Daily Market Outlook, October 12, 2020

Daily Market Outlook, October 12, 2020

Most Asian equity indices are trading higher at the start of the new week, led by Chinese stocks. Overall, however, the broader risk backdrop remains relatively subdued as the lack of progress on US fiscal stimulus talks continues to weigh on sentiment. As talks around a broader package remain challenging, over the weekend the Trump administration called on Congress to use leftover funds from an expired small business loan scheme to pass a watered down coronavirus bill.

The past week has again been dominated by news around further rises in Covid-19 cases, announcements of new restrictions and reports that further support measures will be introduced in the near future. Across Europe, the rules have been tightened in Belgium, France, Germany and Italy. In the UK, Scotland announced stricter controls, which were described as a ‘circuit breaker’, including the temporary closure of pubs and restaurants in the ‘central belt’. Later today, UK PM Johnson is expected to announce further controls for England with media reports suggesting that a three tier-system for local lockdowns will be introduced, with the North facing particularly tighter restrictions. The announcement is expected to be made in the House of Commons around 15:30 BST followed by a press conference.

Elsewhere, with the day void of any major economic data releases, speeches by Bank of England officials are likely to attract significant attention - Governor Bailey at 17:00 BST and fellow MPC member Jonathan Haskel at 15:00 BST, while BoE Governor Ramsden will give opening remarks at an AI forum at 09:00 BST. Their comments will come in the wake of last Friday’s weaker-than-expected August UK GDP figures and amid the imposition of further localised lockdown measures and should provide some clues over the near-term policy outlook, particularly with the November MPC meeting fast approaching.

A number of the ECB’s governing council are due to speak, including Villeroy, Schnabel, De Guindos and Panetta. However, most focus will be on President Lagarde, whose pre-recorded comments will be delivered at the launch of the latest IMF and World Bank annual meeting. The event runs through to the 18th and will focus heavily on the impact of Covid-19 on the global outlook.

Early tomorrow, the latest UK labour market report is forecast to show a further modest rise in the unemployment rate in the three months to August to 4.3% (from 4.1% in July) and a fall in employment of 30k. Meanwhile, overnight, the British Retail Consortium’s September measure will provide an update on whether retail spending remains buoyant for now.

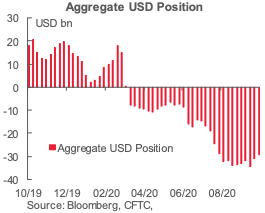

This week’s snapshot of FX market sentiment and positioning provided by the CFTC data continues to reflect modest USD short-covering, essentially driven by the EUR. The aggregate net USD short implied by exposures to all the currencies we cover in this report fell USD1.8bn in the week through Tuesday to total USD29.bn, the lowest in two months. The EUR remains the biggest “play” on the IMM at the moment by far, accounting for 87% of overall market risk. Speculative traders are paring back gross EUR longs and adding lightly to gross shorts but the position remains large and vulnerable to a further squeeze, we feel. The net EUR long fell by a little over USD2bn to total USD25.5bn.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1740-50 (670M), 1.1790-1.1800 (650M), 1.1835 (207M) 1.1850 (260M), 1.1880 (250M), 1.1890-95 (500M).

- GBPUSD: 1.2800 (776M), 1.2845 (223M), 1.3010 (291M), 1.3050 (219M)

- USDJPY: 105.00 (241M), 105.30 (280M), 105.75 (470M), 106.00 (1.4BLN) 106.05-15 (840M)

- AUDUSD: 0.7140-45 (650M), 0.7200 (1BLN).

