Daily Market Outlook, November 8, 2022

Daily Market Outlook, November 8, 2022

“Asian markets retain a bid tone overnight, the outlier remains Chinese equities which have failed to take the positive lead from European and US markets overnight. Overnight data from Australia showed continued deterioration in both business and consumer sentiment readings. Markets are firmly focused on political developments in the US, polling suggests that Republicans are favored to take control of the House of Representatives, the Senate races remain too close to call. With President Biden’s popularity plumbing new lows there is a decent chance that Republicans wrestle control of both houses, this result would significantly hamper the Biden’s administration to make any meaningful policy headway in the second half of his term, further frustration for the Biden administration is seen with former President Trump setting the stage for a Presidential run in 2024, this would essentially see the clock running on the 2024 race as soon as next week. Markets appear poised for a red sweep in the US which will be seen as positive for markets, weighing on the Dollar and US Yields, as the Fed will likely have to take up the baton of economic support as the fiscal impulse from the government will be significantly impeded if not totally neutralised...”

Overnight Headlines

Biden: GOP Win Will Roll Back Help For ‘Struggling’ Families - BBG

Trump Will Make A "Big Announcement" On Nov 15 - RTRS

China Reopening Hopes Keep US Dollar On Guard - RTRS

FTX Token Plummets As Market Fears Possible Alameda Contagion - CoinDesk

Biden Predicts Democrats Will Win The Senate - The Hill

Poll: Biden Approval Ticks Lower As Democrats Brace For Midterm Losses - RTRS

US Monetary Policy Tighter Than Benchmark Rate Suggests - RTRS

Fed’s Barkin: Fed Will Stick To The Task Of Curbing Inflation - BBG

EU Dims Hopes For A Price Cap To Contain Soaring Gas Costs - BBG

EU Aims To Dispel Criticism On Ukraine Aid With €18 Billion Plan - BBG

Eurozone Grapples With Coordinating Energy Support Plans As Recession Looms - RTRS

