Market Spotlight: BP Outlines Strategy Shift Following Record profits

Record Profits

Shares in oil giant BP are trading higher across the European morning today on the back of a stellar set of earnings. The group posted Q4 EPS of $21.95, just a touch under the $22.90 the market was looking for. However, revenues were seen higher than forecasts at $5.75 trillion vs $4.59 trillion expected. On the year as whole, BP posted record profits of $27.65 billion, its highest returns in 14 years. As a result of these gains BP announced a 10& increase in the dividend along with a $2.75 billion share buyback.

Increased Taxation

Record profits from energy companies have drawn plenty of criticism given the cost-of-living crisis in the UK. Last year, the government announced a new windfall profits tax on energy firms making excess profits from the spike in energy prices seen in response to the Russian invasion of Ukraine. BP noted that it will pay around $2.2 billion in UK tax with around a third of that satisfying the government’s new energy tax.

Green Strategy in Question

The spike in profits appears to have impacted the group’s outlook and strategy. Looking ahead, BP noted that it will not be looking to reduce fossil fuel output by 2030 by as much as expected. BP had been among the first energy giants to announce a shift towards greener energy, outlining plans to cut emission by 50% by 2050. However, it now said it will target a 20-30% reduction, citing the need to keep up with global demand for fossil fuels.

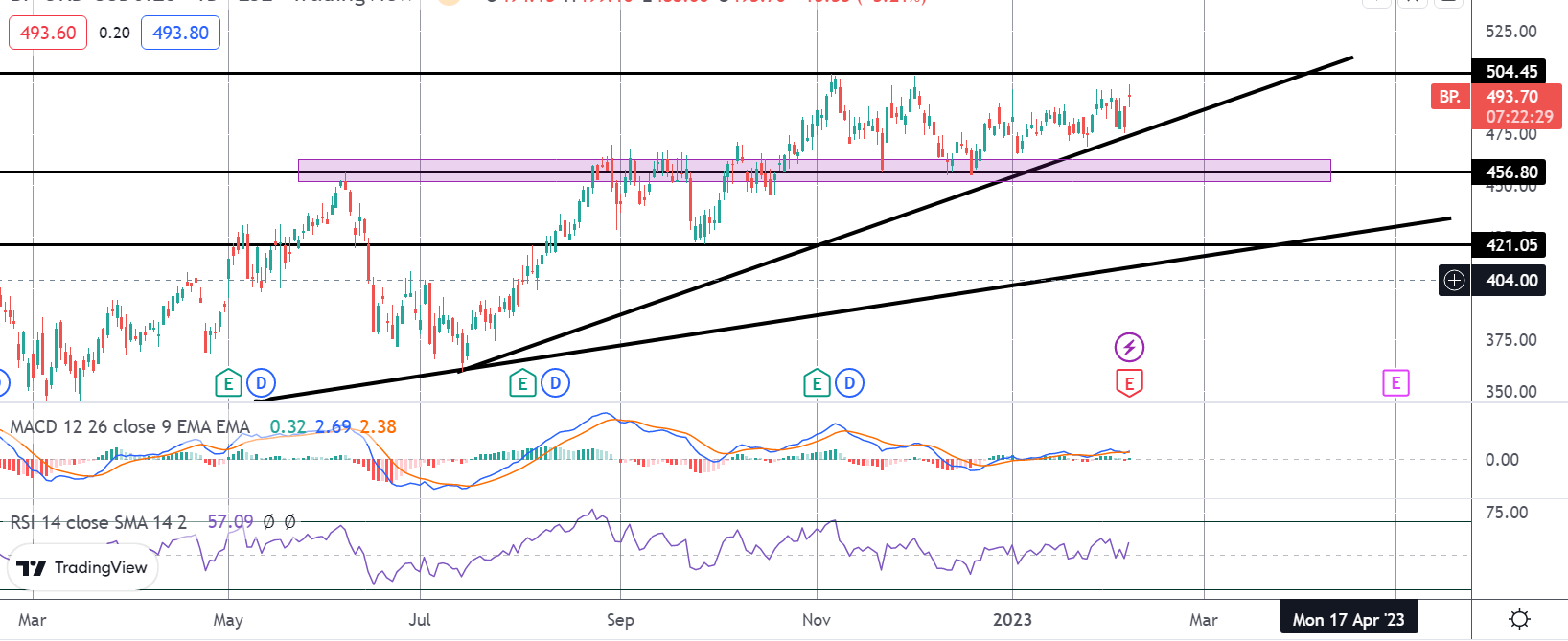

Technical Views

BP

For now, BP shares continue to hold in range between the 456.80 level support and the 504.45 resistance, underpinned by the local rising trend line. In line with the broader bull trend, the focus is on a n eventual break higher while price holds above the support level. However, bearish divergence on momentum studies is worth keeping an eye on. Any downside break of 456.80 opens the way fo r a test of 421.05 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.