Daily Market Outlook, November 2, 2020

Daily Market Outlook, November 2, 2020

UK PM Johnson confirmed on Saturday that a second national lockdown will begin in England from Thursday and last at least through 2nd December. In briefings over the weekend, various ministers and advisers failed to rule out the possibility that it may last for longer. The scheme, whereby the government supports 80% of the wages of furloughed workers, will be extended through the duration of the lockdown. Other parts of the UK are currently not set to match the action, although lockdowns of a shorter duration are already in place in Northern Ireland and Wales. Johnson will make a statement to the House of Commons today and there will be a vote in the House on Wednesday. Labour Party leader Starmer has said that his party will support the motion, but reports suggest that up to 40 Conservative MPs may vote against it.

Asian equity markets are mostly higher this morning. In China both the two official PMIs for October and the unofficial Caixin manufacturing number surprised on the upside, suggesting that the economy continues to recover from its Covid-19 related downturn.

The coming week seems set to again be dominated by Covid19 news. However, the US. Election and monetary policy updates in the UK and the US will also be key events for markets. Today’s economic data calendar is dominated by manufacturing PMI updates for October. The reading for the Eurozone as a whole is a second estimate that is not expected to be revised. The initial outturn showed a small rise, in contrast to the equivalent for services measure which dropped further into contractionary territory. The UK estimate is also a final reading. The initial estimate posted a modest fall compared to September, but the index remained well above the 50 level signaling expansion. The US October ISM manufacturing index is new data. The September reading was down modestly from August but was still well above the 50 level signaling strong growth in the sector. As manufacturing is less impacted by social distancing measures than many other parts of the economy, look for a modest further rise in October. Construction activity data for September is forecast to post a 1% monthly rise primarily due to housing activity.

It is hoped that Australian economic growth will pick up as the country heads into summer. Nevertheless, early Tuesday the Australian central bank is expected to further ease monetary policy. A number of economists are forecasting that the key policy interest rate will be cut to 0.1% from 0.25% and that other policy rates will be reduced by a similar amount. Asset purchases are also expected to be extended to 5-year to 10-year government bonds.

CFTC data for the week through October 27th points to investors trimming their short exposure to the USD slightly but with the reduction in the USD short only taking place owing to a decrease in the net EUR long and an increase in the GBP’s net short. Speculative accounts turned a bit more bullish (or less bearish) on all the other currencies that we track. The USD887mn week-to-week decline took the net USD short to USD27bn—about USD7bn below its Sep 22 level and back to late-July levels. Given ‘bullish’ changes in positioning vis-à-vis risk-sensitive currencies, the move does not clearly reflect a flight for safety ahead of the Nov 3 US election. Investors trimmed their net EUR long by USD1.57bn, which marks the fifth consecutive reduction to the still-sizeable net EUR long of USD22.94bn. While the weekly change may just be a continuation of the trend in the EUR’s net position, speculative accounts may have acted ahead of the ECB’s policy announcement on the 29th or in response to the quick acceleration of COVID19 cases in the Eurozone—that this week pushed France, Germany, and Belgium to announce stricter virus restrictions. Investors cut their EUR long contracts to their lowest point since mid-July that was offset by a slight pull back on their EUR shorts after a substantial increase the previous week.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1570 (305M), 1.1585 (250M), 1.1650 (328M), 1.1675 (416M), 1.1700 (525M)

- GBPUSD: 1.2960 (239M), 1.3000 (223M), 1.3100 (1.2BLN), 1.3150 (961M)

- USDJPY: 104.50 (440M), 104.85-90 (400M), 105.00 (295M)

- AUDUSD: 0.7000-10 (500M), 0.7100 (250M), 0.7140-45 (1.9BLN)

Technical & Trade Views

EURUSD Bias: Bullish above 1.1780 bearish below targeting 1.15

EURUSD From a technical and trading perspective, the failure to hold 1.1687 lows opens quick move to test 1.1610 as 1.1780 contains upside attempts look for a test of the pivotal 1.15

Flow reports suggest topside offers light through to the 1.1750 area with weak stops likely on a push through the 1.1760 area before running into further light stops from the 1.1780-1.1820 area with stronger stops above the level, downside bids light through to the 1.1650 area where strong bids are likely to be present with the market likely containing further buyers through to the 1.1600-20 area, weak stops likely on a break of the 1.1580 area with some mild breakout stops likely to appear however, downside bids then start to improve and the market has to be concerned with Virus runs in other countries not just Europe.