ECB’s Lagarde: ECB Must Bring Inflation Back To 2% - BBG

Germany To Spend €83.3 Billion To Subsidize Energy Prices - BBG

Germany Should Hike Taxes On Rich To Finance Relief Packages - RTRS

Oil Prices Fall As China Demand, Recession Concerns Outweigh Supply Woes - RTRS

Gold Stalls As Investors Brace For US Inflation Data - RTRS

Technical & Trade Views

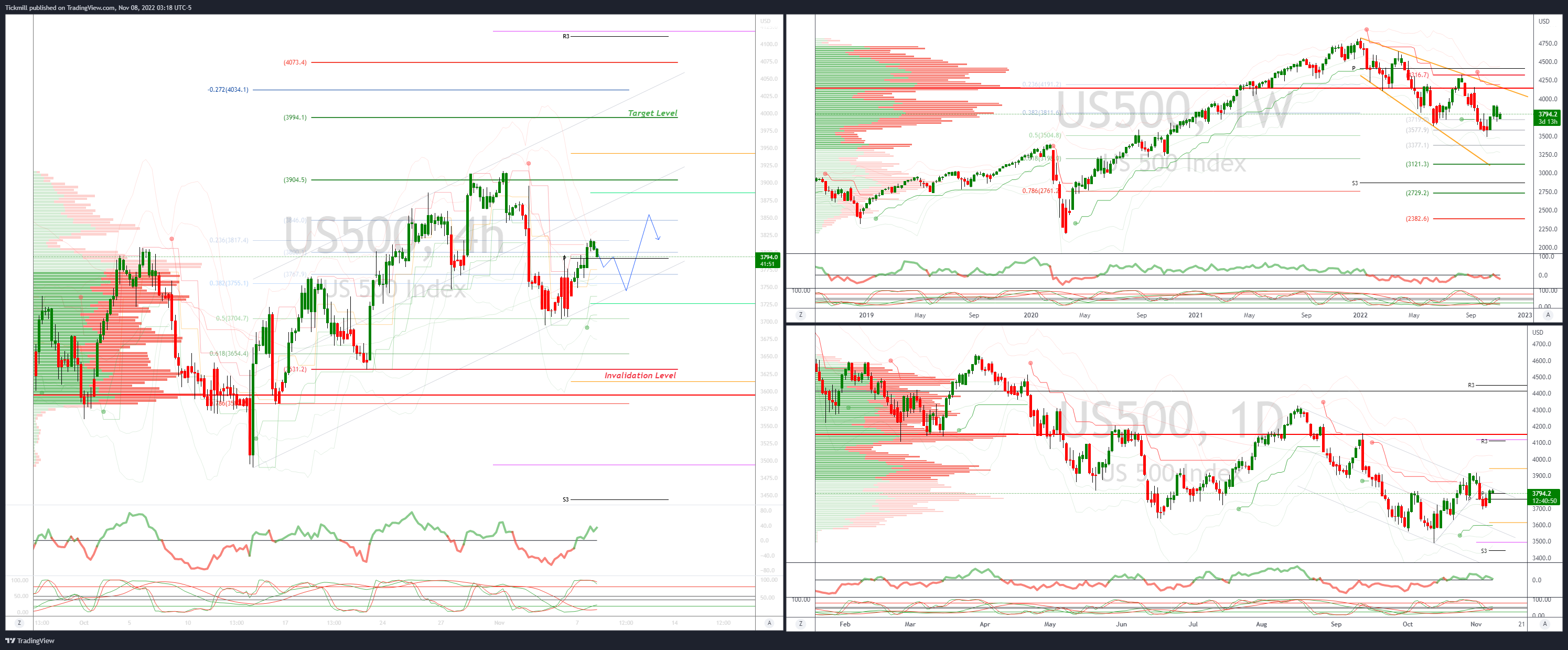

SP500 Bias: Bullish Above Bearish Below 3730

Technicals

Primary support is 3730

Primary upside objective is 3994

Next pattern confirmation, acceptance above 3920

