Daily Market Outlook, August 18, 2020

Daily Market Outlook, August 18, 2020

Asian equity market is mixed this morning but most moves are very modest. Tensions between the US and China continue to rise and yesterday the US announced further restrictions on Huawei.

In Australia, Victoria recorded its lowest daily rise in new coronavirus cases in a month. However, Sydney has been added to the list of Covid-19 hotspots and Tasmania announced that its borders would be closed until at least 1st December. The number of new French cases on Monday was reported as significantly down on the previous two days, although hospitalisations continued to rise. Paris and Marseille, have been added to the highest-risk coronavirus red zone list.

The latest formal round of negotiations on the future relationship of the UK and the EU are set to begin today. Discussions are set to cover some of the key issues where the two sides are said to still be some way apart. Those include competition rules, fisheries policy and state aid. After the previous round of talks the EU’s chief negotiator Michel Barnier said that a deal seemed “unlikely at this point”. In contrast, his UK counterpart David Frost, while agreeing that there were still “considerable gaps”, expressed more confidence that a deal would be achieved.

Today’s data calendar is very light with nothing of note in the Eurozone or the UK. In the US, the July data for housing starts and building permits are expected to provide further evidence that the housing sector is continuing to rebound post lockdown. Starts are expected to have risen by 4% less than June’s 17% rise but an indication that activity is still on the increase. Permits, which rose by only 3.5% in June are expected to have accelerated. Yesterday’s data for August was mixed, as the New York Fed manufacturing index disappointed but the NAHB housing index rose to its highest level for more than 20 years.

ECB Vice-President De Guindos is scheduled to speak today. Markets will be particularly interested to hear if he has anything to say about the economic implications of the most recent rise in Covid-19 cases in the Eurozone.

Early Wednesday, the UK July inflation release is forecast to show a modest rise in annual CPI inflation to 0.7%, from 0.6% in June. That will still leave it well below the 2.0% target and so will have no new implications for monetary policy. Particularly as inflation seems likely to fall below 0% in August when the temporary VAT reduction and ‘eat out’ policy will impact on the numbers.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1670-75 (455M) 1.1745-50 (1.33BLN)

- USDJPY:105.50 (631M), 106.00 (481M), 106.60 (520M)

- EURGBP: 0.9100 (230M), 0.9500 (456M)

