USD: no longer smiling

Investors have swiftly lost confidence in the “Trump trade” as concerns mount over whether the US president’s tariffs and spending cuts influenced by DOGE could push the US economy into a recession.

Donald Trump’s seeming apathy towards the declining US equity market is particularly unsettling for investors. They had believed that his tariff threats were simply negotiation strategies and that a declining equity market would moderate his most radical policies. Currently, both of these beliefs seem to be mistaken.

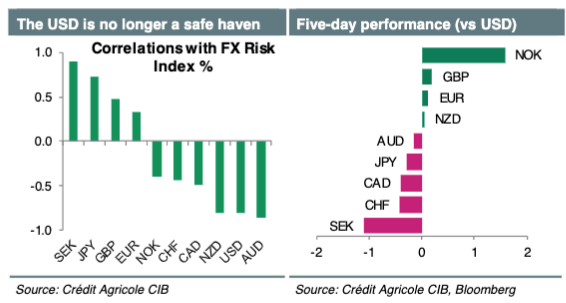

This shift in sentiment has resulted in a change in FX market correlations. The USD has ceased to be a safe haven and is now categorized alongside the Antipodean currencies as a risky asset. European currencies have gained strength as investors seek alternative locations for funds leaving the US. Europe’s previously overlooked and undervalued equity markets have proven to be inviting.

Increased German defense and infrastructure spending as its debt constraints may be relaxed, along with a potential peace agreement between Ukraine and Russia, have enhanced the attractiveness of European currencies.

A vote on modifying the debt constraints in a special session of the Bundestag this week will be crucial for the EUR’s momentum, as will the release of German ZEW data.

A pause from the Riksbank may not revive the SEK’s exceptional rally, which has lost some momentum this week.

There might be some relief for the USD in the upcoming week, however. The Fed is expected to maintain its stance and potentially counter market expectations for three 25bp rate cuts in 2025, particularly as inflation remains persistent. We anticipate the FOMC will signal that it is not in a hurry to lower rates, despite the more uncertain economic outlook. US retail sales data will test investor worries about a recession.

Encouraged by evidence of significant wage increases in spring, the BoJ is likely to maintain a hawkish hold next week. The JPY’s response will depend on whether the board expresses any concerns regarding the US economy and how this might affect their willingness to further raise rates.

The BoE is expected to keep its rates steady while emphasizing its outlook of further easing ahead. The impact of the policy meeting on the GBP may be overshadowed by the FOMC, tariff-related news, and the overall movements of the USD.

The SNB will likely move rates closer to 0%, enhancing the appeal of the CHF as a funding currency.

This week, we took a long position on the USD against a basket of JPY and CHF, while maintaining a long position on EUR/USD through options.

The outlook for the euro (EUR) has recently brightened, driven by increasing market expectations of significant rises in defense and infrastructure spending, which could alter the Eurozone's growth trajectory in the coming quarters. Domestic demand may also receive a boost from a potential resolution to the war in Ukraine and further declines in global energy prices, supported by a budding rapprochement between the U.S. and Russia. While a trade war with the U.S. remains a key downside risk, it would be from an upwardly revised baseline growth scenario for the Eurozone. Our economists now project a terminal European Central Bank (ECB) rate of 2.25% or higher, exceeding current market expectations. These developments present upside risks to our existing EUR/USD outlook, prompting us to review whether to accelerate the timeline for the EUR/USD strength we anticipate in the medium to long term.

The U.S. dollar (USD) underperformance, which began after President Donald Trump’s January inauguration, persists. Foreign exchange (FX) movements reflect ongoing investor rotation out of U.S. assets into European and Asian equities and fixed income securities. This portfolio reallocation appears to stem from persistent concerns about U.S. growth and renewed optimism about European growth. However, we believe many negative factors are already priced into the USD, and we expect it to regain some ground in the coming months as uncertainty over Trump’s trade policies continues. Any consolidation of the USD could lead to renewed weakness in the long term. Specifically, a combination of Federal Reserve rate cuts, a revival of Trump’s “Weak USD Doctrine,” and fears of fiscal dominance over the Fed could weigh on the USD in the second half of 2025 and into 2026.

The Swiss franc (CHF) has moved out of its range-trading pattern against the strengthening EUR. The EUR/CHF pair could trend higher throughout the year, as the reintroduction of zero interest rate policy (ZIRP) in Switzerland makes the CHF an attractive funding currency. Nonetheless, reduced inflation differentials should temper the CHF’s real valuation, while balanced growth rates should help mitigate significant nominal losses.

Among G10 currencies, the Japanese yen (JPY) was relatively resilient to tariffs during Trump’s first term. We expect the U.S.-Japan interest rate differential to continue narrowing as the Federal Reserve cuts rates while the Bank of Japan (BoJ) hikes further. This compression in the U.S.-Japan rate spread will diminish the carry trade appeal of being long USD/JPY. Meanwhile, exchange rate volatility is likely to remain elevated due to uncertainty surrounding the monetary policy paths of the Fed and BoJ, as well as Trump’s trade agenda. Additionally, Japan’s Ministry of Finance (MoF) is expected to remain prepared to intervene in support of the JPY.

Concerns about the U.K.’s economic outlook, coupled with rising government borrowing costs, could push the Labour government toward fresh austerity measures. Such measures would exacerbate challenges for the U.K. economy, particularly amid ongoing geopolitical risks and the threat of a U.S.-led trade war. While GBP/USD has benefited from recent broad-based USD weakness, caution remains warranted over the next three to six months. However, the GBP is viewed as a higher-yielding proxy for the EUR, which supports a constructive outlook for GBP/EUR in 2025 and 2026. GBP/USD strength could reemerge in the second half of 2025, driven by persistent USD weakness and signs that increased defense spending and improved financial conditions are steering the U.K. economy back toward sustained growth.

The Canadian dollar (CAD) remains sensitive to the evolving U.S. trade policy landscape, with USD/CAD hovering near the 1.44 pivot. The duration and impact of U.S. tariffs on Canada’s economy—and whether they prompt a response from the Bank of Canada (BoC)—will determine whether the pair settles above or below this level. Canada’s robust retaliatory measures may somewhat mitigate the risk of significant CAD depreciation.

The Australian dollar (AUD) weakened during Trump’s first term due to China tariffs and a declining Australia-U.S. interest rate differential. We anticipate that Trump may adopt a more conciliatory stance on China tariffs, potentially imposing rates lower than the 60% he pledged during his campaign, which would support AUD/USD. Additionally, the Reserve Bank of Australia (RBA) is expected to remain less dovish than many other G10 central banks, further bolstering the AUD.

The New Zealand dollar (NZD) faced headwinds during Trump’s first term due to a falling NZ-U.S. rate differential, China tariffs, and adverse weather conditions in New Zealand. However, we believe Trump’s China tariffs may ultimately be less severe than his 60% campaign pledge, providing support for NZD/USD. A stable NZ-U.S. rate differential, as the Reserve Bank of New Zealand (RBNZ) aligns with Fed rate cuts, along with a rebound in New Zealand’s

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!