ECB Faces Dilemma as EU Inflation Report Shows Downside Surprise

The EU April inflation report that hit the wires on Tuesday, surprised on the downside, albeit slightly, signalling that tight credit conditions are gradually taking effect on demand. Headline inflation, in line with the consensus, accelerated to 7.0% YoY in April from 6.9% in March. Core inflation took a step lower: from 5.7% to 5.6%. The rise in price pressures in the economy was again driven by energy prices getting more expensive, which explains why recent headline inflation figures somewhat lost their importance: the high rates of energy price growth seen last year are unlikely to persist, and therefore downside headline inflation effects that may occur this year are exclusively the effect of a high base from last year and inherent volatility of energy prices. At the same time, there has been some strengthening of price pressures in the services sector. As with the GDP data, there is a range of inflation rates across the block, reflecting different government efforts to introduce caps on energy prices, subsidies, etc., which will determine how pressure in wholesale prices will seep into retail prices. The range of inflation in the block varied from 2% to 15%.

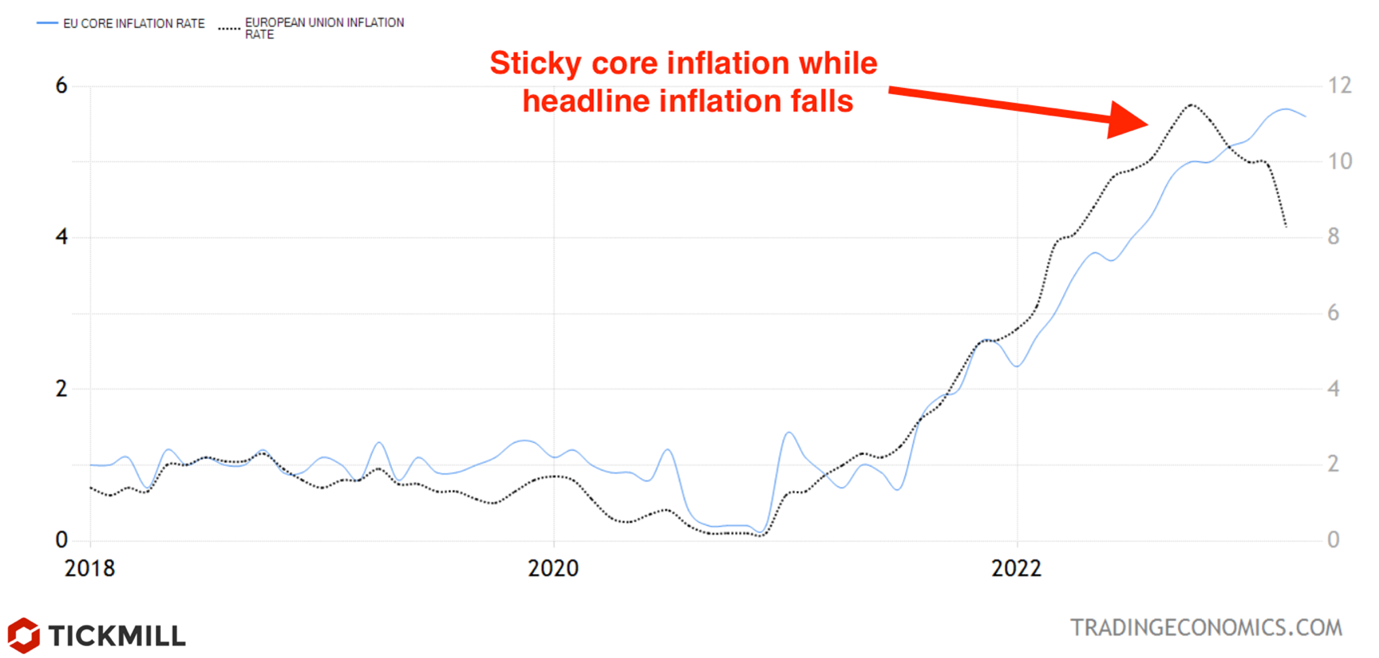

The main problem that the ECB is currently facing is a persistently high core inflation due to a still high share of firms planning to raise prices (i.e., execute price power) as well as slow supply recovery in the labour market, which ensures a persistent upside momentum in wage growth. And it seems to be a positive trend, but it takes inflation out of the control of the central bank because as incomes grow, so will demand and therefore inflation, and so on in a spiral. Earlier, ECB official Isabel Schnabel said that the central bank's task is to return core inflation to a comfortable level closer to 2%. Until this happens, the policy will likely remain in a restrictive space.

Over the past year, inflation in the eurozone, which started as a supply-side problem, has turned into a demand-side problem. This problem definitely falls under the competence of the central bank. The central bank can’t control the supply side, but it can change the proportion of the money supply to the volume of goods or services, i.e., reduce demand. And this is exactly what the ECB will continue to do on Thursday. Even if the main inflation indicator is decreasing and will continue to decrease, it is not yet a moment of relief. The ECB does not want to repeat the previous mistake of keeping rates too low, ignoring building price pressures, and will be ready to go too far, even if it turns out to be a policy error.

The only open question is whether the ECB will raise interest rates by 25 or 50 basis points. Only the head of the Austrian central bank, Robert Holzmann, openly supported 50 basis points. Other hawks, such as Isabel Schnabel, allowed for such a possibility. Inflation data clearly emphasizes the need to continue raising rates, but with last week's GDP growth report coming in weaker than expected, and today's weak data on credit growth and demand, arguments for slowing the pace and size of interest rate hikes become stronger. The most likely scenario remains a moderate one, with a 25 b.p. increase.

And although inflation in the EU remains at a relatively high level, core inflation, albeit slowly, is moving towards the target level. The EURUSD pair, as discussed earlier, after consolidation near the lower bound of the trend channel, has moved lower after the data release:

Bearish momentum is unlikely to unwind too fast and sellers are likely to push a little harder, sending the price to the mid-April minimum of 1.09. Here, the pair will wait for the FOMC decision, which is scheduled for tomorrow.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.