Institutional Insights: Goldman Sachs Trading Desk Views On Equity Sell Off

.jpeg)

GS Risk Taker Views FICC and Equities | 10 March 2025 |

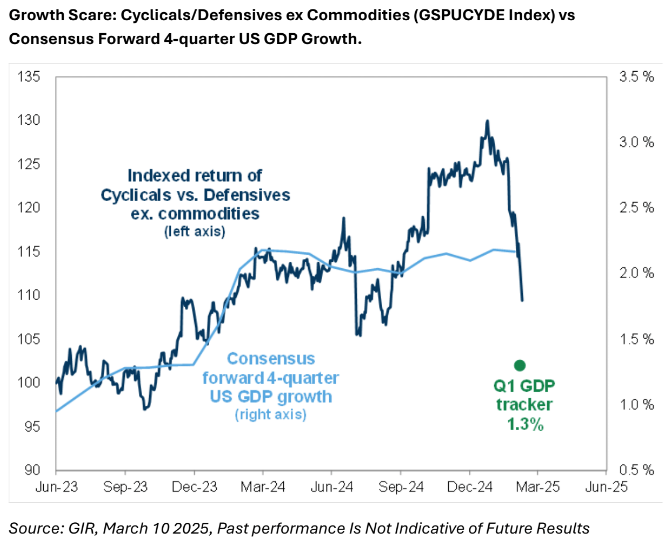

What began as a repricing of growth from an elevated starting point has now evolved into a broader growth scare, fueled by factors such as tariffs, cryptocurrency volatility, retail selling pressures, uncertainty surrounding artificial intelligence, and the perception that the new administration is willing to tolerate short-term economic pain, potentially creating boardroom unease. Our Cyclicals/Defensives ex Commodities pair (GSPUCYDE Index) has declined approximately 16% from its peak, serving as a strong indicator of current market trends. Growth scares often trigger significant factor rotations, and we’ve observed a predictable pattern with beta and momentum experiencing their worst start in over 15 years. However, the underperformance of long-side crowding is a newer and concerning development, which we are monitoring closely alongside the short leg, which had been performing well until Friday. Inflation expectations this Friday will be critical to watch to avoid a stagflation narrative, although the GSPUSTAG index remains the best-performing U.S. theme year-to-date. While my colleagues in EMEA and Asia are exploring compelling themes, the U.S. market opportunities may become clearer and more rewarding after navigating through this challenging period.

GS Risk Taker Views:

- Thomas Eason (Head of Index Vol): The unwind of U.S. exceptionalism-type positioning continues, with systematic strategies adding momentum to the decline. It appears that systematic length hasn’t been fully unwound yet, and the market is searching for clarity on the “Trump Put” strike level. Volatility has reset to stressed levels. To position for a reversal, we’ve implemented 1x1.5 and 1x2 call spreads in QQQ with expiries between late March and May. This unwind feels distinct from the August 5th event last year, where VIX and volatility carry were central. Currently, gross risk and long/short positioning seem to be the focal points as markets test new lows.

- Benny Adler (Head of ECM Trading): Several factors are creating a challenging environment for risk assets:

1. The post-election market euphoria has shifted to a hangover as the realities of Trump 2.0 policies appear less market-friendly than anticipated.

2. U.S. growth data has slowed independently of tariffs and recent policy changes.

3. AI, a key driver of the recent bull market, is unlikely to provide near-term support amid DeepSeek-driven uncertainty.

4. Trump’s recent messaging suggests a willingness to endure short-term market and economic pain, leaving the “Trump Put” out of reach.

These dynamics have led to a swift, one-sided unwinding of crowded positions. While it’s difficult to pinpoint a bottom, we may be nearing a tradable bounce in some of the hardest-hit sectors as market participants shift strategy.

- Richard Privorotsky (Head of EMEA 1D Trading): The market is caught in a reflexive loop, testing the pain threshold of the Trump administration. A combination of spending cuts and regressive tariffs has sparked a growth scare. Equities are significantly oversold, creating conditions for short-term rallies in SPX/NDX and momentum. However, without a clear catalyst, the market drift remains downward until the pain point is identified.

