Daily Market Outlook, September 6, 2022

Daily Market Outlook, September 6, 2022

Overnight Headlines

- Bank Of England’s Mann Calls For ‘Forceful’ Action On Rates

- Retailers Warn Of Storm Ahead As UK Sales Growth Stutters

- UK Shoppers, Feeling The Inflation Hit, Cut Back On Non-Essentials

- Truss Earmarks £130Bln To Keep UK Energy Bills Below £2K

- China Delays Key Annual Financial Forum Amid Covid Flare-Up

- Japan's Household Spending Extends Growth But Inflation Risks Loom

- Japan July Real Wages Continue To Slide As Rising Prices Weigh

- The RBA Lifts Rates To 2.35%, More Increases To Come

- Australia Current Account Surplus Balloons In Q2, Boosts Growth

- Australia Government Spending Makes Minor Contribution To Q2 GDP

- China Sets Yuan Fix Weaker Than 6.9 A Dollar, Unseen Since 2020

- Oil Holds Advance After OPEC+ Delivers Modest Cut In Production

- EU Chief Negotiator: Iran Nuclear Deal ‘In Danger’

- Brussels Pushes For EU-wide Caps On Gas Price

- Stocks In Asia Turned Mixed, While US Equity Futures Rose

- CVS Agrees To Buy Signify Health For About $8 Billion

The Day Ahead

- Asian equity markets are mixed as investors continue to assess the outlook for the global economy and interest rates. The Reserve Bank of Australia raised interest rates by 50bp to 2.35% as expected. US Treasury yields rose overnight after yesterday’s hiatus for a public holiday. In the UK, the British Retail Consortium reported like-for-like sales easing to 0.5%y/y in August, down from 1.6%y/y in July. Oil prices pared gains after rising yesterday following the decision by OPEC+ to cut production.

- New Conservative Party leader, Liz Truss, formally becomes UK Prime Minister today after Boris Johnson tenders his resignation to the Queen. Market reaction yesterday to Truss’s victory in the leadership contest was limited because the outcome was in line with expectations. A new package of measures to support the economy is expected to be announced on Thursday which could include plans to freeze household energy bills for households. According to reports, the measures could cost over £100bn.

- The only notable UK data release today is the August construction PMI. The headline index fell to 48.9 last month, below the key 50 level separating expansion and contraction for the first time since early 2021. Markets are looking for a sixth consecutive decline today, to 48.0.

- The US data calendar is relatively quiet this week, but it includes today’s August ISM services report. The July ISM services index unexpectedly rose to a three-month high of 56.7, despite recession concerns. Expect it to ease back to 54.5, although that would remain firmly in the growth zone. In contrast, the alternative US services PMI compiled by S&P Global has been below 50 in both July and August. The final August reading for that survey is also due today.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9900 (792M), 0.9995-1.0000 (1.08B), 1.0095-1.0100 (896M)

- USD/JPY: 138.75 (600M), 140.00 (626M). USD/CHF: 0.9815-25 (720M)

- AUD/USD: 0.6800 (722M), 0.6875 (1.06B). USD/CAD: 1.0325-30 (996M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0250