Technical & Trade Views

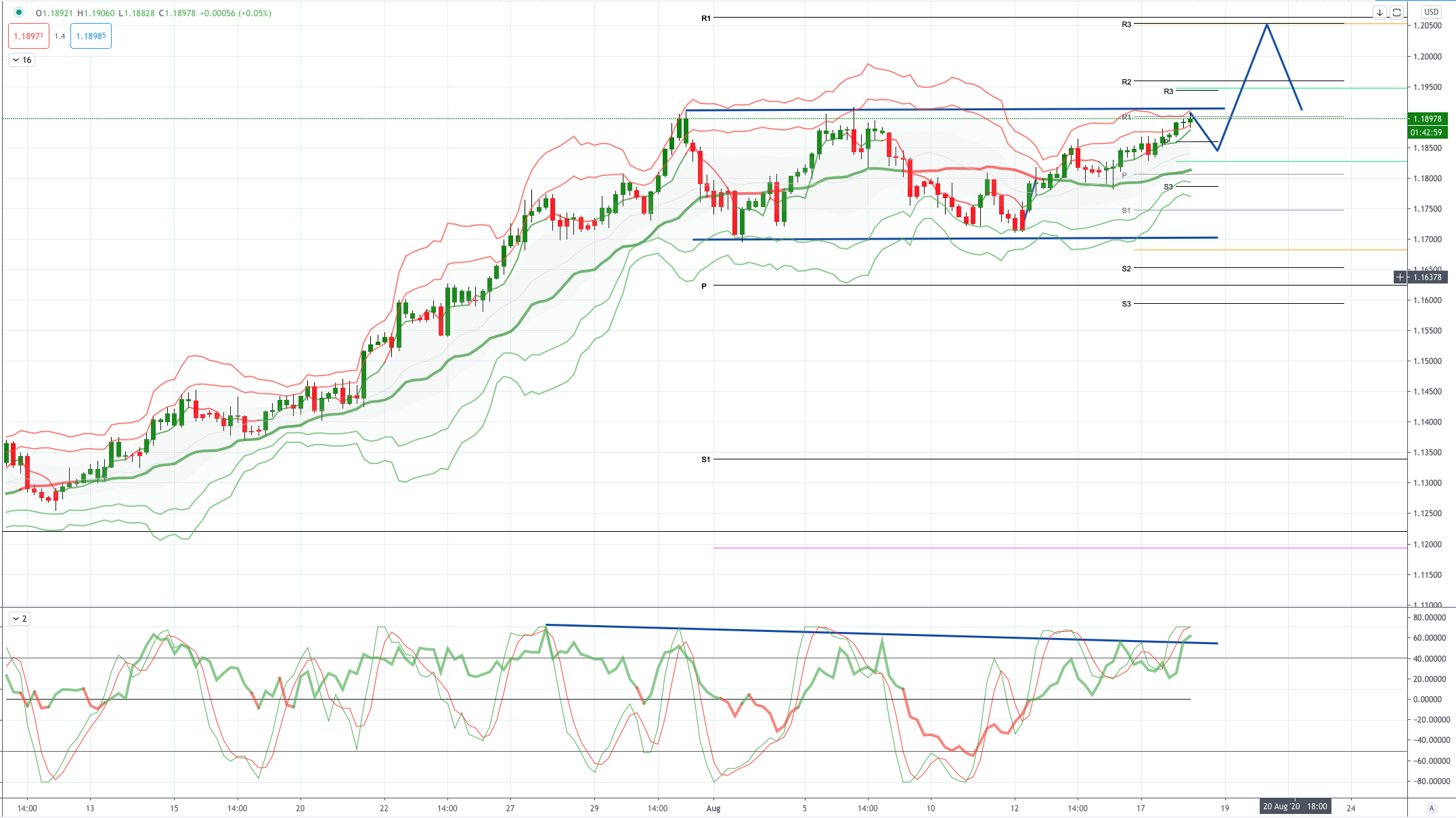

EURUSD Bias: Bullish above 1.17 targeting 1.20

EURUSD From a technical and trading perspective, as.18 continues to hold as such stops above 1.19 are starting to look vulnerable en route to a 1.20 battle as discussed in last week's live session. Only a closing breach of 1.17 would concern the bullish bias

