Daily Market Outlook, October 6, 2020

.jpg)

Daily Market Outlook, October 6, 2020

Asian equity markets are mostly higher this morning following strong gains yesterday on Wall Street. Risk appetite was supported by President Trump’s release from hospital and by hopes that more US fiscal stimulus will be forthcoming before the US election. Key Democrat and Republican politicians are set to meet again today to discuss a deal.

As expected Australian monetary policy was left unchanged at today’s central bank meeting. Afterward the RBA said that policy will remain “highly” accommodative as long as required and additional easing was being considered. In Germany, August factory orders rose by a much stronger than expected 4.5%, a further sign that manufacturing trends continue to improve.

PMI data has been signalling a sharp initial post-lockdown rebound in UK economic activity and construction has been at the forefront. From a low of 8.2 in April the overall construction PMI index rebounded to 58.1 in July, a five-year high, before slipping to a still elevated 54.6 in August. We forecast a rise to 55.0 in September helped by the boost to the housing market provided by the temporary cut in stamp duty. However, doubts persist about the sustainability of the pick-up particularly given the recent rise in Covid-19 cases.

In the US, already released data for trade in goods points to a rise in the overall international trade deficit for August. Look for an increase to –US$66.4bn from –US$63.6bn in July as imports rebound more quickly than exports. The JOLTS survey is a detailed report on labour market trends but its usefulness is diminished by its lack of timeliness. It lags last Friday’s September jobs report by a month and so may not help explain why the employment upturn seems to have slowed.

Early Wednesday, German industrial production is expected to have posted a fourth successive rise in August. Factory activity, which is less intensely impacted by social distancing measures than other sectors, seems to have picked up sharply in many countries and PMI data suggests that continued in the Eurozone through late summer. A number of other Eurozone countries will also report on industrial activity this week.

Today has a busy schedule of central bank speakers led by ECB President Lagarde and Fed Chair Powell. Markets will be watching for reaction to the latest rise in Covid-19 cases and any hints on possible further moves in monetary policy.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1715-25 (1BLN), 1.1780 (261M), 1.1800 (600M), 1.1820 (1BLN) 1.1830 (500M), 1.1840-50 (1BLN), 1.1855 (425M)

- USDJPY: 104.75 (620M), 105.00 (1.1BLN), 105.50 (440M), 106.00 (1.2BLN) 106.10-15 (1BLN)

- GBPUSD: 1.3000-10 (400M), 1.3060 (180M), 1.3100 (250M)

- AUDUSD: 0.7145-50 (320M), 0.7205-10 (450M), 0.7240-50 (1BLN) 0.7270 (521M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1750 Bullish above

EURUSD From a technical and trading perspective,test of 1.1750 trendline attracted fresh bids, as 1.18 now acts as interim support look for a test of offers and stops above 1.1950 UPDATE as 1.1700/50 acts as support expect continued rotation in 1.17/1.19 range, a breach of 1.17 would suggest a deeper correction underway to challenge bids at 1.16. UPDATE as 1.1750 now acts as resistance look a challenge of bids and stops below 1.16 UPDATE 1.18 the line in the sand now through here and bulls target 1.1850 test next

Flow reports suggest topside resting offers congested through the current highs into the 1.1840 and then new offers follow that so likely to absorb weak stops with long term trend line holding into the 1.1880 area likely to cause significant disruption to any push higher. Downside bids light through to the 1.1700 area where better bids start to appear through to the 1.1660 level and strong bids increase.

GBPUSD Bias: Bearish below 1.2850 Bullish above

GBPUSD From a technical and trading perspective, test of the pivotal primary trendline support at 1.2830/50 stalls downside for now, however as 1.3000 acts as resistance look for renewed downside to target 1.2650 next UPDATE as 1.2850 acts as resistance look for a test of bids to 1.26/1.2570 UPDATE as 1.28 now acts as support lok for a test of 1.30, a breach of 1.2750 would suggest a false upside break and resumption of downtrend UPDATE 1.3030 likely to retain sufficient supply to cap the current cycle, potential for inverse head and shoulders pattern to develop on a pullback to 1.28

Flow reports suggest topside offers remain through the 1.3000 level with weak stops appearing and then congestive offers through the 1.3050 area, those congestive offers continue through in increasing size to the 1.3100 level with strong congestion likely to limit any further movement for the short term, downside bids light through to the 1.2900 level with weak stops opening a quick test to the 1.2850 area and stronger bids then moving into the 1.2800 area and through to the 1.2750 level.

