Major Bearish Breakdown in Bitcoin

Bitcoin Breaks Key Support

The close below the $91,750 level yesterday is a worrying milestone for Bitcoin. Having spent the last three and a half months trading above the level, the path to a broader reversal lower has been opened. Fresh trade-tariff fears and the US-China tech standoff have hit sentiment hard with institutional demand evaporating. The latest data shows Bitcoin ETFs suffered their largest daily outflows yesterday of just under $1 billion ($938 million). In total, Bitcoin ETFs have seen around $2.3 billion exit the market this month, reflected by the more than 20% decline we’ve seen in Bitcoin futures from the YTD highs.

Trump Yet to Move on Crypto

Alongside broader investor uncertainty, Bitcoin has also suffered amidst the absence of any crypto positive moves from Trump. Despite going heavy on his pledged support for the crypto community during his campaign, Trump has yet to make any concrete steps towards a proposed strategic US Bitcoin reserve. Many now judge that any such moves are likely to come later in the year given Trump’s current agenda of trade tariffs and negotiating peace between Russia and Ukraine.

Bearish Risks

In light of this, Bitcoin has room to push deeper in coming months before we see a rebound in H2 in response to any crypto moves Trump makes. However, depending on how current agenda items develop, crypto could be pushed further down the priority list, kicking any recovery further down the road for now.

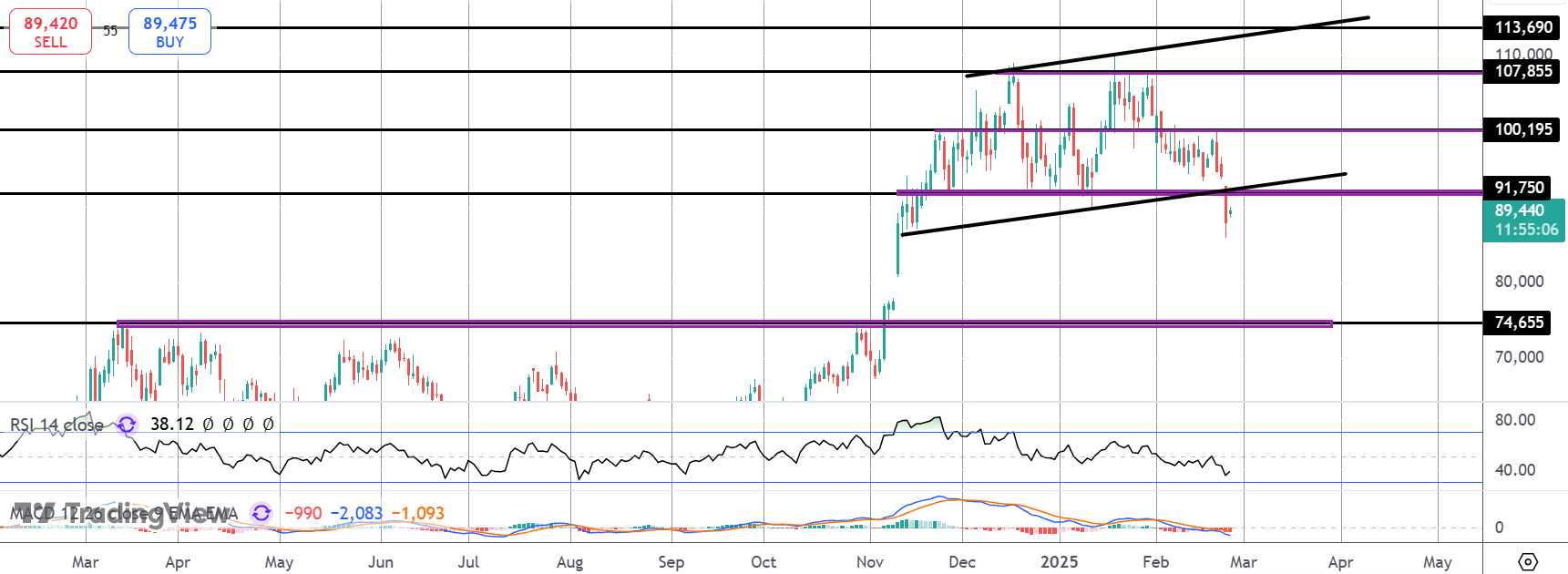

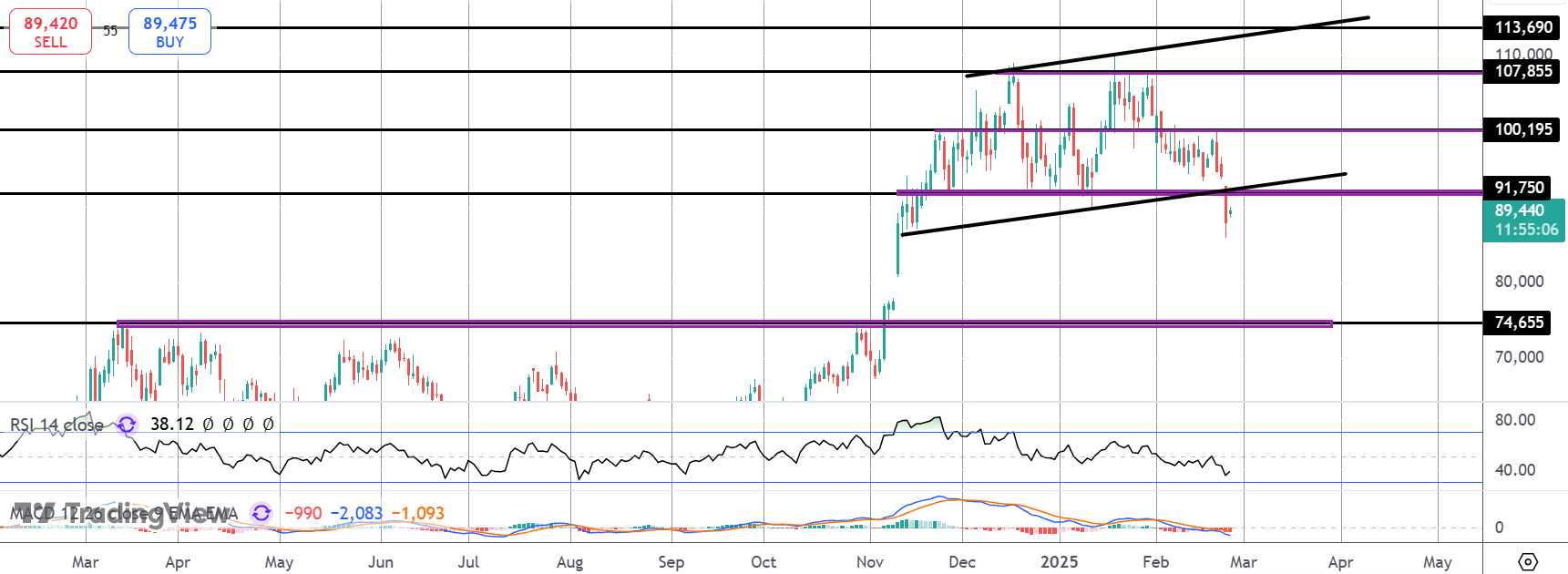

Technical Views

BTC

The break below the bull channel lows and the $91,750 support is a firmly bearish development. While below this area, and with momentum studies bearish, focus is on a further decline towards $74,655 next. If bulls can get back above the channel lows, the $100k mark is still a key hurdle that needs to be crossed to alleviate near-term downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.