USD Under Pressure

The US Dollar has come under fresh selling pressure through early European trading on Tuesday. Dovish comments from Fed’s Waller yesterday have fuelled a reversal of the gains we saw at the start of the week. The Washington Fed governor told the audience at a central bank symposium that he was in support of a further rate cut this month.

Dovish Fed Comments

Waller explained that inflation is still forecast to return to target and a further cut at this point wouldn’t likely hinder that progress. Furthermore, Waller said that rate cuts could be slowed later on, if needed, to ensure inflation stays on track towards 2%. Waller’s comments were more definite than that of Fed’s Bostic who yesterday said that a December rate cut was not “preordained”. Fed’s Williams refrained from commenting on December specifically and in comments yesterday simply said that he expects the Fed to cut rates further ‘over time’.

US Data Due

Looking ahead, traders will be watching the JOLTS jobs number later today, ahead of the all important NFP release on Friday. A weaker figure today should help drive USD selling deeper into tomorrow where focus will turn to Fed chairman Powell who speaks just ahead of the Fed entering its pre-FOMC blackout period. As such, plenty of scope for USD volatility this week, particularly around the jobs data on Friday. Any move higher in December rate-cut pricing should see USD reversing lower through the week.

Technical Views

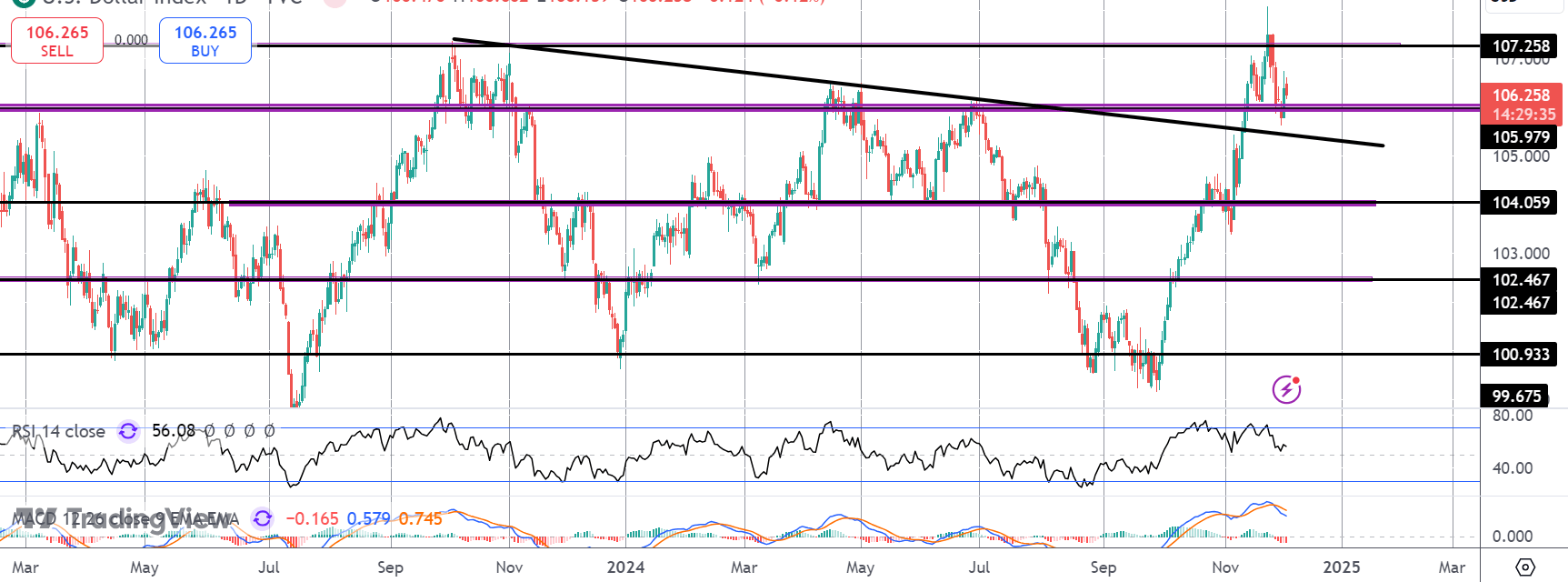

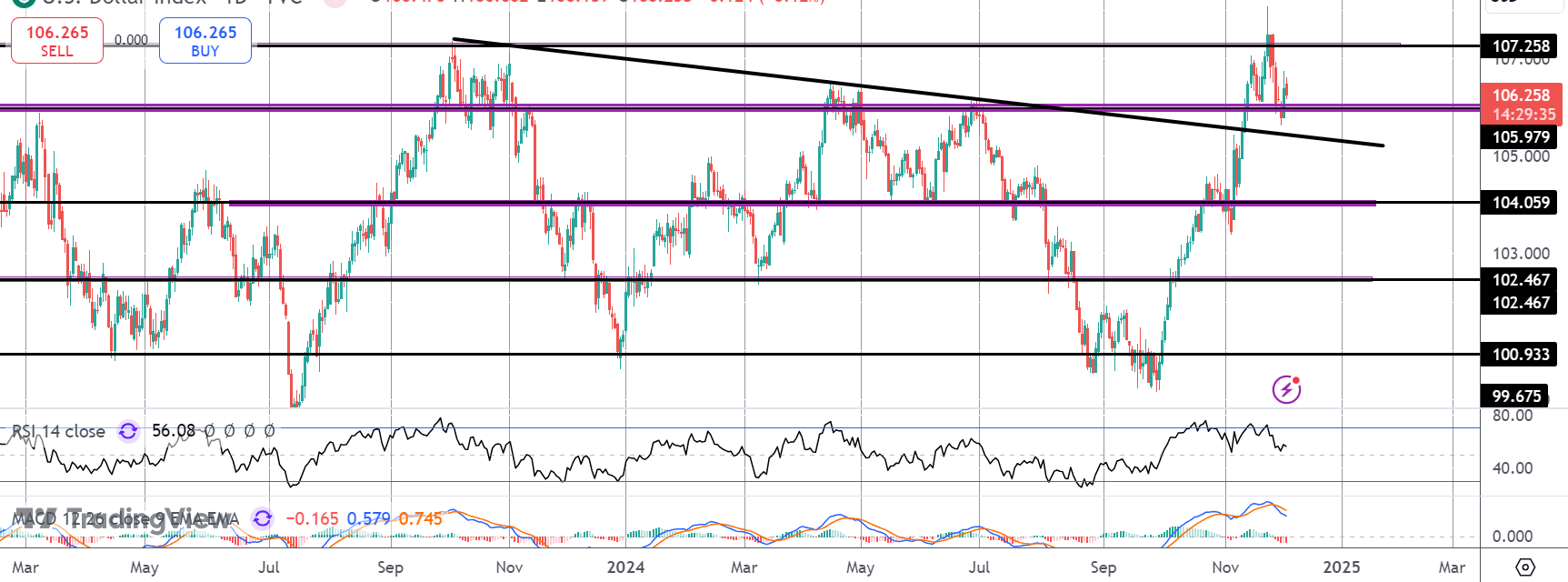

DXY

For now, the index remains caught between support at the 105.97 level (and the broken bear trend line just below) and the 107.25 highs. Given the rally over November, focus is on a continued push higher for now and an eventual breakout. This view only shifts on a break below the 105.97 level where focus turns to 104.05 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.