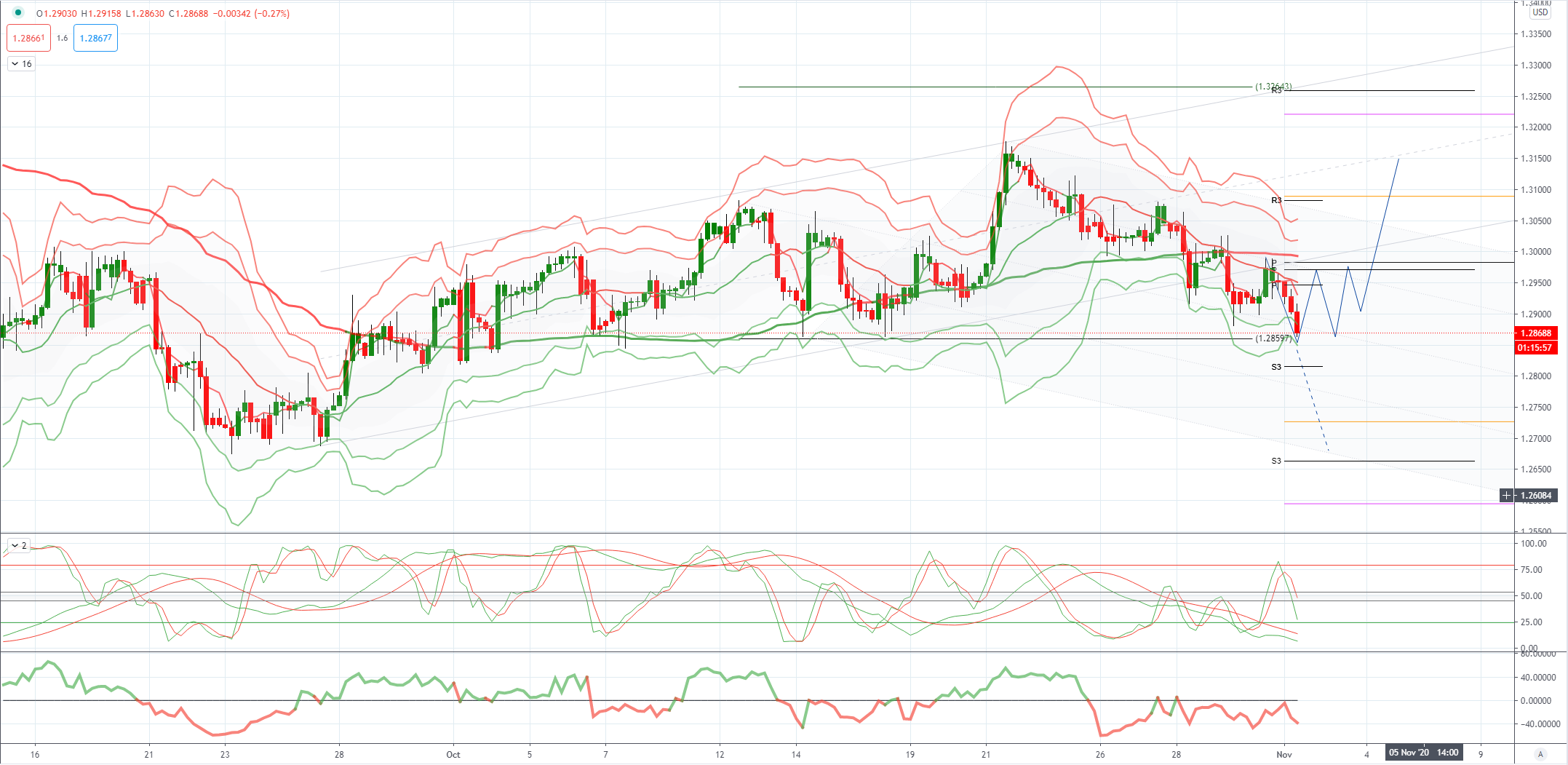

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, while 1.2950 attracts sufficient bids look for a test of primary equality objective at 1.3264 UPDATE a failure to find sufficient bids ahead of 1.2850 opens a test of 1.27 next

Flow reports suggest downside bids light through to the 1.2900 area where stronger bids remain, with weak stops likely through the level and opening the downside only to the 1.2850 where stronger bids are likely to move through and the support growing for the moment at each sentimental level. Topside offers light through to the 1.3100 level before limited offers move in, only once the market tests towards the 1.3200 level do the offers increase with strong stops suspected through the level.

USDJPY Bias: Bearish below 104.30 bullish above

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50

Flow reports suggest downside bids strengthen into the 104.20-00 level with possibly bottom pickers appearing below the figure level however weak stops through the 103.80 area could see a quick stab lower through to the 102.00 level before bids start to reappear. Topside offers light on a push through the 105.00 level with limited offers into the 105.80-106.20 area and the possibility of congestion then continuing through to the 106.40-80 area. And stronger offers thereafter.