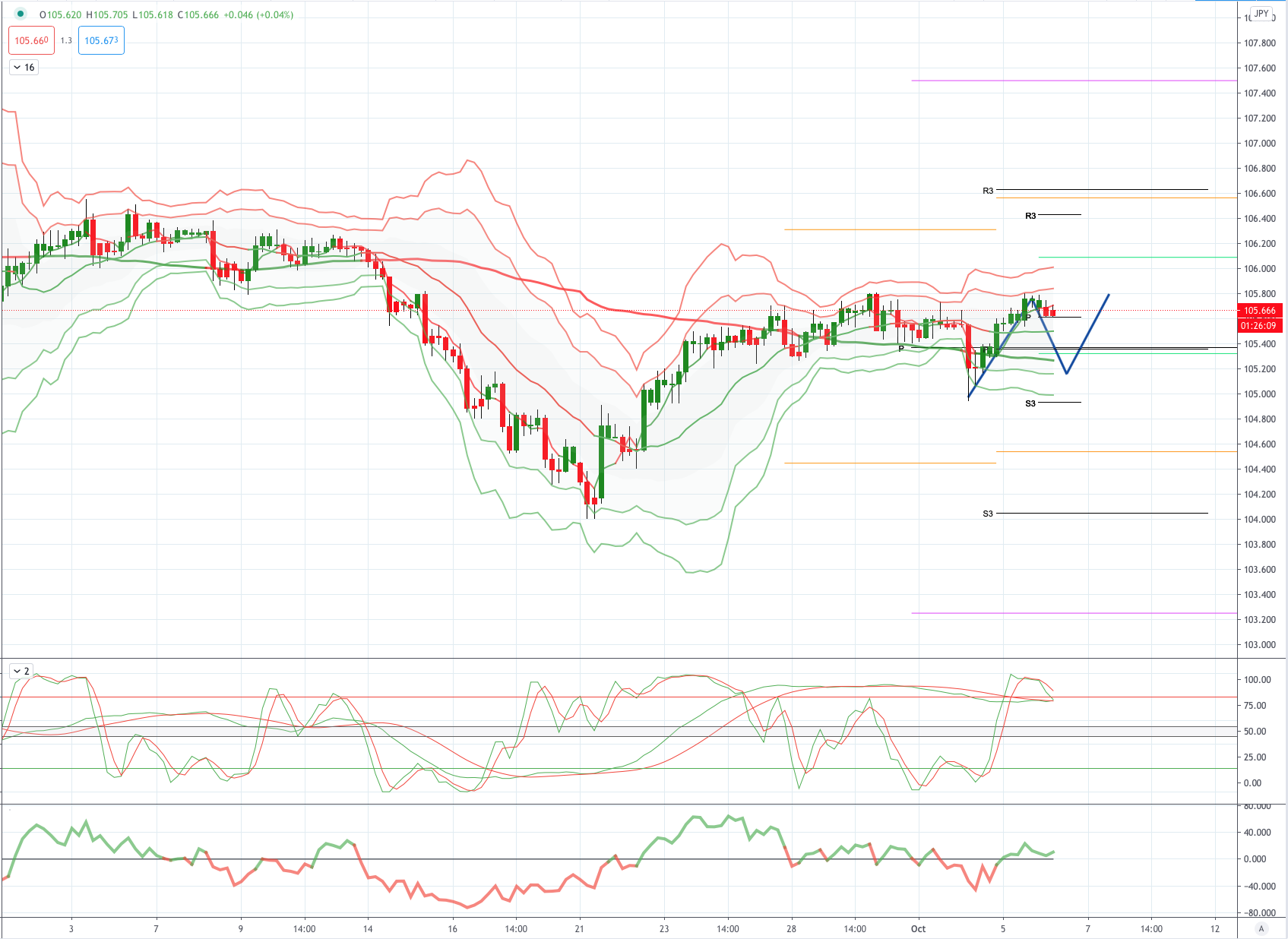

USDJPY Bias: Bearish below 105.50 Bullish above

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. UPDATE as 105.50 now acts as resistance look for a test of bids towards 103.80 as the next downside objective. UPDATE continued rotation around 105.50, as 105.10 supports look for a test of 106.00

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

AUDUSD Bias: Bullish above .7150 Bearish below

AUDUSD From a technical and trading perspective, as .7220 now acts as support, look for a test of psychological .7500. Only a daily closing breach of .7220 would concern the bullish thesis opening a retest of .7100. UPDATE as .7220 now acts as resistance look for a test of bids to .7050 UPDATE as .7150 acts as resistance look for a test of bids and stops below .7000 UPDATE breach of .7150 opens a retest of .7220 from below UPDATE .7200 caps for now look for retet of bids and stops to .7100

Flow reports suggest downside light bids through to the 0.7020 area with stronger bids starting to make an appearance and possible option related bids coming into play, a push through the 0.6980 level should see weak stops appearing and the market running into congestion on any push to the sentimental 0.6950 area and likely to continue through to 69 cents area, Topside through to the 0.7220 level with some of the area cleared but immediately filling up again however, that weakness exposes the market through to the 0.7250 area with likely strong offers again into the level with congestive offers likely continuing through to the 0.7300 levels.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!