GBPUSD Capped by Shock UK Retail Sales Drop

Weak UK Retail Data

GBPUSD is softening today from earlier highs following a shock disappointment in UK data this morning. UK retail sales were seen contracting 2.7% last month, a stark shift from the prior month’s 1.3% increase and far deeper than the -0.5% level the market was looking for. The data reflects the sharpest monthly decline since December 2023. The breakdown of the data shows the decline was driven mostly be the fall in food sales, which saw their lowest reading since mid-2021. Non-food sales were also heavily weaker with retailers noting reduced foot traffic over the month.

BOE Easing Expectations

The data comes on the back of a lacklustre BOE meeting yesterday. The bank refrained from offering much in the way of new guidance, a trend seen over recent meetings. However, the shift in voting (now 6-3 hold-cut) can be seen as a dovish signal. With UK data still printing on the weak side, traders are now looking for a cut in August, where previously September had been seen as the strongest option. Barr the upside surprise in CPI this month, recent data has shown an increase in unemployment, a drop in retail activity and a drop in overall growth. While the backdrop of UK data weakness persists, GBP looks vulnerable to a move lower as we head into the August meeting.

Technical Views

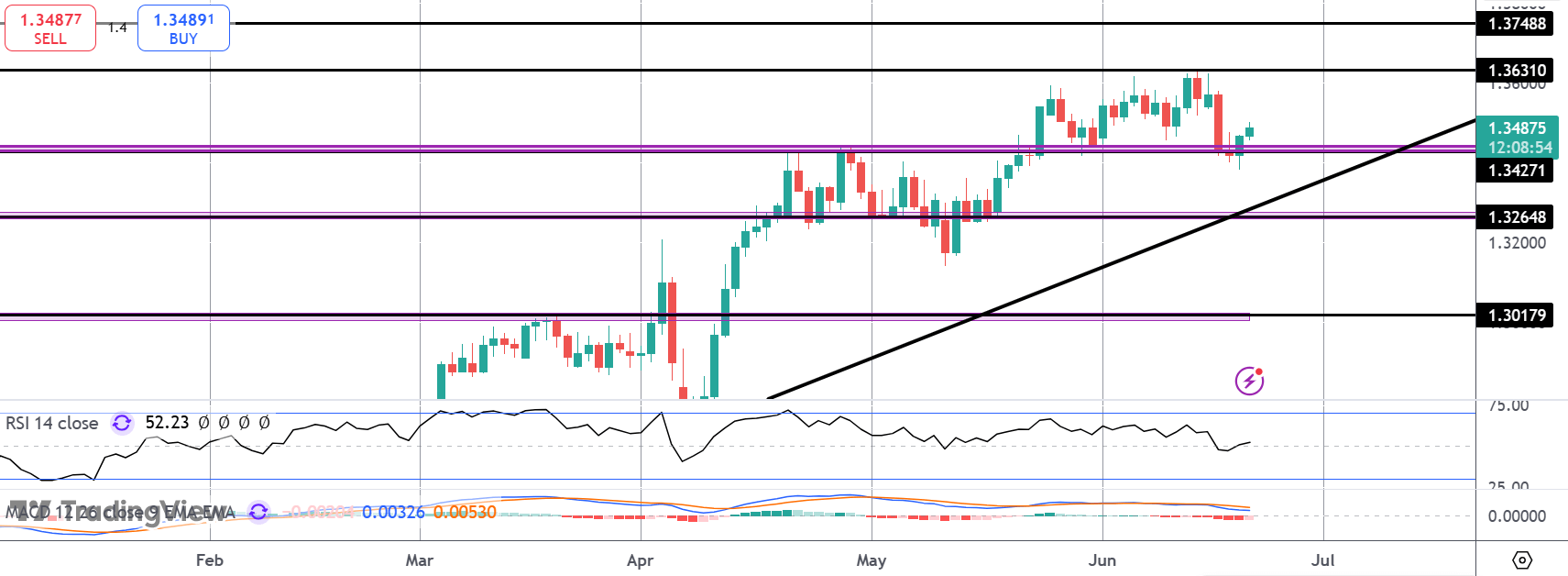

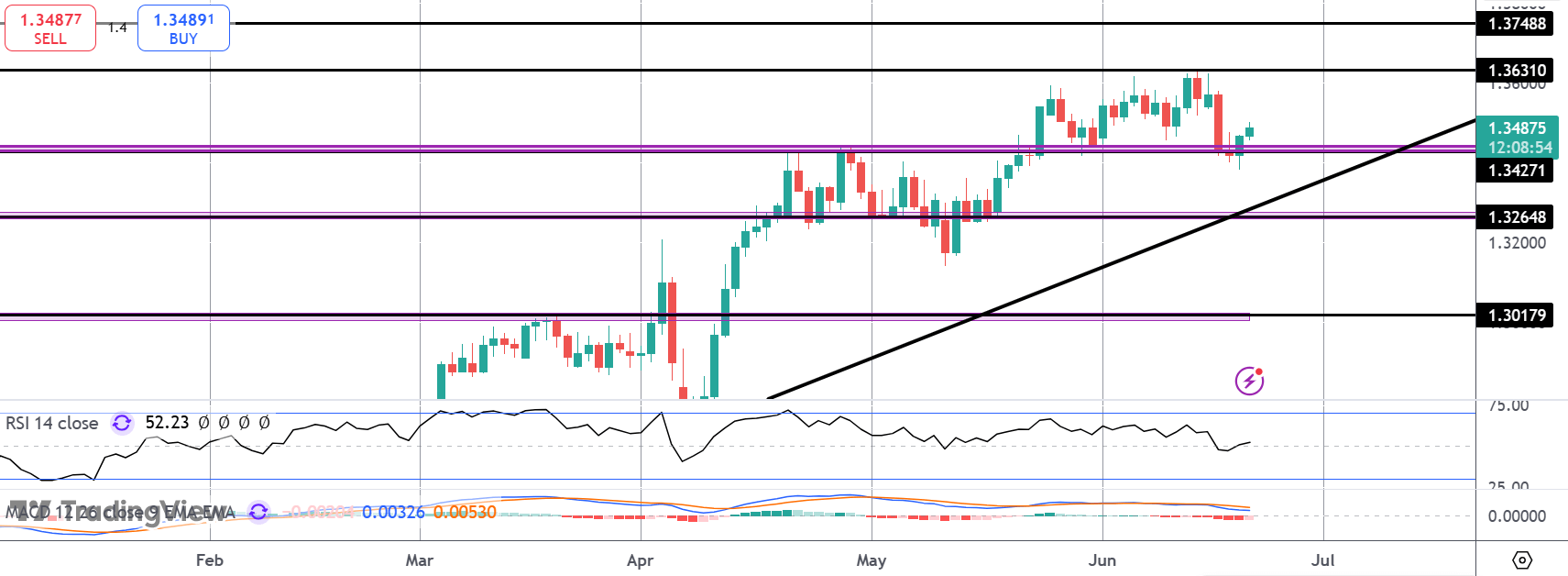

GBPUSD

For now, the correction lower has found support into the 1.3247 level and with the market still above the rising trend line, focus is on a continuation higher. 1.3631 remains the key upside hurdle with 1.3748 sitting as the next target for bulls if we do break North. To the downside, the bull trend line and 1.3265 level will be next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.