Failure below 3695 opens a test of 3630

20 Day VWAP bullish, 5 Day VWAP bullish

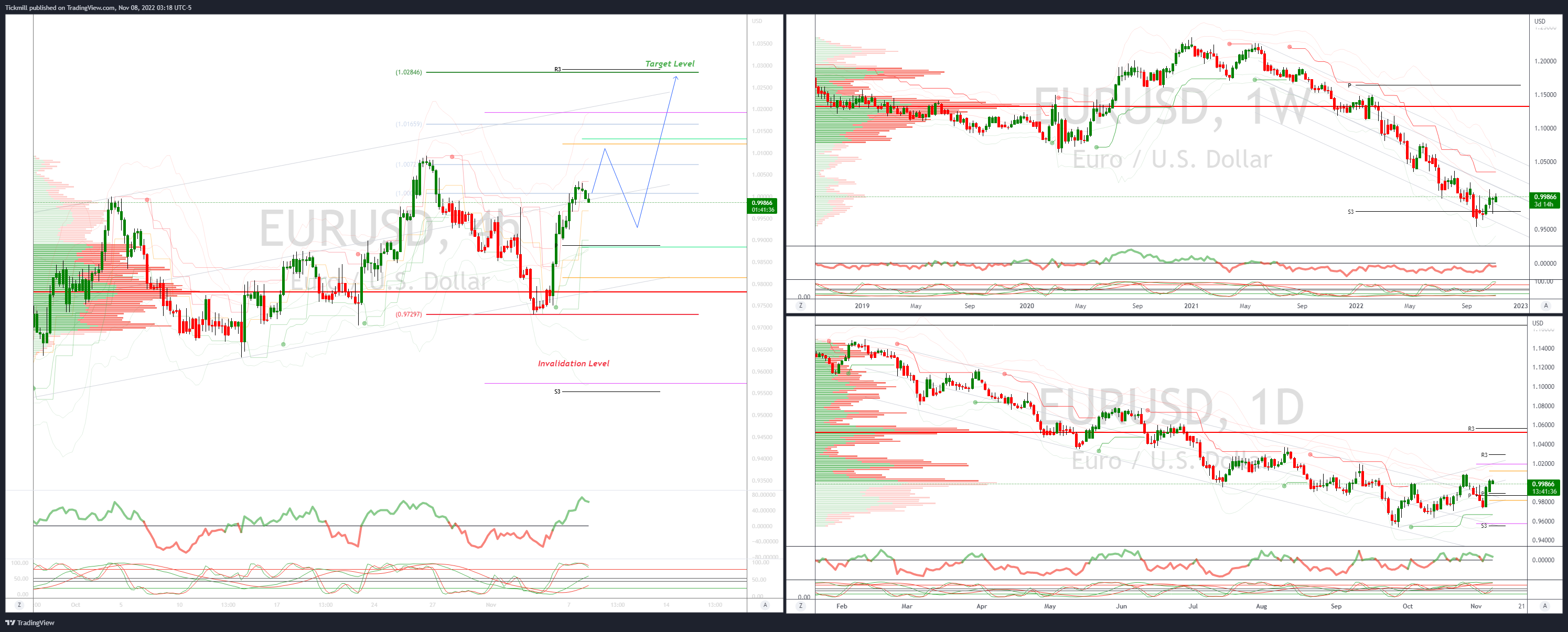

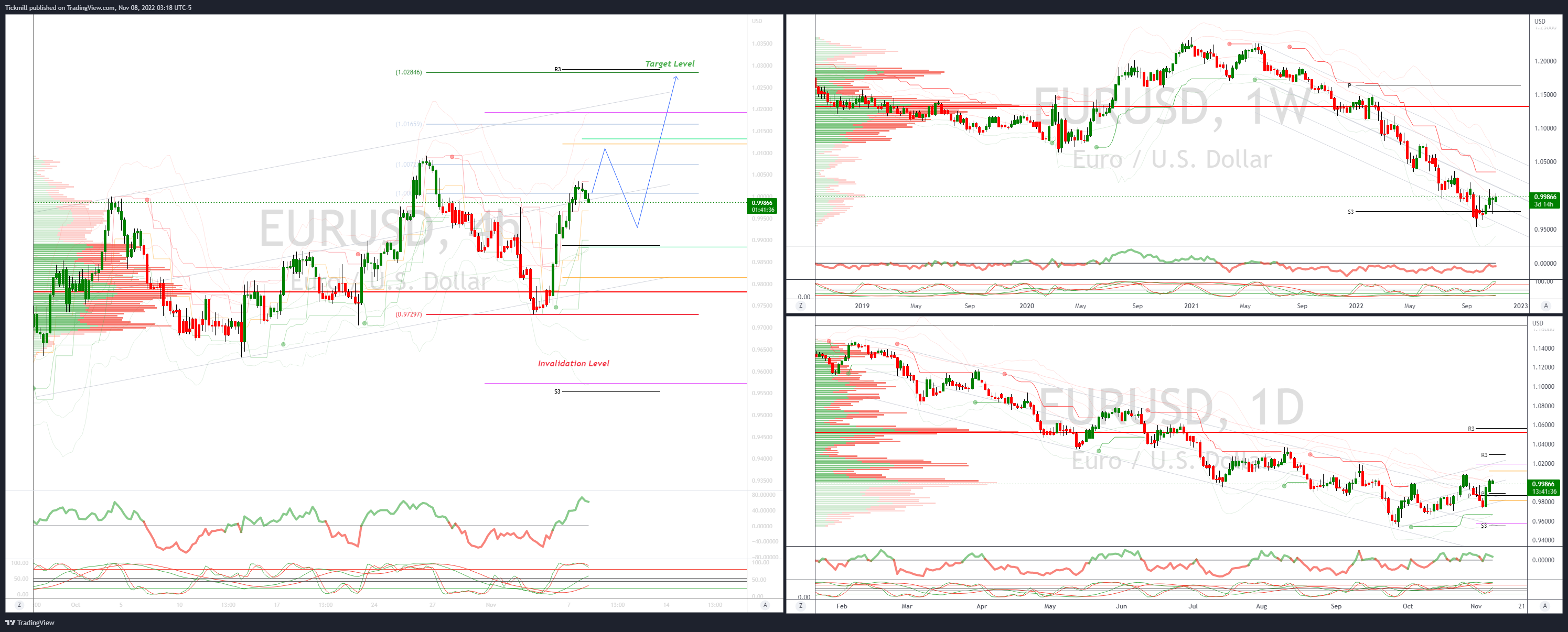

EURUSD Bias: Bullish Above Bearish below .9890

Technicals

Primary support is .9890

Primary upside objective is 1.0284

Next pattern confirmation, acceptance above 1.00

Failure below .9815 opens a test of .9630

20 Day VWAP bullish, 5 Day VWAP bullish

Today’s New York Cut Option Expiries: 0.9800 (1.06BN), 0.9900 (201M), 0.9950 (603M),0.9970-85 (1.42BN), 0.9990-00 (1.022BN), 1.0020-25 (673M), 1.0050 (468M)

