Institutional Insights: The March FOMC – Goldman’s Take from Traders and Research

Goldman Sachs Views: March FOMC – Key Takeaways

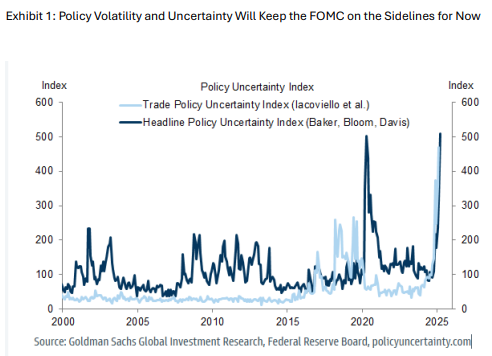

Market Outlook: Markets seek clarity on trade uncertainty, growth forecasts, and QT policy. Goldman expects the FOMC to maintain a cautious stance, signalling no urgency to cut rates. Growth projections are down, unemployment is up, and core inflation is rising toward 3%, complicating the Fed's dual mandate.

Rates & Strategy: GIR prefers long front-end US rates, shorting USD in hawkish Fed reactions, and anticipates credit underperforming its historical beta to stocks as markets adjust to a new regime.

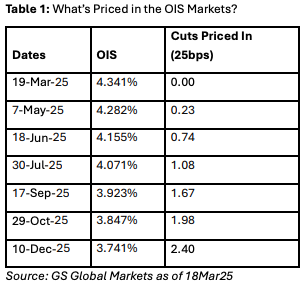

Economic Projections: The FOMC is expected to hold rates steady amid policy uncertainty. Tariffs have raised inflation and lowered growth forecasts, with 2025 core PCE inflation projected at 2.8% (+0.3%) and GDP growth at 1.8% (-0.3%). Despite challenges, the Fed may keep 2025’s projection of two rate cuts to avoid market instability. GIR expects rates at 3.875% (2025), 3.375% (2026), and 3.125% (2027), with the neutral rate slightly higher at 3.125%.

Tariff Impact: Higher tariffs complicate policy, raising inflation and dampening growth. While normalisation cuts for 2024 seem unlikely, the Fed may consider “insurance cuts” later if risks escalate.

Balance Sheet Strategy: The Fed may slow its balance sheet runoff, potentially halting Treasury reductions while continuing mortgage-backed securities reductions through Q3. A decision could come as soon as May or even during the March meeting. This reflects the Fed’s effort to manage liquidity amid economic shifts.

Summary: The Fed faces complex trade-offs as it navigates elevated inflation and slower growth, with its outlook closely aligned to current market pricing.

GS Trading/Strategy

Rates:

- Bullish US Front-End; Bearish Equities; Bullish Swap Spreads: Fed is in a "watchful waiting" mode, anticipating weaker data in March/April, leading to rate cuts by June. Labor market weakness will drive policy easing. Tariffs impact mandates oppositely. Starting from restrictive policy allows room for rate cuts. Bullish on US front-end rates (~60bps cuts), bearish on equities near-term, bullish on swap spreads.

- Neutral on Rate Vol; Slight Bias to Short Payer Side: Softer payrolls/inflation data calmed rate vol. Neutral stance with slight bias to short payer side via payer ladders/ratios. Rate vol may drop further if equity markets relax.

- Receive May FOMC: May FOMC receiving favored amidst recession fears. Expect no major statement changes, with dots likely showing 2 cuts for 2025. Fed balancing inflation uptick and softer growth data.

FX:

- Short USD in Hawkish Fed Reaction: Fed perceived hawkishness (due to rising dots, inflation expectations, or Powell's tone) could strengthen USD briefly. Short USD as Europe’s narrative shift progresses and Fed may soften stance later.

- Fed Constrained on Inflation Mandate: Core PCE tracking higher and inflation expectations complicate Fed’s ability to cushion growth. Balancing growth risks and inflation pressures makes cuts tougher than in 2019.

Equities:

- Market Isn’t Pricing Major Fireworks: Equity vol spiked in February but normalized post-CPI. SPX implied move for FOMC is 1.3%. If no major news, vol relaxation may continue.

- Favor Diversification Across Equities & Bonds: Fed likely to hold rates steady amidst policy uncertainty and tariff impacts. Growth risks remain downside. Diversification across equities/bonds recommended as yields may fall with downgraded growth outlook.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!