- Recovery from 20 year low continues, nears resistance

- EUR/USD tracking higher in Asia as short-covering continues

- It has traded as high as 0.9971 with the 10-year MA at 0.9976

- A clear break above 0.9976 would likely force more short-covering

- USD softer against most currencies as Asia trading with a risk-on tone

- Sustained 0.9900 break would target 0.9608 base in September 2002

- 20 Day VWAP bearish, 5 Day bearish

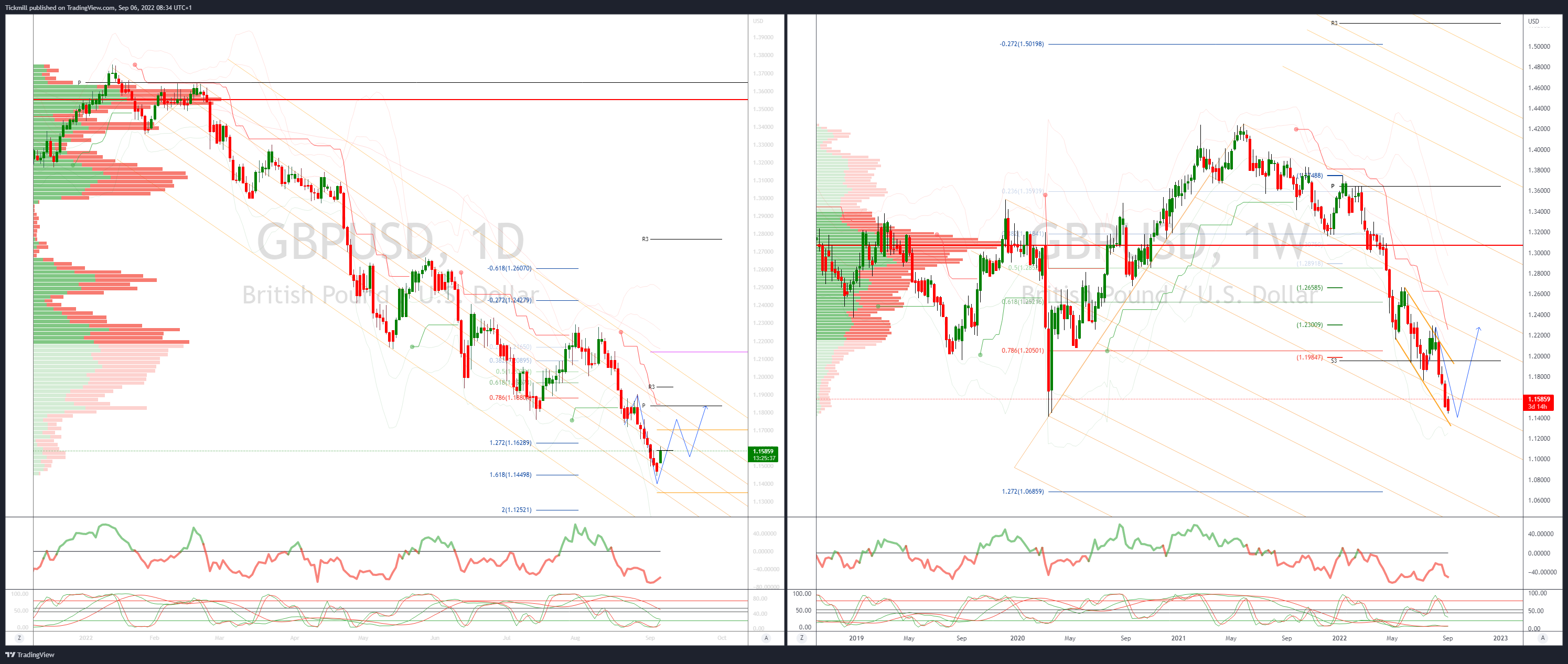

GBPUSD Bias: Bearish below 1.2050

- Relief rally as UK political uncertainty ends

- +0.5%, leading USD lower - short squeeze as Truss becomes PM

- Cautious UK shoppers, feeling inflation, cut non-essentials

