Fed’s upcoming rate cut is likely to be preemptive rather than a response to recession

World stock markets rose on Thursday after the Fed signaled about intentions to cut rates, presumably at the next meeting, removing the “patience” wording from the statement, emphasising the growth of uncertainty in forecasts. Updated dot plot showed that more and more officials are inclined to lower rates at the next meetings.

The MSCI index, a replicating portfolio of stocks from 47 countries, grew by 0.4%, expecting a fresh batch of stimulus from the world's major securities, intending to close the third trading session in positive territory. The Asian MSCI index rose by 1.2% due to the rise in the stock market of China.

Despite the lack of direct hints at a rate cut in July, futures on the federal funds rate assessed the chances of keeping the rate at the current level of 0%. The main expected outcome of the July meeting is the new range of rates of 2-2.25% (a decrease of 25 bp), with chances of 67.7%.

The long-term interest rate forecast fell from 2.75% to 2.5%. It is also noteworthy that the forecasts for GDP and inflation (staff economic projections) have changed in different directions. The Fed expects that GDP in 2019 will grow by 2.0% (+ 0.1% compared with the previous forecast), while inflation will slow to 1.5% (-0.3%). A relatively positive outlook for the economy may indicate that the potential rate cut would be preemptive, rather than a response to the approaching recession, which created a relatively safe opportunity to push stock indices up to new highs. Futures on the S&P 500 during the trading session on Thursday updated the maximum and are 42 points from 3000 points round mark.

Next week, the S&P 500 will most likely overcome the 3000 mark, since the deadlock in the US and China talks is most likely priced in expectations, and the next piece of important data on the US economy will arrive only early next month.

It is necessary to recognise that the factor of synchronous actions of world central banks cannot be underestimated. Therefore, yesterday’s article in support of the views of Goldman, which predicted the extension of the neutral position of the Fed, turned out to be insufficiently substantiated speculation. By the way Goldman ditched its call for the Fed’s “on hold” stance, now expecting rate cuts in 2019.

In the meantime, the probability of a recession, according to the New York Fed Recession Model, increased to 30%, almost the necessary level to historically substantiate the approach of the next crisis:

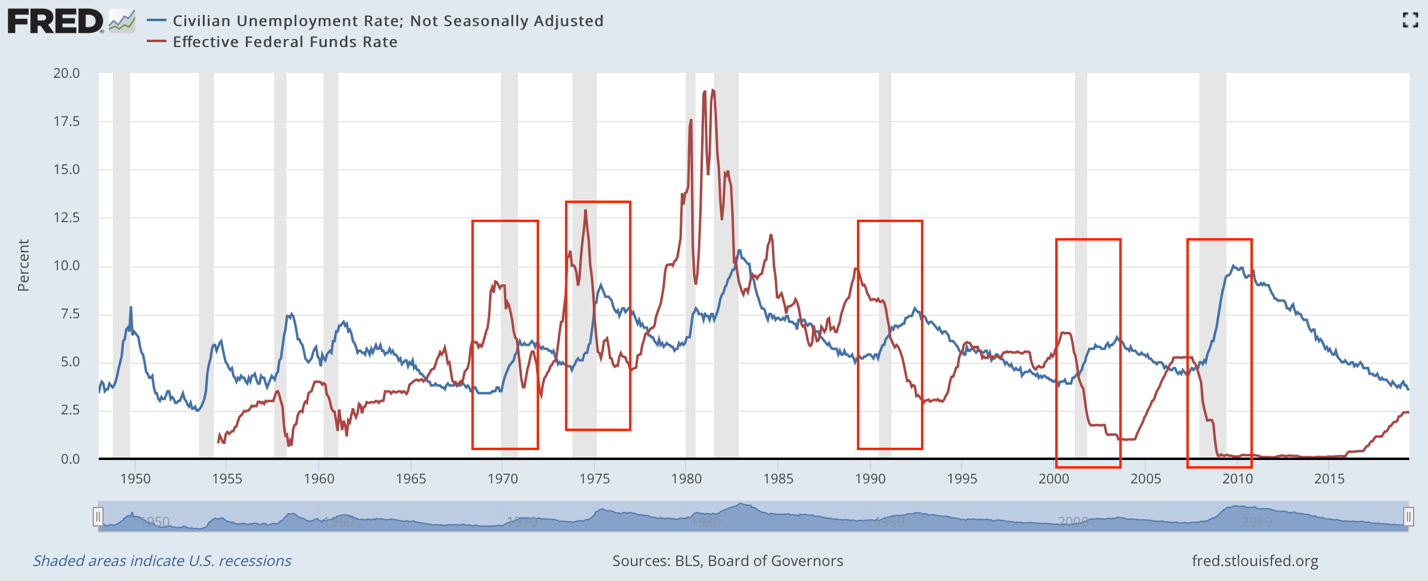

The following pattern is also curious: every time when the Fed moved into the phase of reducing interest rates, unemployment in the US economy began to rise sharply:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.