Dollar Slips As Focus Turns to The FOMC

Fed Up Next

The US Dollar is softening today ahead of the FOMC decision later, giving back some of yesterday’s post-election gains. Trump’s victory in the elections and the prospect of a clean sweep for the Republican party will no doubt have important repercussions for the Fed. While a further .25% cut is firmly priced in today, the bigger focus will be on the guidance offered by the bank and how likely a further cut in December looks.

Trump Trade Returns

The reaction higher in USD is highly indicative of how the market views Trump’s proposed policies. A return to protectionist trade policies and growth focused economic policy in the US are expected to lead to higher inflation and a stronger US Dollar. With this in mind, there could well be some repricing of the Fed rate path, particularly if the Republicans do take the House.

Two-Way Risks for DXY

The key focus today will be how much emphasis the Fed puts on Trump’s victory and whether there is any shift in tone. The recent drop in US labour market data means the market is still pricing in a roughly 66% chance of a further .25% cut in December. If the Fed keeps the focus more on recent data, this vie should stay intact, seeing USD soften further. However, if the Fed starts to talk about risks to the outlook as well as the impact of a stronger US Dollar, this pricing could come down, leading USD higher again.

Technical Views

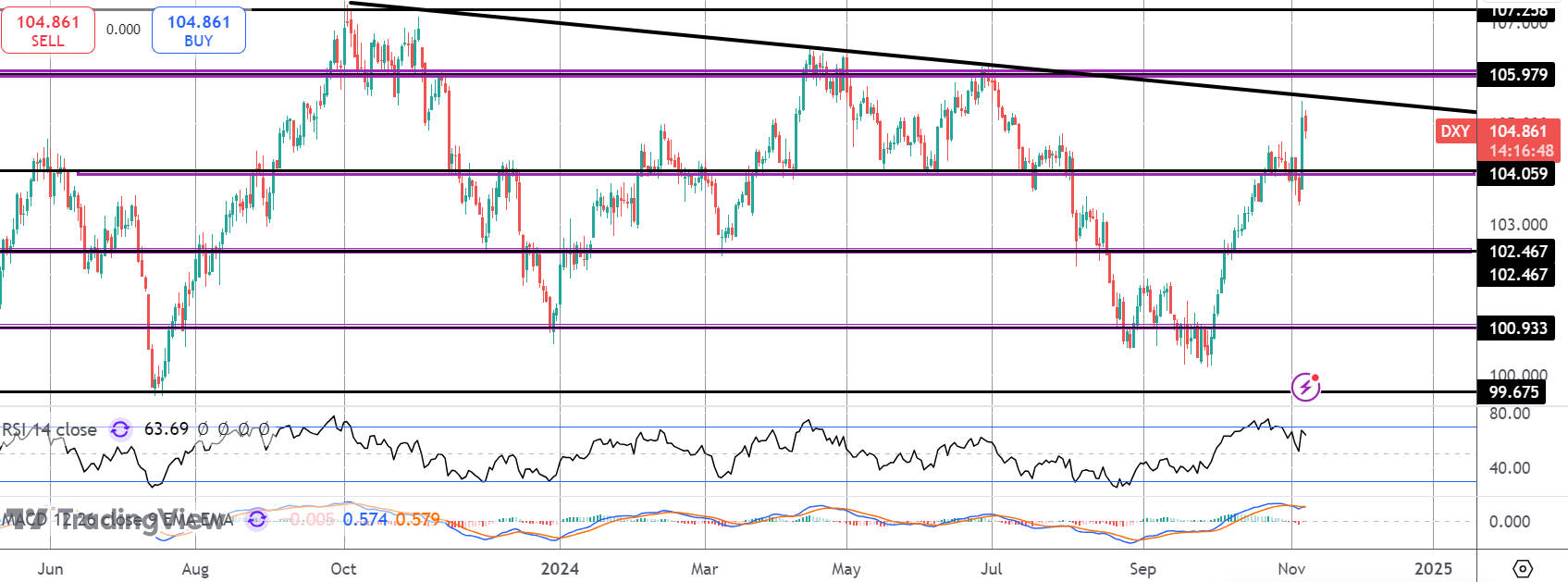

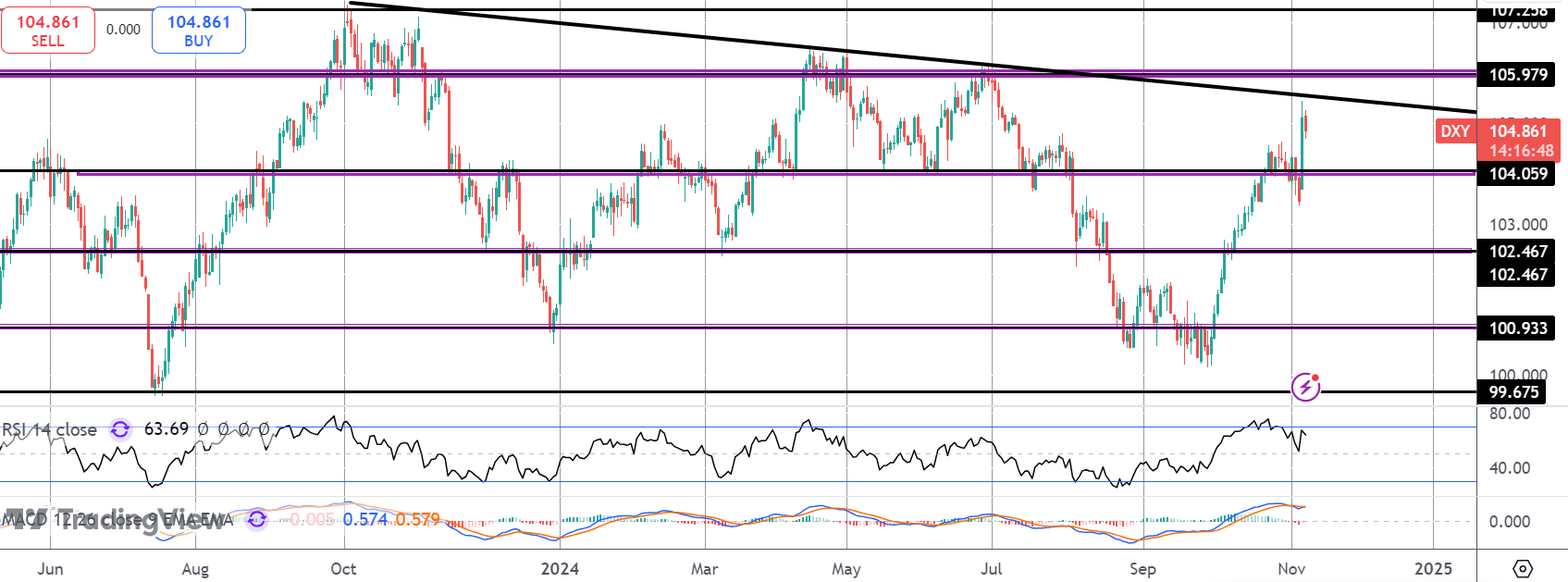

DXY

The rally has stalled for now into the bear trend line from YTD highs. While above 104.05, the focus is on a further push higher and a test of the 105.97 level next. To the downside, 102.46 is the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.