- Food spending +7.2%, utility bills +45.2% on Barclaycard - tough winter

- Bearish trending setup targets 1.1413 March 2020 base longer-term

- Close above 1.1672 needed to undermine downside bias

- 1.1413 March 2020 low initial support, 1.1519 NY close resistance

- 20 Day VWAP is bearish, 5 Day bearish

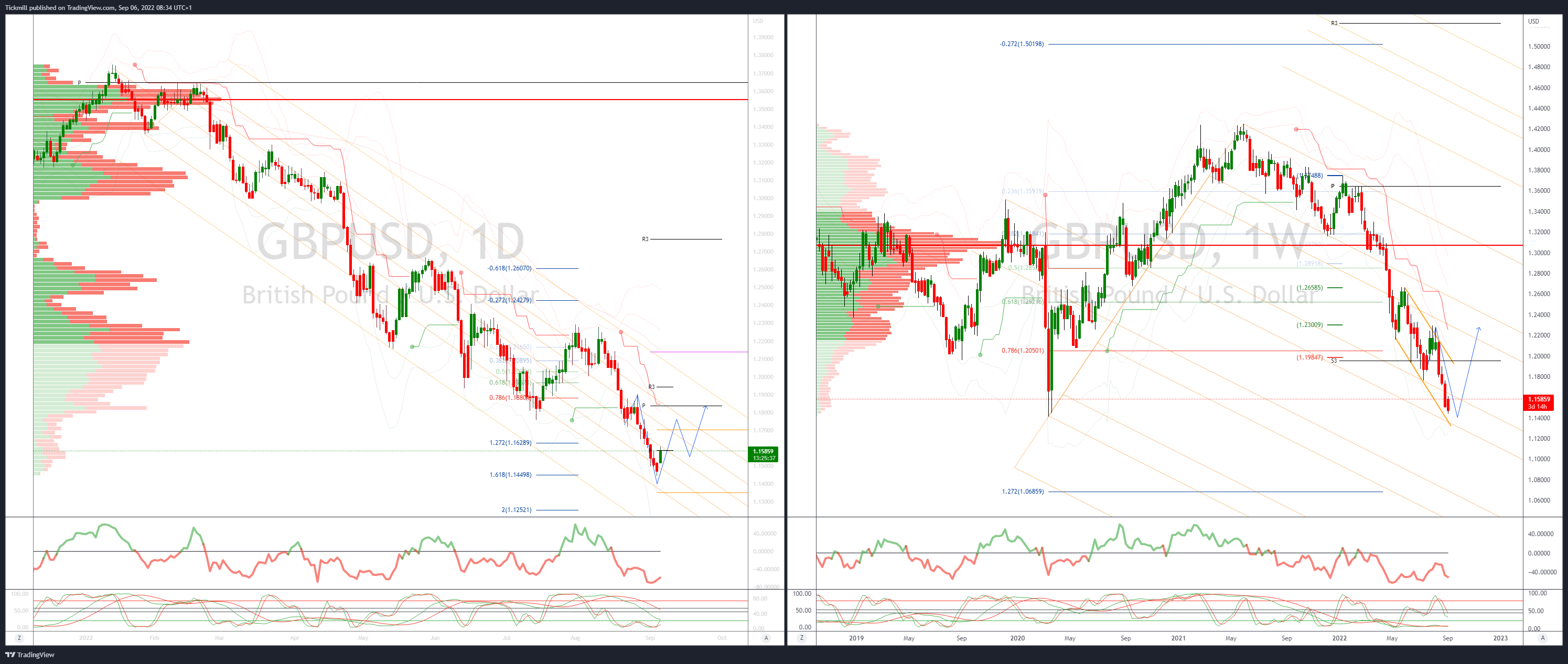

USDJPY Bias: Bullish above 133.40

- Japan FX jaw – boning again fall on deaf ears

- USD/JPY bounces after to dip to 140.25 EBS despite fresh jaw-boning

- FinMin Suzuki again lashed out at high FX volatility

- Stressed FX must reflect fundamentals, move in stable fashion

- As in recent past, he is watching the market with sense of urgency

