BTC Rally Pauses for Now

Following the breakout move we saw in Bitcoin last week, the market has yet to follow through with bullish momentum stalling for now. Indeed, Bitcoin futures posted a large bearish reversal candle on the daily timeframe yesterday, signalling risks of a fresh turn lower following the rally. BTC printed highs this week of mid $106 before sellers stepped in. Price is holding just below those weekly highs for now, keeping the focus on further upside. However, if we slip back below the $100k mark this near-term outlook will turn bearish.

US Trade Optimism

The driver behind the move higher was optimism over the recent shift in tone from the US on its trade agenda. A trade deal between the US and UK last week, boosted risk sentiment ahead of the planned US/China talks which took place over the weekend. BTC rallied again in response to news that the US sand China agreed a 90-day tariff reduction window before the move stalled and reversed. The fading of this bullish reaction suggests the market is waiting on something more permanent before we see a fresh leg higher.

News-Flow Risks

As such, traders will be monitoring incoming news-flow on the US/China front with positive headlines likely to spur fresh buying in BTC while any negative headlines will see crypto assets come under pressure. Looking further out, if the US and China do agree a trade deal on the back of this negotiations window this should pave the way for a breakout move in BTC ands and much higher prices by year end. Similarly, if talks break down, BTC is vulnerable to a heavy reversal.

Technical Views

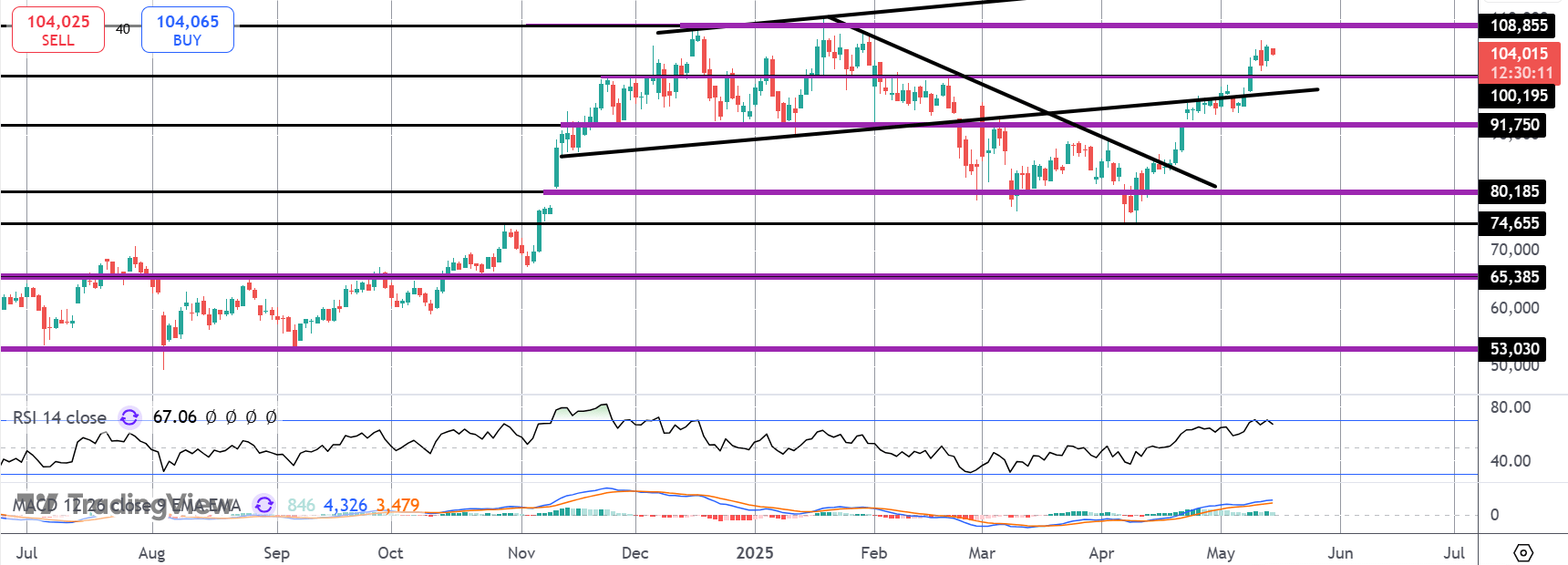

BTC

The rally in BTC has stalled for now ahead of the YTD resistance around $108.85. However, with momentum studies bullish, focus is on a continuation higher while price holds above the $100k mark. Below there, focus turns to $91,750 as deeper support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.