Technical & Trade Views

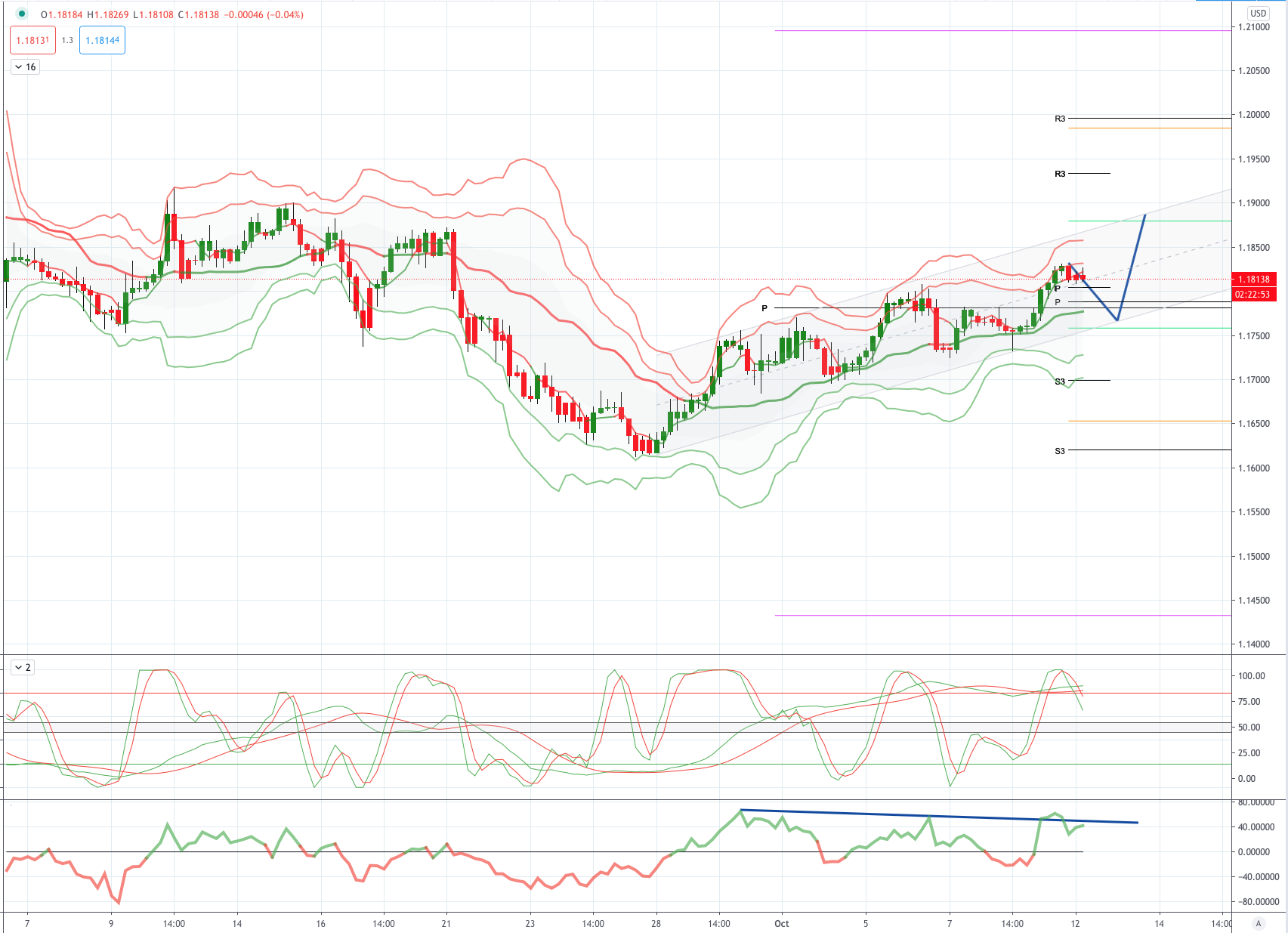

EURUSD Bias: Bullish above 1.1750 targeting 1.19

EURUSD From a technical and trading perspective, as ascending trendline support at 1.1750 is defended look for a test of projected trend channel resistance to 1.19

Flow reports suggest topside offers likely to be strong on any move through to the 1.1860 area with those offers increasing into the 1.1880 area in particular and continuing through the 1.1900, possibly weak stops appearing above the 1.1910 area however, the offers are likely to continue through to the 1.1950 area before buyers start to enthuse about the 1.2000 area, Downside bids likely to appear on a dip through the 1.1800 level with stronger bids continuing through to the 1.1780 area with weak stops likely in size on any dip through quickly testing through to the 1.1700-20 area.

