Dovish RBA Signals Keep Aussie Pressured

Dovish RBA Outlook

The Aussie Dollar has come back under fresh selling pressure today following the latest RBA rate decision overnight. While the bank held rates steady, the decision was accompanied by a dovish outlook which saw traders keeping near-term rate-cut expectations intact. The bank warned that upside inflation risks had largely subsided with CPI now moving sustainably towards target.

On the broader economy, the bank noted that a slower pickup in consumption was likely to keep output growth skewed lower, leading to a further, deeper deterioration in the labour market. The RBA also noted rising risks from global geopolitical uncertainty.

Weak China Data

Alongside this dovish and concerned messaged from the RBA, AUD has also come under pressure from further, soft Chinese data this week. Chinese imports and exports were seen slumping last month, likely a reaction to the expected US tariffs Trump has threatened to reactivate next month once he’s back in office. November import levels feel to their lowest point in 14-months.

Bearish Risks for AUD

Given the strong trade relationship between Australia and China, weakness in Chinese imports has a sharp impact on Aussie export income. Coupled with the decline we’ve seen in commodities prices in recent months as a result of a stronger USD, the near-term outlook for the Aussie remains weak. Looking ahead this week, traders will now be watching the latest US inflation data this week for any surprise readings which could fuel fresh USD volatility, further impacting AUDUSD.

Technical Views

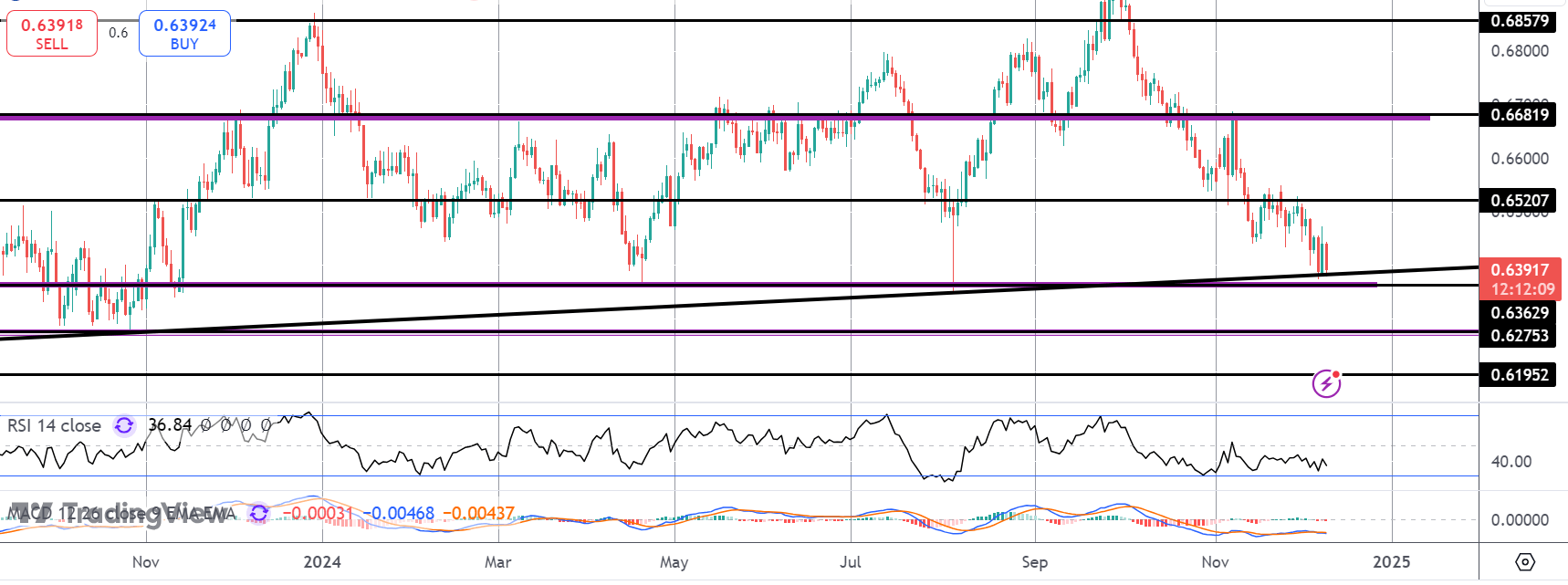

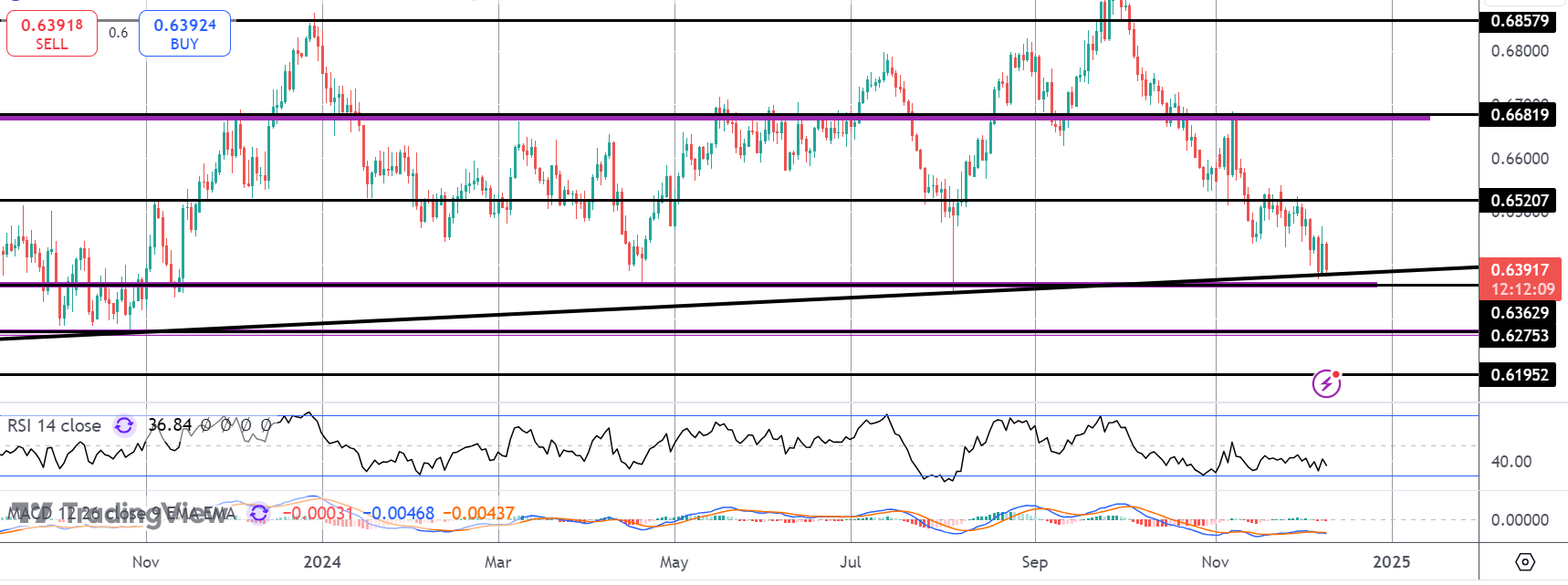

AUDUSD

The sell off in AUDUSD has stalled for now into the rising trend line and the .6362 level, just above 2024 lows. With momentum studies bearish, risks are skewed towards a further breakdown towards the .6275 2023 lows. Near-term, bulls need to get back above .6520 to alleviate bearish pressure.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.