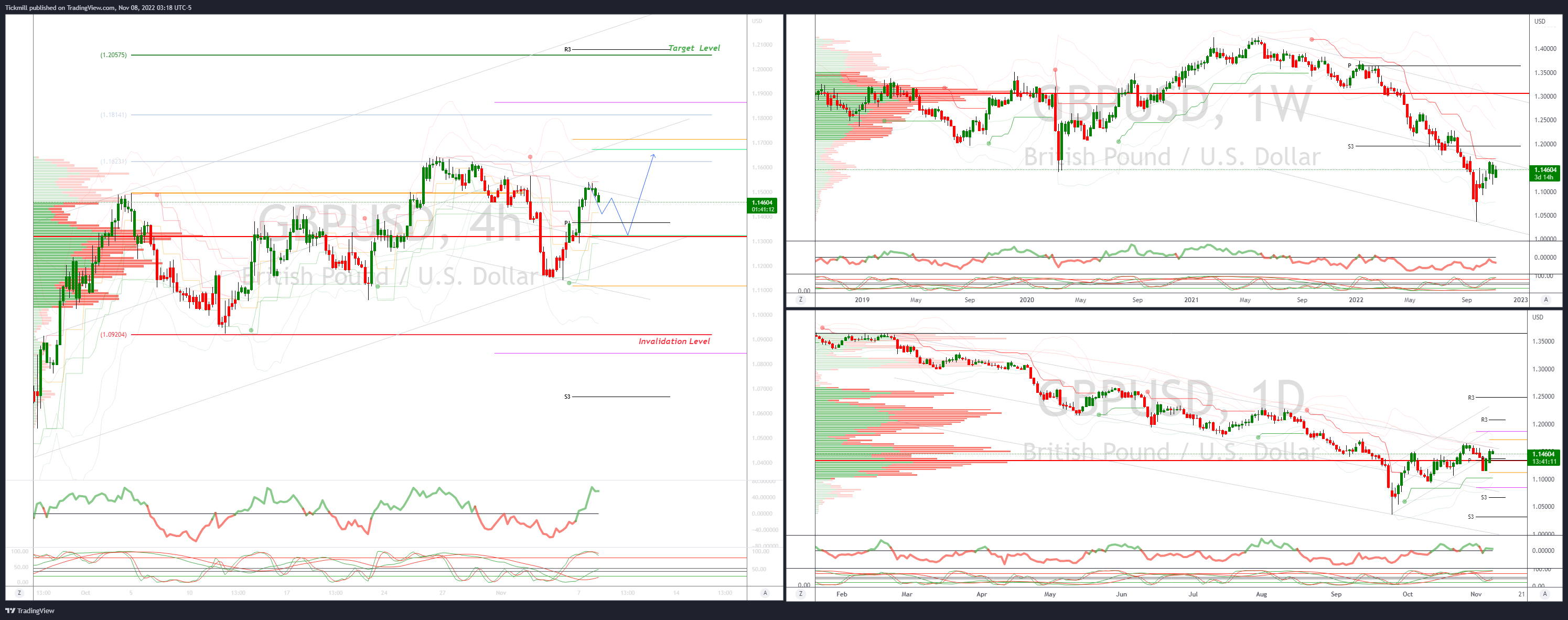

GBPUSD Bias: Bullish Above Bearish below 1.1320

Technicals

Primary support is 1.1320

Primary upside objective 1.20

Next pattern confirmation, acceptance above 1.1650

Failure below 1.1290 opens a test of 1.1150

20 Day VWAP bullish, 5 Day VWAP bullish

Today’s New York Cut Option Expiries: 1.1500 (603M)