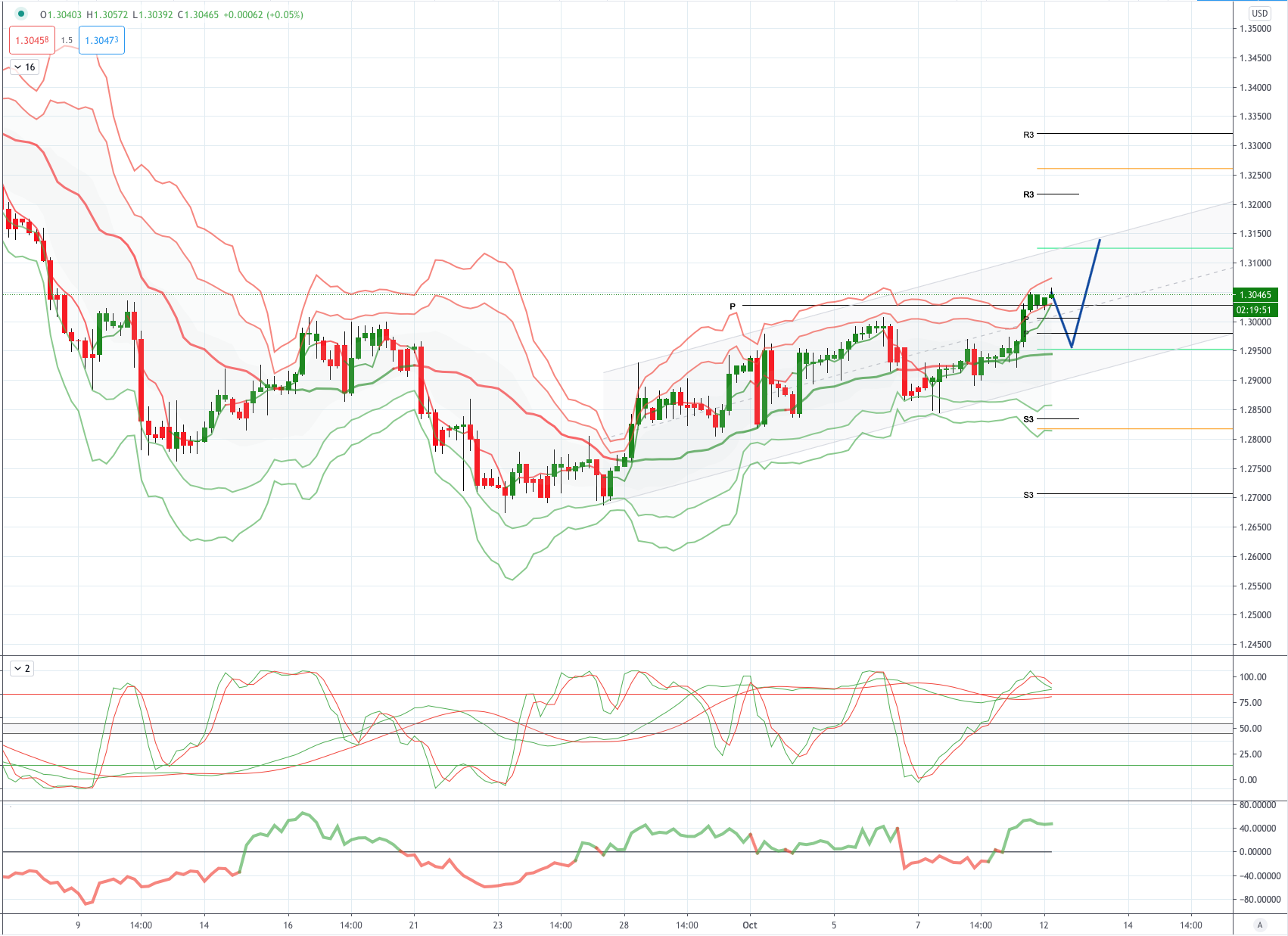

GBPUSD Bias: Bullish above 1.29 targeting 1.3150

GBPUSD From a technical and trading perspective, as 1.2950 is defended intraday look for further upside extension to target projected trend channel and predicted daily range resistance to 1.3150

Flow reports suggest topside congestion through the 1.3050 level and continuing into the very strong resistance around the 1.3100 area, weak stops on a push through the area will likely see a quick rise through to the 1.3150 level then a more sedate push for the strong 1.3200-20, downside bids light back through the 1.3000 level with weak stops likely close through the level with very little around the 1.2950 area and increasing into the 1.2900 level, stronger stops on a break here will then see stronger bids starting to appear through to the 1.2800 area.

