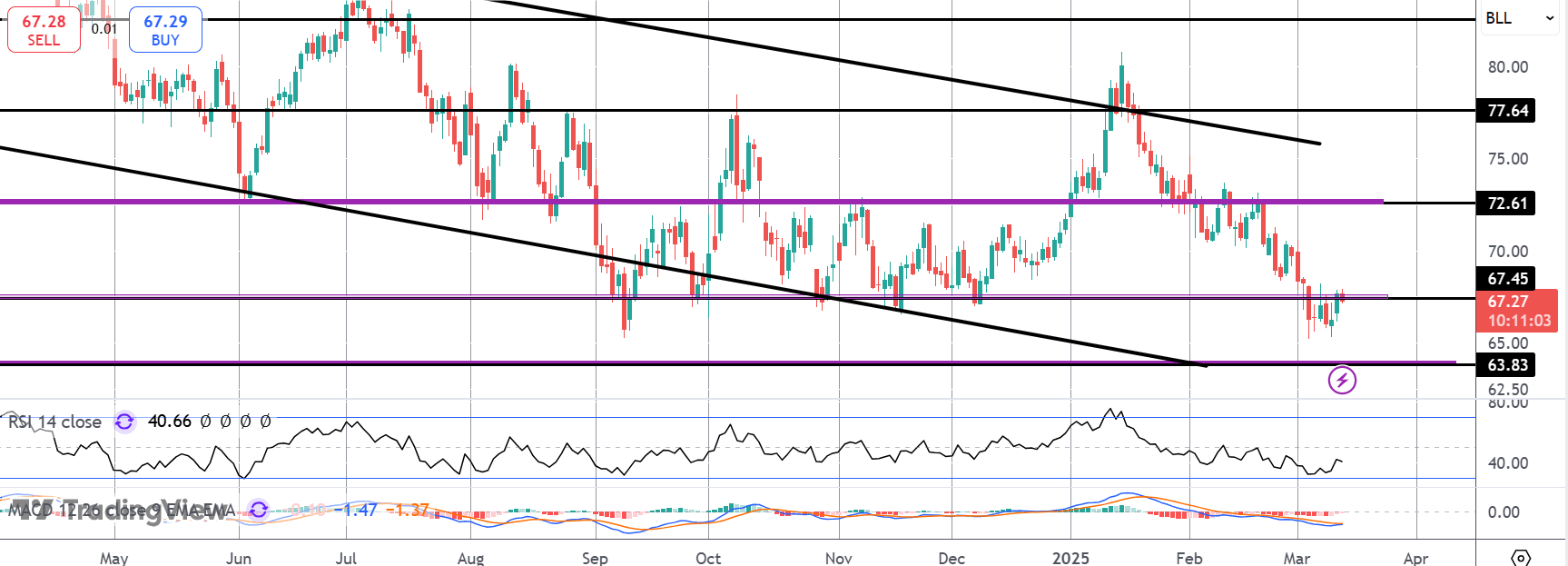

Technical Views

Crude

The sell off in crude has stalled for now into the 67.45 area lows. This is a key multi-year support area for the market and if bulls can hold here, chances of a rotation higher towards 72.61 are seen. Failure here, however, will turn focus to 63.83 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.