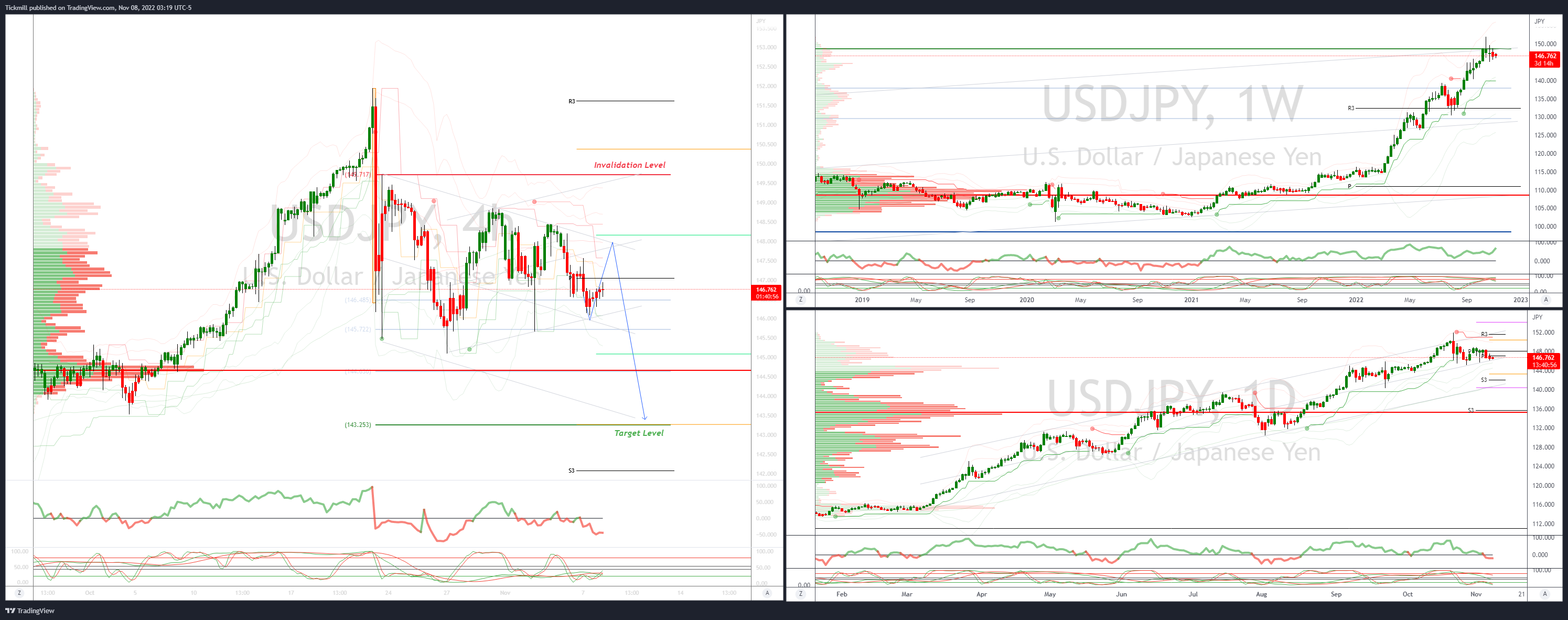

USDJPY Bias: Bullish above Bearish Below 148.10

Technicals

Primary resistance is 148.10

Primary downside objective is 143.25

Next pattern confirmation, acceptance below 146

Acceptance above 148.50 opens a test of 149.70

20 Day VWAP bearish, 5 Day VWAP bearish

Today's New York Cut Option Expiries: EUR/JPY: 146.00 (243M)