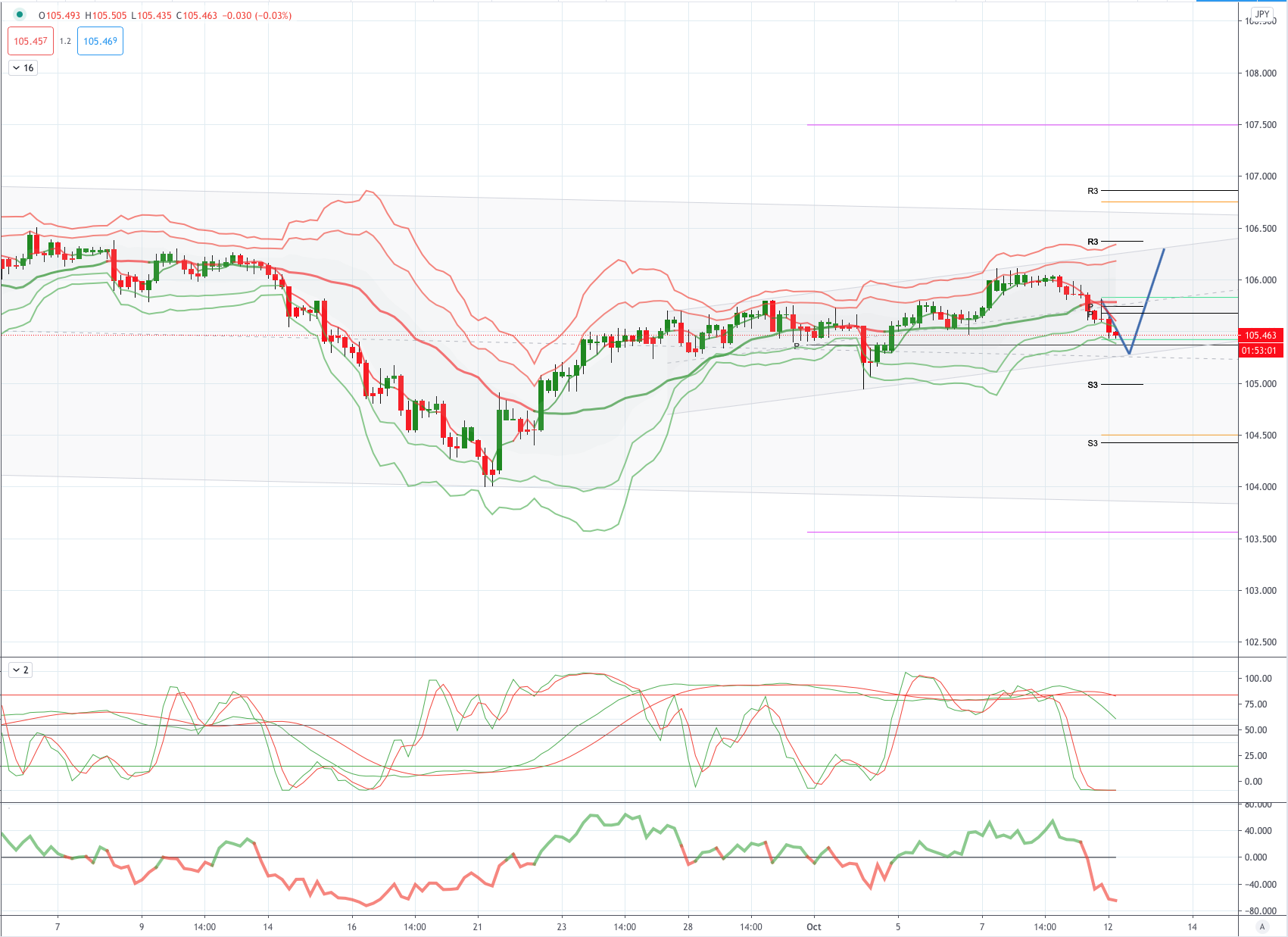

USDJPY Bias: Bullish above 105.20 targeting 106.30

USDJPY From a technical and trading perspective, as 105.20 supports look for a move to test offers and stops to 106.30