- USD/JPY downside remains limited with market bias remaining up

- Hawkish Fed, higher US yields, importer demand to keep USD bid on dips

- 20 Day VWAP is bullish, 5 Day bullish

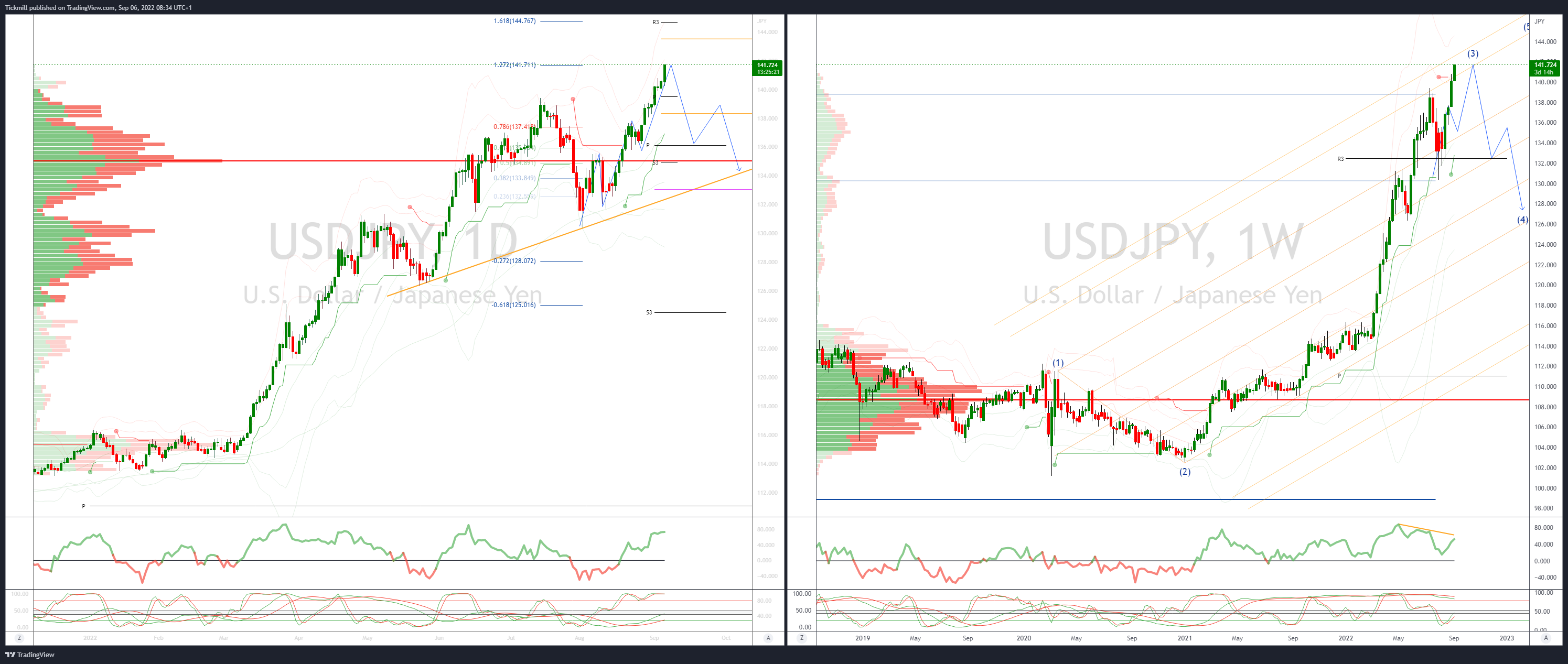

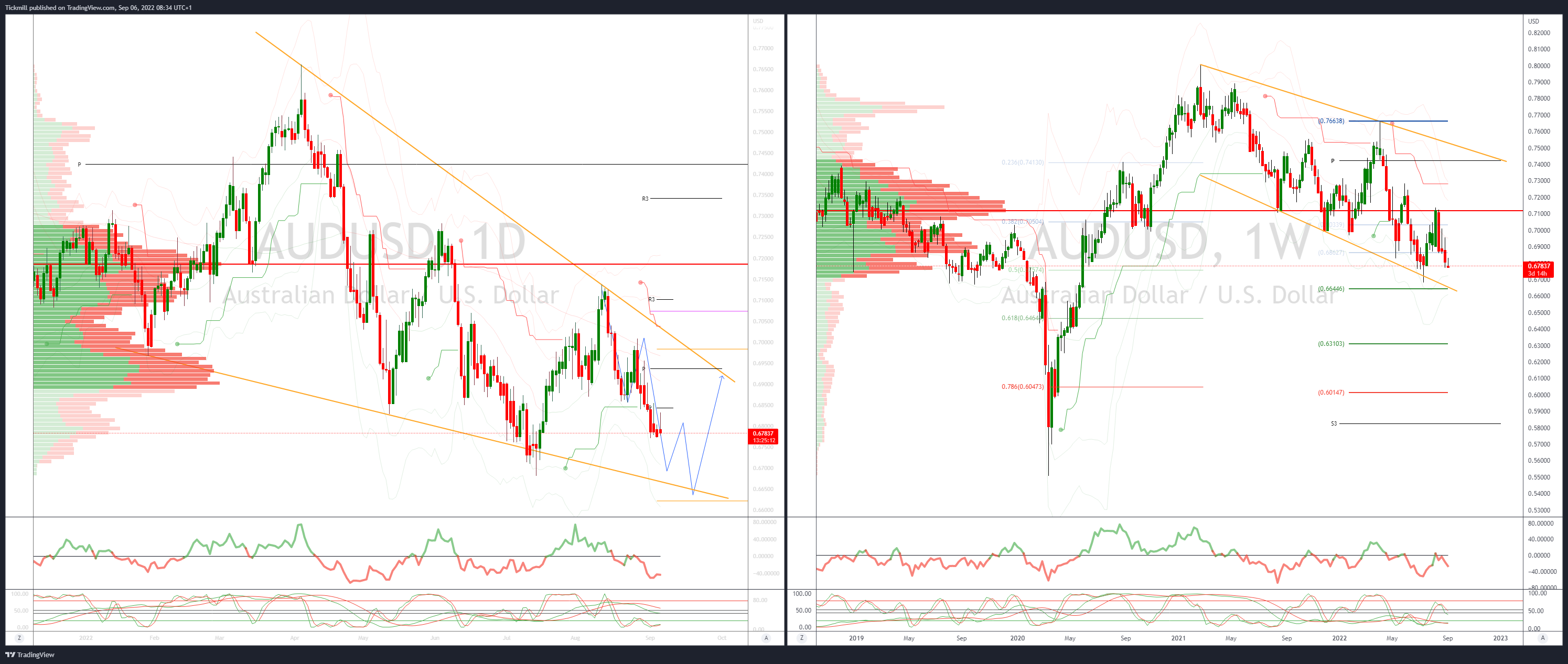

AUDUSD Bias: Bearish below .71

- Gives back early gains – RBA reaction muted

- AUD/USD opened -0.16% at 0.6797 and immediately moved higher

- E-minis opened -0.60% and provided a positive tone for Asia

- AUD/USD traded up to 0.6832 as USD broadly weakened

- Rally ran out of steam and AUD/USD was around 0.6805 into the RBA decision

- RBA hiked 50 BPs to 2.35% as expected and statement was same as August