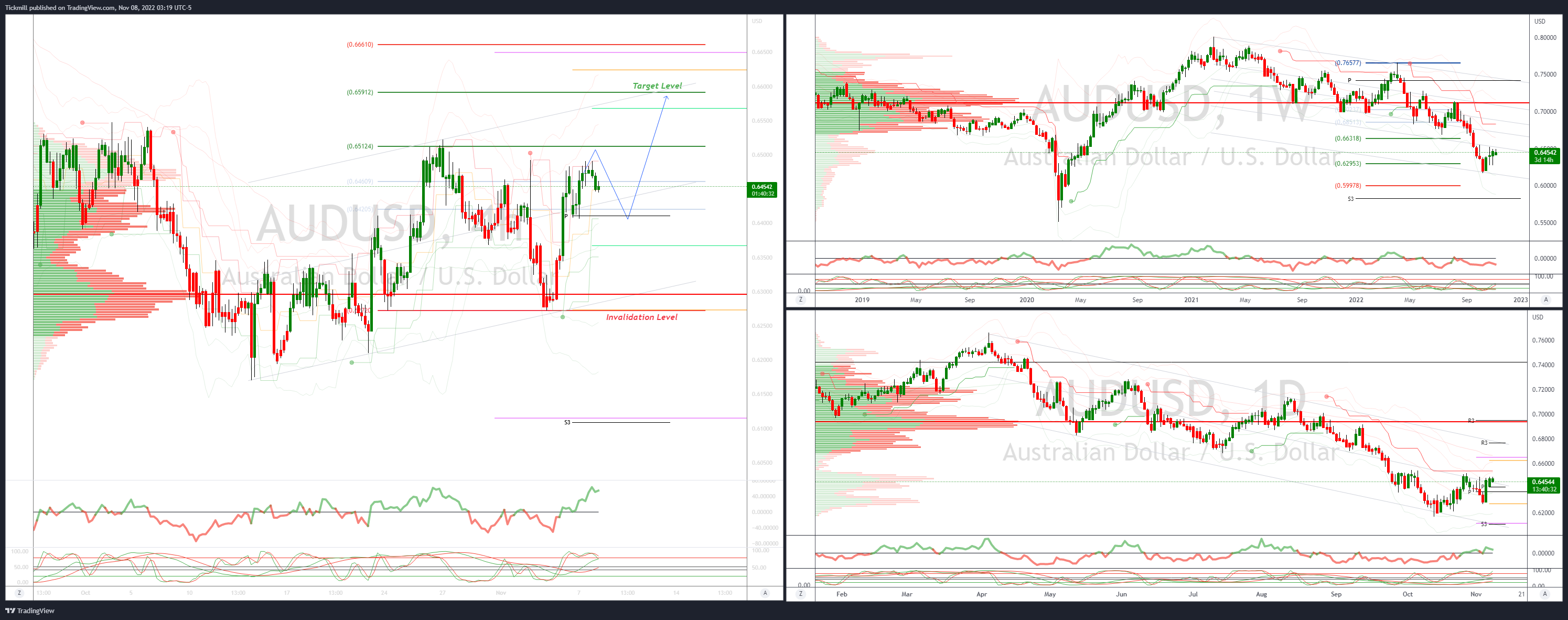

AUDUSD Bias: Bullish Above Bearish below .6400

Technicals

Primary support is .6400

Primary upside objective is .6590

Next pattern confirmation, acceptance above .6520

Failure below .6350 opens a test of .6280

20 Day VWAP bullish, 5 Day VWAP bullish

Today’s New York Cut Option Expiries: 0.6250 (307M), 0.6275 (714M), 0.6300 (325M),

