UBS Agree Credit Suisse Purchase

The main story dominating markets as we begin the new week is the news of UBS agreeing to purchase Credit Suisse for $3.3 billion in last-minute, all-share deal aimed at avoiding a major banking crisis. Credit Suisse liquidity has become a major threat to the health of the overall banking sector in recent months. The recent market turmoil around the collapse of SVB saw Credit Suisse shares plummeting to fresh lows, stoking fears of an imminent collapse.

However, on Sunday, UBS finally agreed to purchase the bank for $3.3 billion while also being guaranteed a CHF 100 billion liquidity line from the SNB. Additionally, the SNB provided a CHF 9 billion backstop to ensure any losses taken on certain business lines.

Concerns Over Bond Write-Downs

The move, which is intended to prevent the collapse of Credit Suisse and bolster confidence in the global banking sector. However, with Swiss regulators writing down CS’s Tier 1 bonds, leaving holders with sizeable losses, investors across the banking sector have been spooked, leading bank stocks lower on Monday.

Traders are now bracing to see where UBS and Credit Suisse open up today. German banks have been hard hit this morning given their heavy exposure to Swiss banks while banks listed on the FTSE such as Barclays and Natwest have also come under pressure.

Technical Views

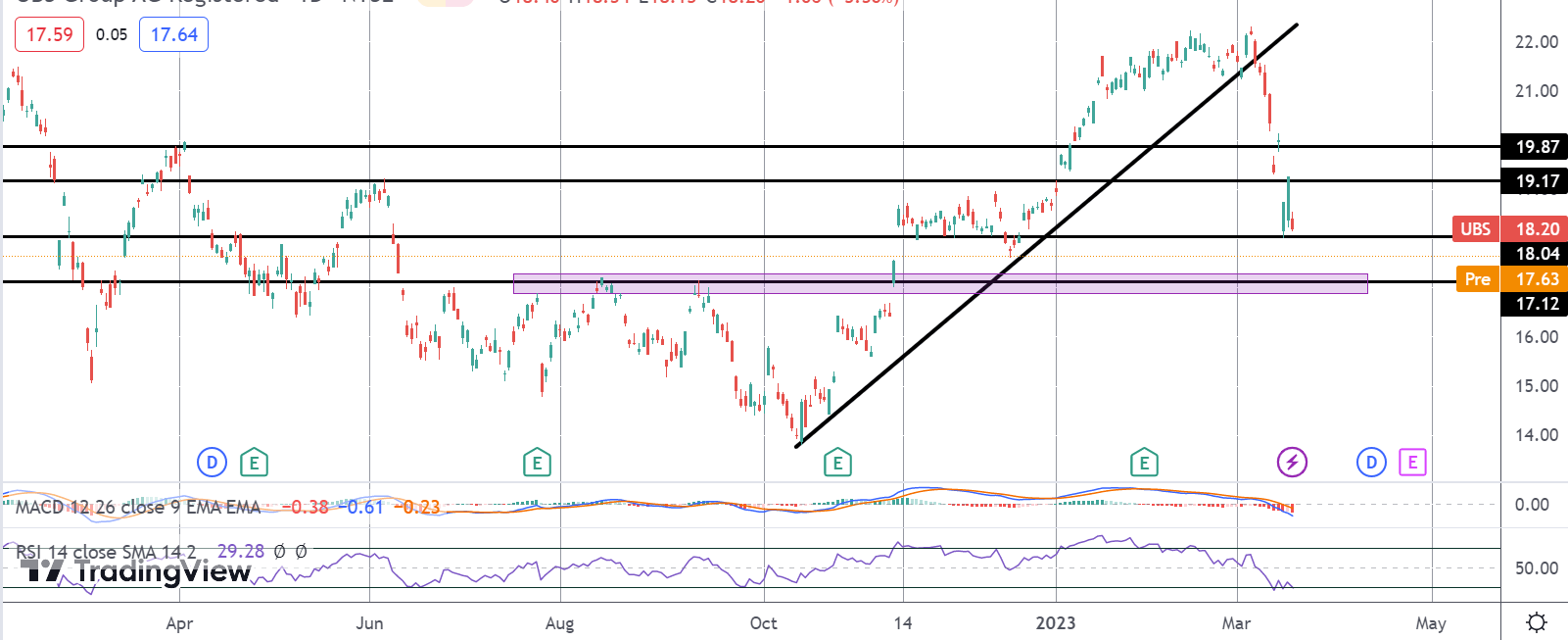

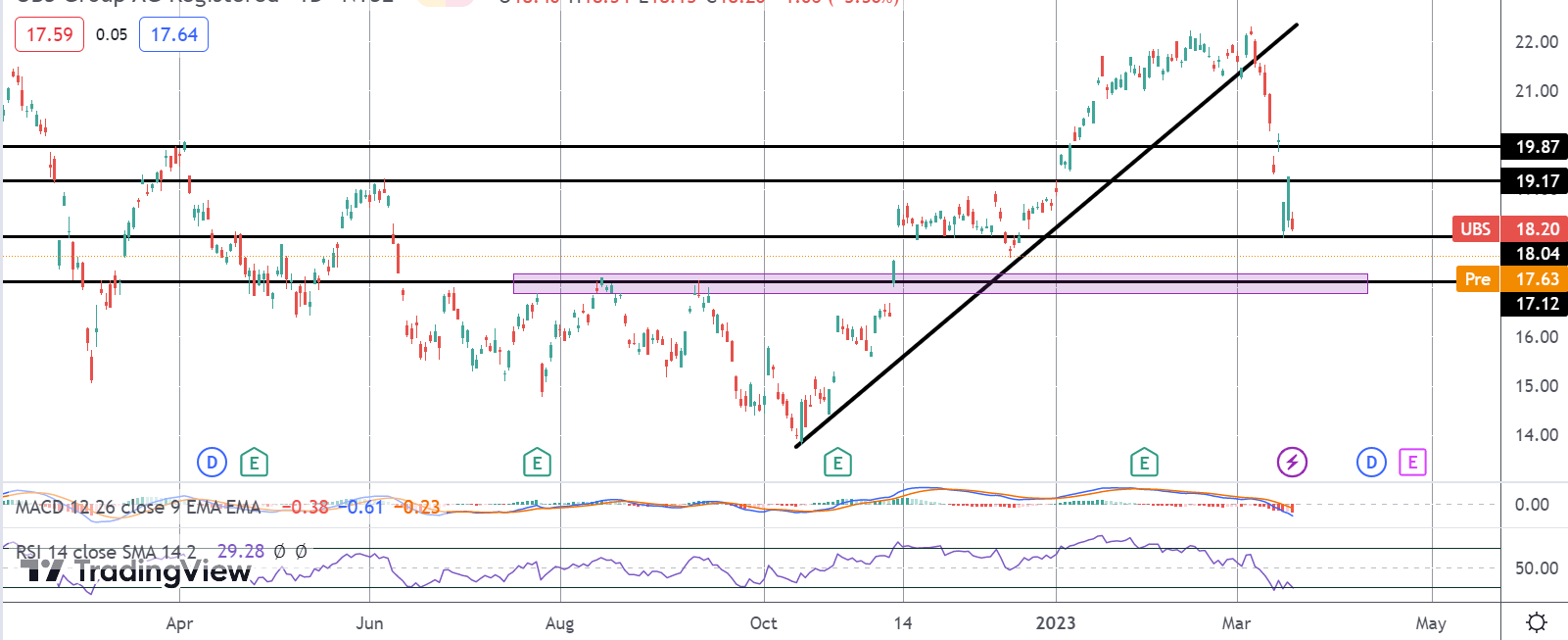

UBS

Following the breakdown below the rising trend line from last year’s lows, UBS shares have accelerated lower. Price is currently sitting on support at the 18.04 level, down around 20% from highs. With momentum studies bearish, the focus is on a break lower here and a test of the bigger 17.12 area support next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.