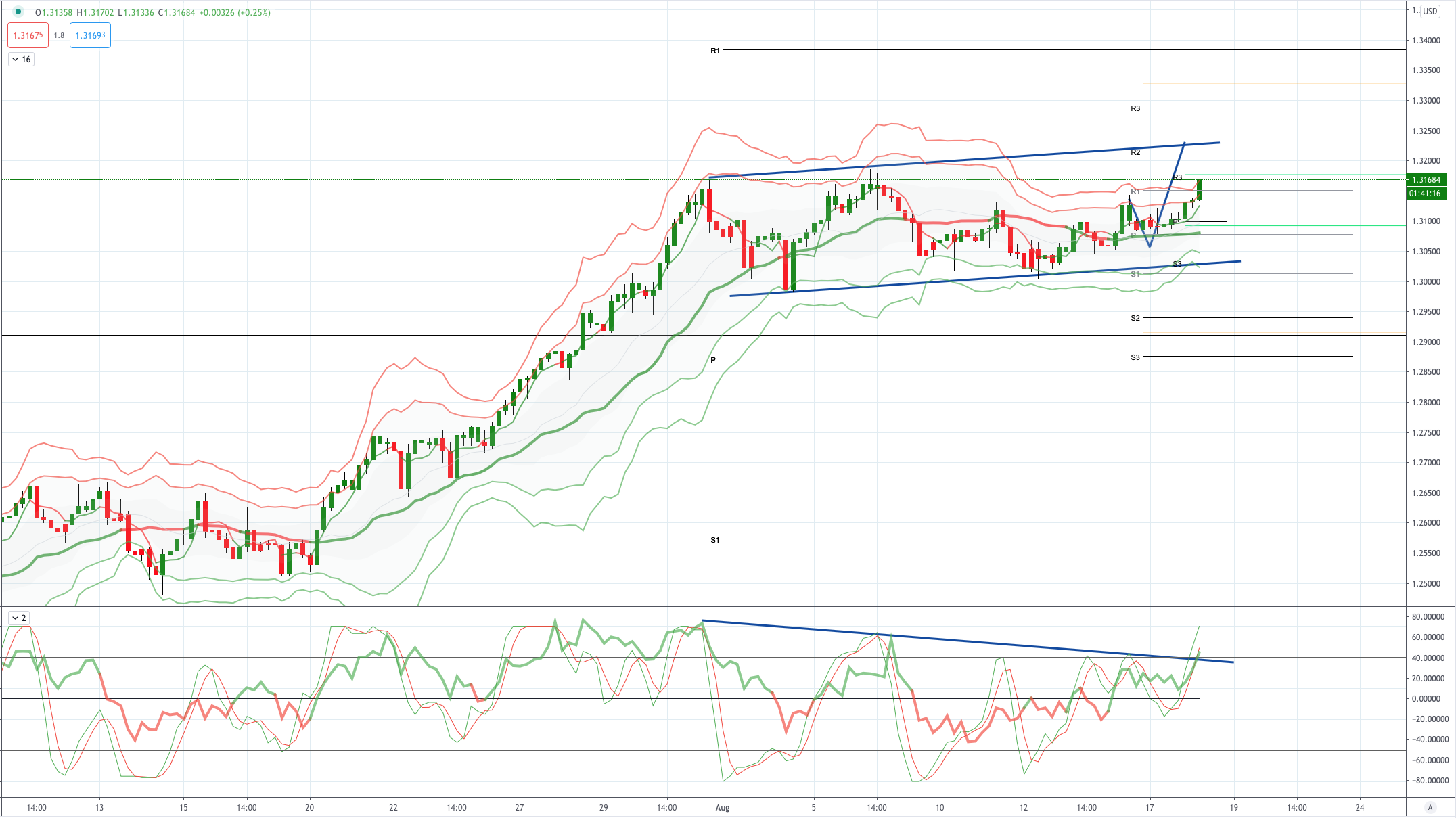

GBPUSD Bias: Bullish above 1.30 targeting 1.3250

GBPUSD From a technical and trading perspective, as 1.30 is defended stops above 1.32 look vulnerable for a test and breach enroute to a 1.33 test. Only a closing breach of 1.30 would concern the bullish bias

USDJPY Bias: Bullish above 105.50 targeting 107.50 Bearish below 105.30

USDJPY From a technical and trading perspective, anticipated test of the equality objective at 104.50 attract big bids, printing a key reversal pattern on Friday, as discussed in today’s Chart Hit, as 105.50 acts as a support look for a test of the equality objective to 107.50. UPDATE as 106.40 supports look for a grind higher to test symmetry swing resistance sighted at 108 UPDATE retesting support at 105.50 failure to find sufficient bids here will expose 104.18 again

AUDUSD Bias: Bullish above .7200 targeting .7300

AUDUSD From a technical and trading perspective, test of stops and offers above .7220 has delivered the anticipated corrective phase, as .7170/90 now acts as resistance look for a test .6950 as ascending support. UPDATE potential double top in place to deliver the test of ascending trend channel support now at .7000 UPDATE price retesting supply to .7220 through here opens a test of ending diagonal resistance at .7300 as discussed in today’s Chart Hit

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!