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

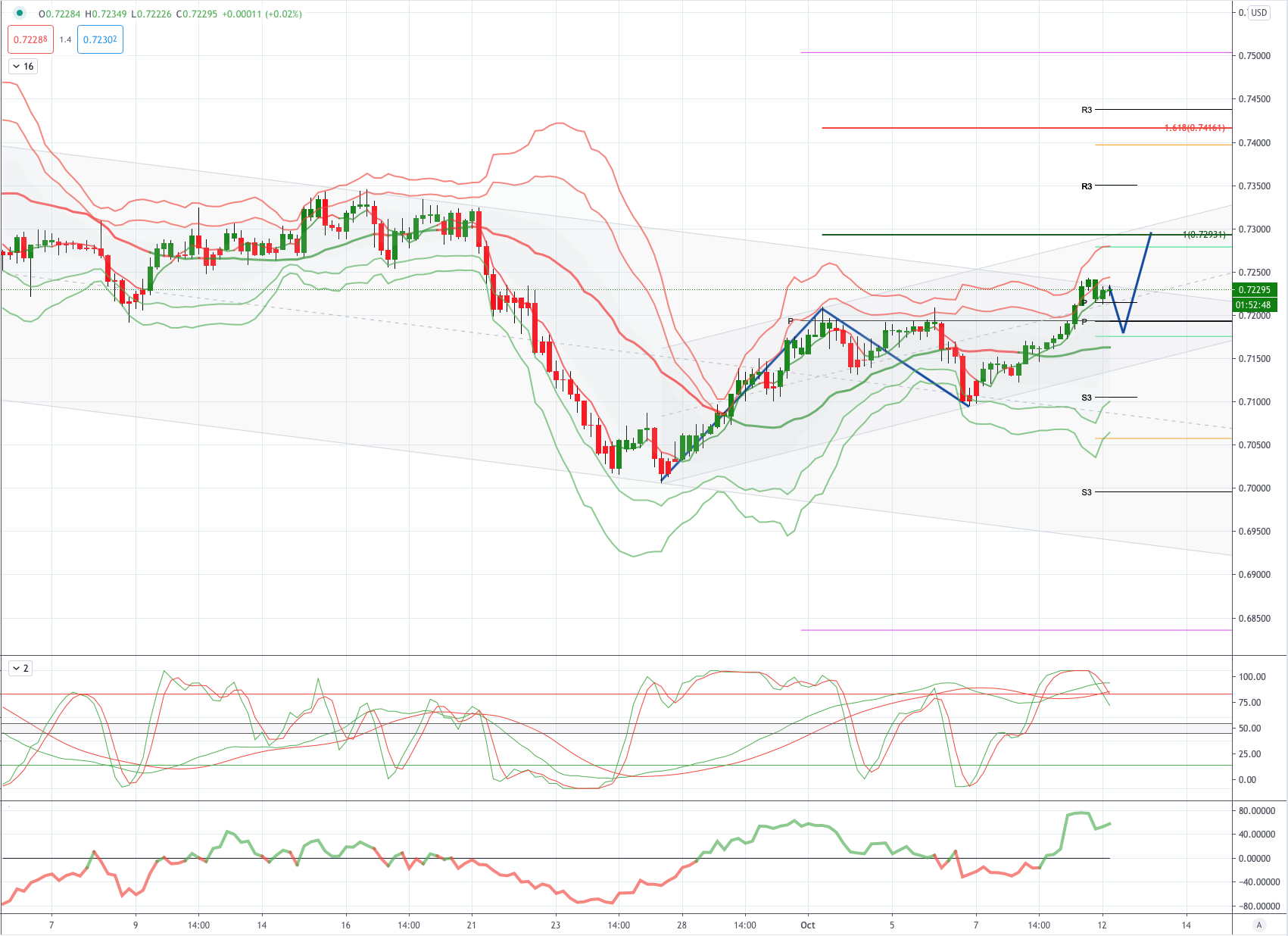

AUDUSD Bias: Bullish above .7150 targeting .7300

AUDUSD From a technical and trading perspective, as .7190/50 area continues to attract bids look for a grind higher to test ascending projected trend channel resistance and the equality objective at .7300.

Flow reports suggest topside offers increase through the 0.7250 area and likely to find very deep congestion through to the 0.7340 area with minor stops likely to be absorbed easily, a push through the 0.7360 area though would likely see stronger tests appearing for a test of the stronger 74 cents level from the beginning of last month, downside bids light through the 72 cents level with weak stops on a move through the 0.7180 area congestion into the 0.7150 area and stronger bids into the 0.7100 area and stronger stops then opening a quick move through to the 70 cents levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!