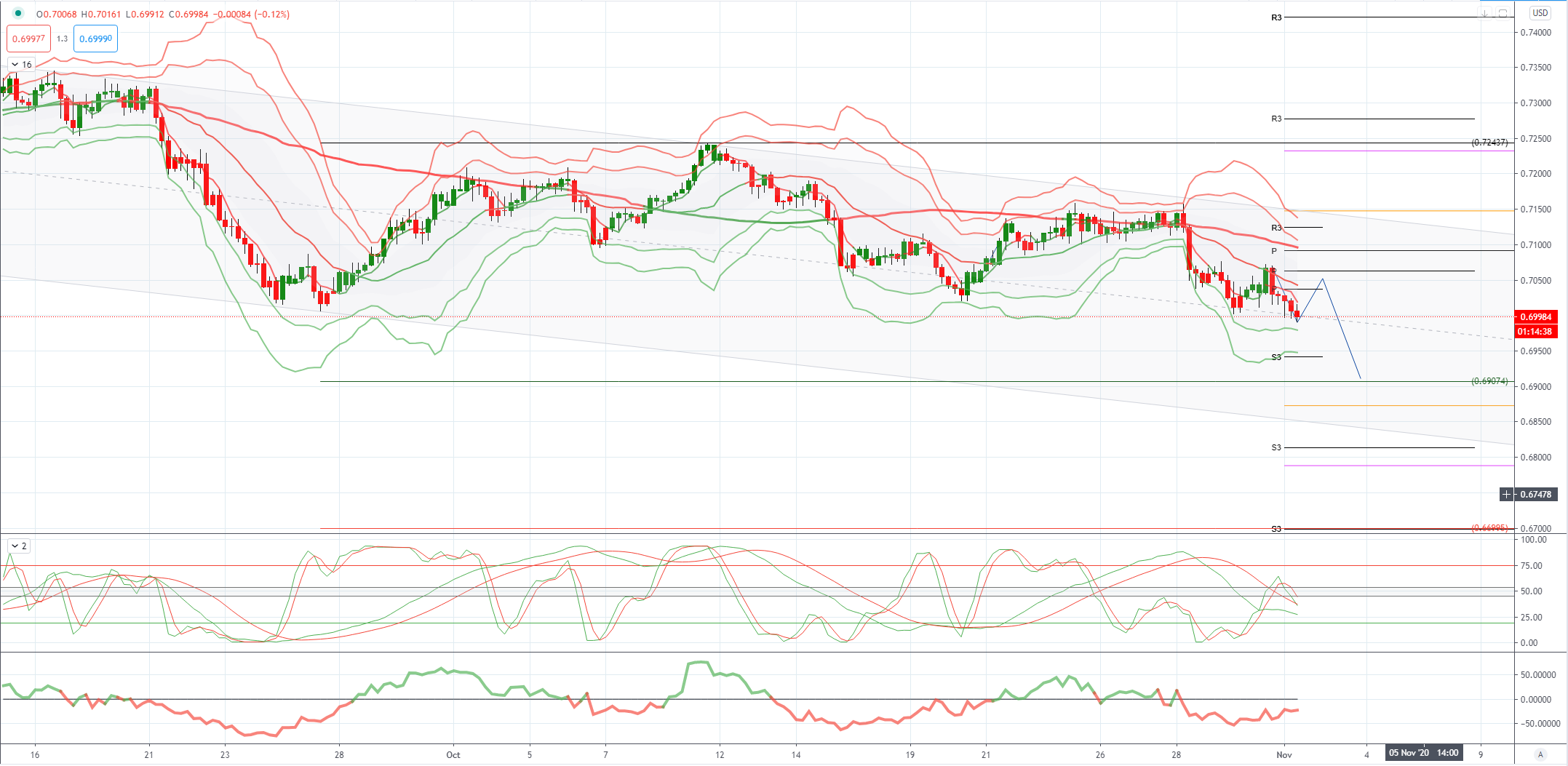

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, as .7170 caps upside attempts look for decline to resume to expose bids and stops towards .6900

Flow reports suggest topside offers into the 0.7140-60 area unchanged before some light weakness appears however, 0.7180-0.7200 area sees stronger offers and 0.7220 level likely to see some congestion with stop losses through the level to open a quick move to stronger offers around the 0.7250 area. Downside bids light through to the 0.7060-40 area with stronger bids likely to appear on any move to test the 0.70000 areas, while there may be some weak stops on a move through the 0.6980 area the market is likely to see plenty of congestion into the 0.6950 area and increasing bids beyond

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!