0.6390 (225M), 0.6450 (1.73BN), 0.6500 (494M)

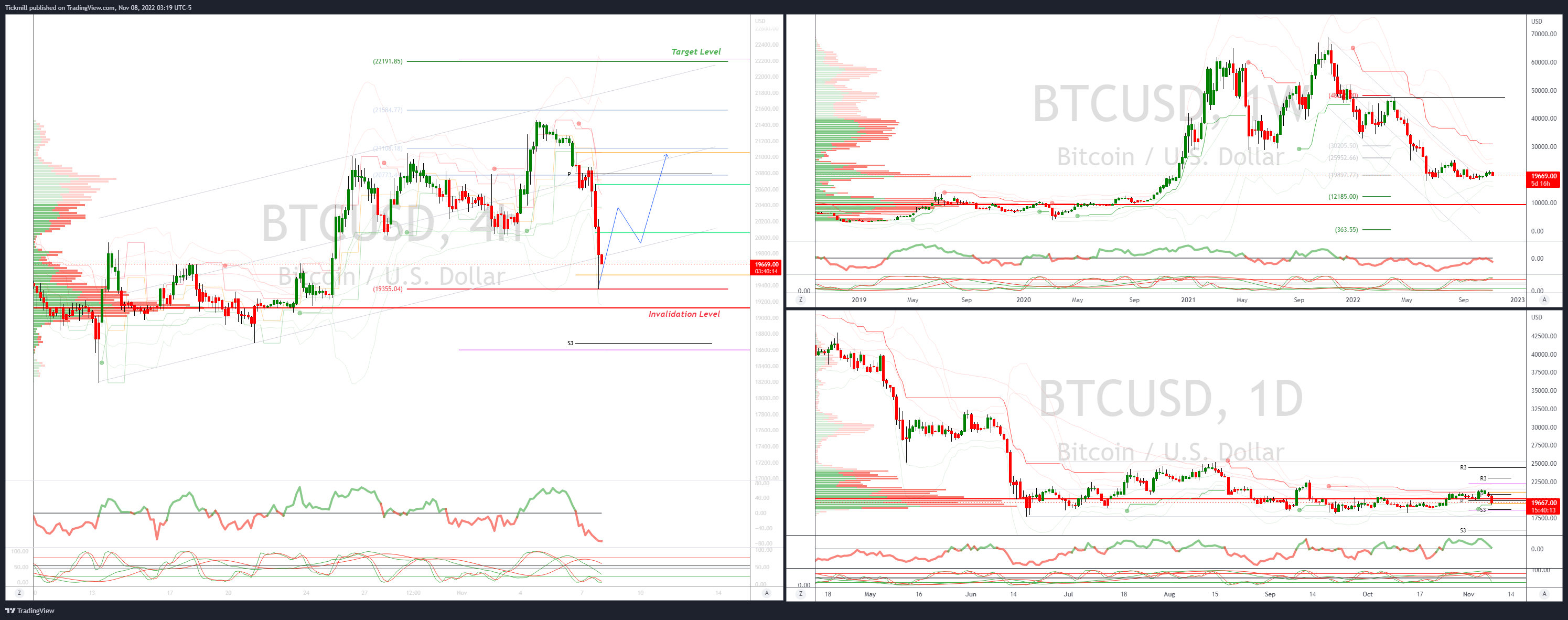

BTCUSD Bias: Intraday Bullish Above Bearish below 19100

Technicals

Intraday 19100 is primary support

Primary upside objective is 22191

Next pattern confirmation, acceptance above 21460

Failure below 19000 opens a test of 18600

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!