- AUD/USD grated around 0.6800 before settling 0.6805/10

- Market will now focus on global growth outlook now the RBA is out of the way

- AUD/USD support is at double-bottom formed around 0.6770

- 20 Day VWAP is bearish, 5 Day bearish

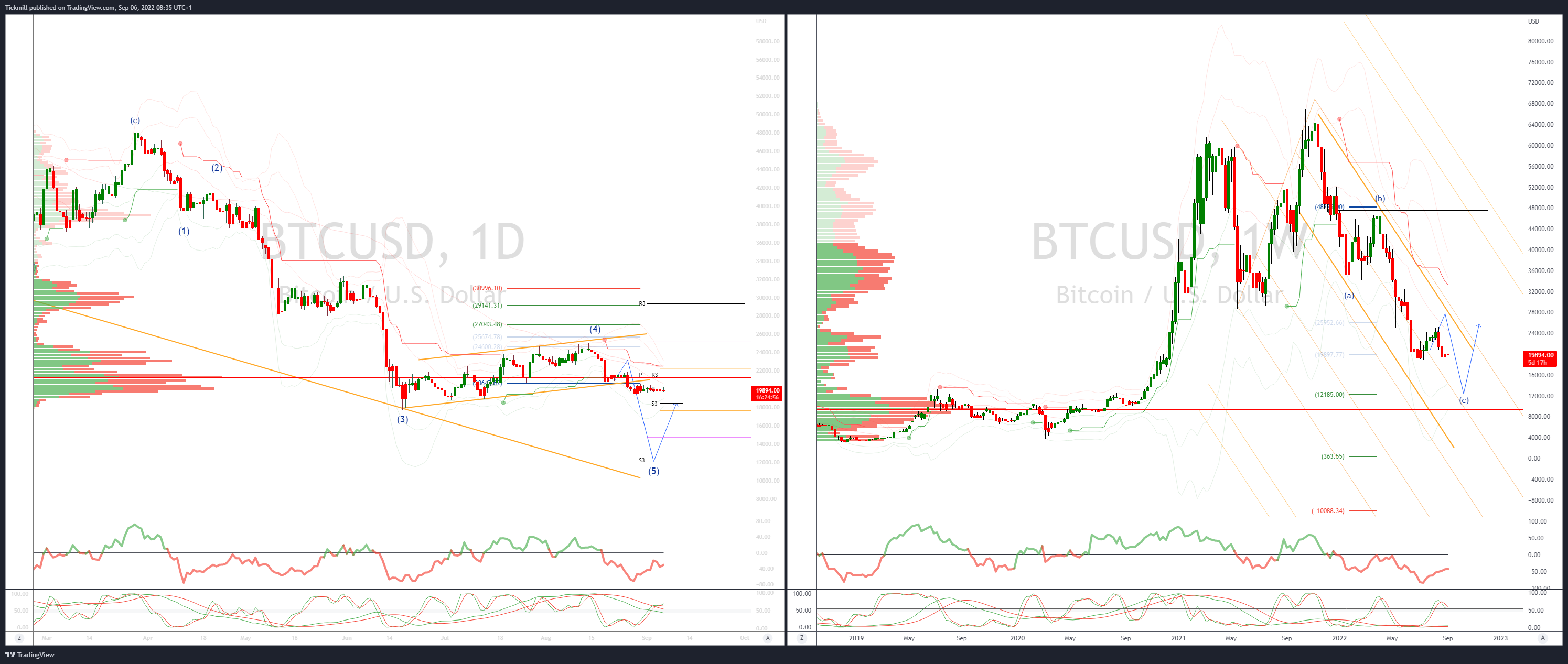

BTCUSD Bias: Bearish below 25.3K

- BTC trades sub 20k again

- ETH outperforms BTC as merge countdown continues

- Cardano & Cosmos competing blockchains notable outperformers

- Macro econ uncertainty continues to weigh on BTC as USD prints 20yr highs

- BTC supported by Jul 13 low 18.9k

- Aug 28's 22.2k may pull BTC higher

- 20 Day VWAP is bearish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!