Iron Ore Sell-Off Deepens

Iron Under Pressure

The sell off in iron ore prices is accelerating this week with iron ore futures now down around 7% this week, extending the sell off from YTD highs which has seen the market dropping around 25%. The main driver behind the move lower has been an uptick in concerns over the health of the Chinese economy. With key Chinese data, particularly industrial and manufacturing readings, plunging lower in recent months, the demand outlook for iron ore has weakened materially.

Soft Chinese Construction Season

A soft start to the construction season in China has fuelled a weaker outlook for steel demand, in turn weighing on iron ore prices. Indeed, with the Chinese property sector in the spotlight over the last 6 months there is considerable uncertainty in the near-term outlook which should keep iron ore prices pressured lower near-term.

USD in Focus

Away from China related issues, focus is also on the US Dollar. A hotter-than-forecast US inflation reading this week has dampened near-term rate-cut expectations, doing little to help revive iron ore prices. While the reaction in USD has been muted for now, risks of a restrengthening of the US Dollar pose a further risk to iron ore prices here. Looking ahead today, traders will be waiting on a trio of US data inputs which could see iron ore prices falling lower into the end of the week if USD is seen rallying on any data upside.

Technical Views

Iron Ore

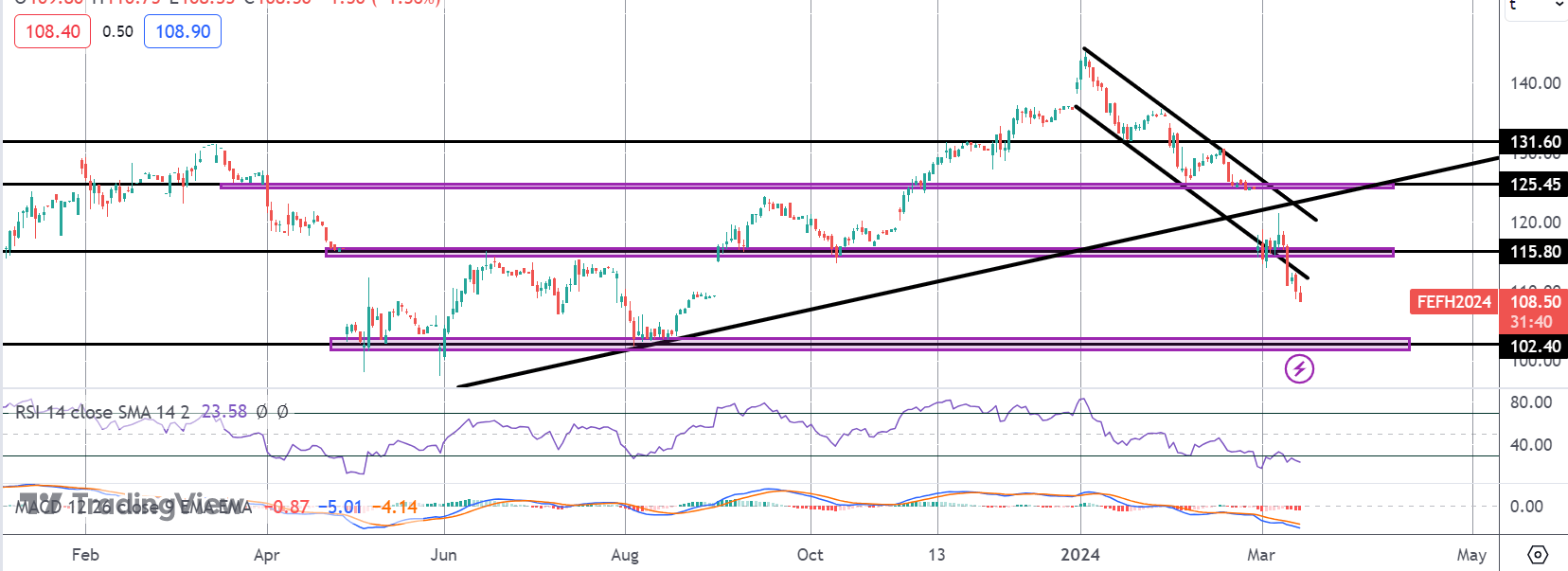

The sell off in iron ore has seen the market breaking below the 115.80 level most recently, with price now trading below the bear channel lows, reflecting intensified selling. While below the 115.80 level and with momentum studies bearish, the focus is on a continuation lower towards the 102.40 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.