- John Flood (Head of Americas Execution Services): Investors remain cautious, with no offensive strategies in play. The S&P 500’s 200-day moving average of 5730 has failed to provide support, which is concerning. Fundamental long/short hedge funds are underperforming, with concentrated trades and momentum driving losses. Asset managers have been largely inactive but are now trimming positions in tech and financials. Liquidity remains tight, and positioning dynamics continue to act as headwinds. Oversold technical conditions may prompt rebounds, but rallies are likely to be viewed as selling opportunities due to persistent market challenges.

- Jon Shugar (Head of Cross Asset Sales): In a tough technical environment, investors are increasingly adopting a growth scare perspective, focusing on the impact of policy uncertainty on consumer spending and business confidence. Credit protection in high-yield markets, receiver swaptions, and hedges in European indices like SX5E, SX7E, and DAX are worth considering. On the long side, non-pharma healthcare stands out as attractive from both a valuation and positioning perspective.

- Carlo Didonna (Flow Exotics/Hybrids MD): Bearish flows dominate, with demand for growth hedges and downside plays like SPX and KO puts. The SPX-rates correlation has risen, and we continue to favor dual binaries for leverage, given the high volatility levels and potential for further risk-off moves.

- Brian Garrett (Head of Cross-Asset Equity Execution) – Volatility often leads to upside? Over a 12-year analysis (excluding March 2020), markets have tended to normalize after prolonged periods of volatility. Key observations include:

1. Inversion of VIX spot vs. VIX 1-month futures often signals stress or panic.

2. This inversion has persisted for 11 consecutive sessions.

3. Such consistent inversion has occurred only 20 times in 12 years (excluding 2020). Historically, the average 10-day return is +4% with an 85% success rate, while the average 22-day return is +4.1% with a 95% success rate.

Erin Tolar (PB Content, Stock Loan) – Performance pressures are mounting. As of today, global FLS performance has turned negative for the year, after peaking at +4% in mid-February. Similarly, TMT L/S funds are now down nearly -2% YTD, after being up as much as +8% mid-February. Despite the selloff since mid-February, hedge funds (HFs) only began significant de-risking last Friday. Over the past three weeks, HFs have actively reduced net leverage, particularly through shorting Macro Products and, to a lesser extent, single names. Net leverage for FLS funds has declined at the fastest pace since 2022, now sitting near 1-year lows. Friday marked the most significant broad-based de-grossing on our books in over two years, particularly in US single stocks, signaling that the de-risking process may not yet be complete.

Alex Dieppedalle (STS Structuring) – The GS SPX Conditional Downvariance Strategy (GSISCVS1 Index) could be timely. Key points:

1. The downside barrier is currently close to SPX spot, averaging 5571 points. A small SPX decline could bring long puts in-the-money, with only a sharp move in realized volatility needed to trigger payouts.

2. GS Economics recently raised recession odds from 15% to 20%, enhancing the strategy's relevance.

In a deep equity shock scenario, traditional protection involves purchasing S&P 500 put options. The GS SPX Conditional Downvariance Strategy buys far out-of-the-money SPX puts, financed by selling closer-to-the-money put spreads, aiming to replicate an OTC conditional downvariance payoff. The downside barrier is set at the 2-month 15-delta strike, historically aligning with a ~10% SPX drop over two months. The strategy pays off if the barrier is breached and realized volatility spikes.

Erin Briggs (Derivatives Sales MD) – Recent client activity and discussions have centered on adding macro hedges and adjusting portfolios to reflect rising US growth concerns. Equity volatility skew was already elevated entering this period. Following recent selloffs, street gamma has flipped short, and implied volatilities, along with daily straddle costs, remain high. Despite elevated intraday realized volatility, our desk no longer sees strong opportunities in being outright long vol. Instead, we see value in upside trades that net sell volatility, positioning for a potential de-grossing or relief rally in heavily shorted market segments (e.g., IWM, most-shorted baskets, momentum shorts via call spread collars, call ratios, etc.).

Lee Coppersmith (Derivatives Sales MD) – Trump’s recent interview failed to reassure equity investors and likely pushed the "Trump Put" further out of the money. While US equity positioning metrics indicate some de-risking, widespread capitulation has not yet occurred. Our Sentiment Indicator remains neutral, offering no clear 'all-clear' signal. Moreover, equity market growth expectations, while falling closer to GS Research's revised outlook, are not yet overshooting to the downside.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!