QE That Only Few Wanted

A short pause in the ECB's QE turned out to be a difficult test for the European economy, which failed the very first stress test of the war and subsequent export contraction. At the meeting on Thursday, Draghi said that “there was no need to vote” on the resumption of QE, since all members of the Council “agreed on the need to act” and “significant majority” voted to resume QE.

In the range of expected scenarios, the ECB decision was definitely softer than neutral (ECB gave the maximum degree of policy guarantees - “as much QE as needed”), however, the classic textbook market response - euro down, bonds up didn’t not last long and the common currency soon reversed declines. Then what information guided the market?

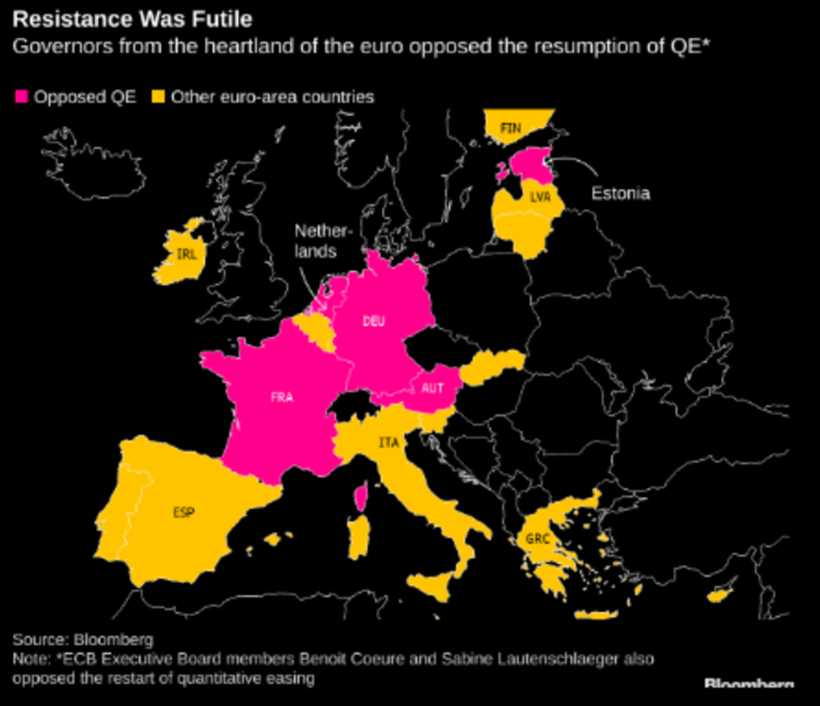

Firstly, the “significant majority” of those who voted for QE could have turned out to be a lie. For the first time in eight years of the presidency of Draghi, the disagreement of key members reached its peak. According to Bloomberg, referring to anonymous sources, in addition to the “public opposition” of QE - the head of the Danish Central Bank (Knot), his German counterpart (Weidmann), Lautenschleger, the head of the Bank of France Villeroy also spoke out against unconventional measures. The countries they represent make up half of the European region measured by GDP and population. They could also be joined by colleagues from Austria and Estonia and the chief economist of the ECB Benoit Coeure. The majority that Draghi claimed could be very narrow, so he probably declined voting, as this would show that only countries in the periphery or with weak fiscal discipline spoke in favour of renewing QE:

Strengthening of the opposition camp communicated to the market through the voting results would create risks of maintaining the course on QE under the Lagarde presidency and the reinforced forward guidance and QE pledge could be much less supportive for inflation expectations. From the reaction of the euro, we can conclude that the market doubts the official position of the ECB.

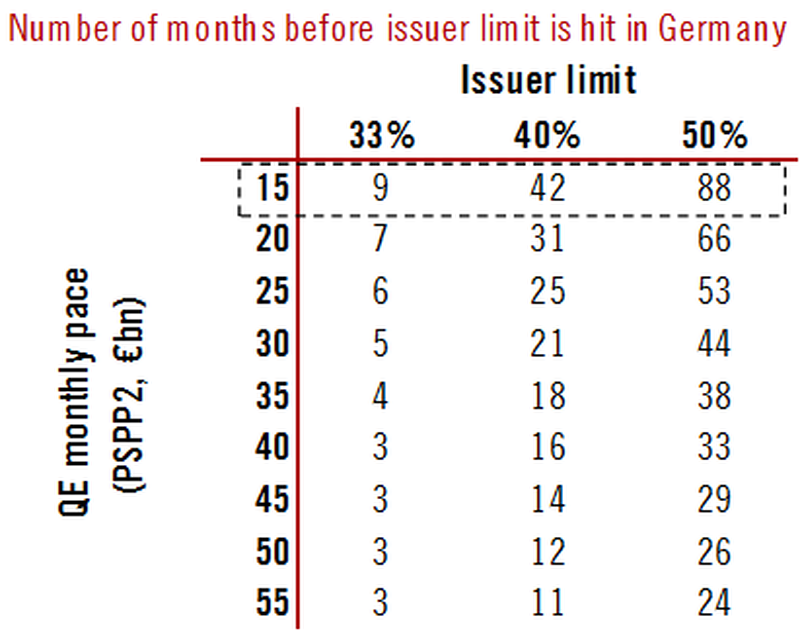

Secondly, we can recall that QE has an objective limit - the share of sovereign debt of EU members cannot exceed 33% of the total assets on the balance sheet of the ECB. It was rumored that the new QE round “as much as needed” would require an increase in this limit, however, it didn’t happen on the meeting. In this case, with the announced APP of 20 billion euros per month (5 billion of which will be spent on corporate debt), QE can last only 9 months before the limit is spent:

It is not really clear what Draghi meant by saying that QE will continue until inflation reaches 2%. Either there is an expectation that this will happen within 9 months, or the EU government will authorise an increase in the limit, or the composition of monthly purchases will change - bonds of some individual countries will occupy a large share. The most likely option is the second, but will the opposition allow this?

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.