SP500 LDN TRADING UPDATE 23/1/26

SP500 LDN TRADING UPDATE 23/1/26

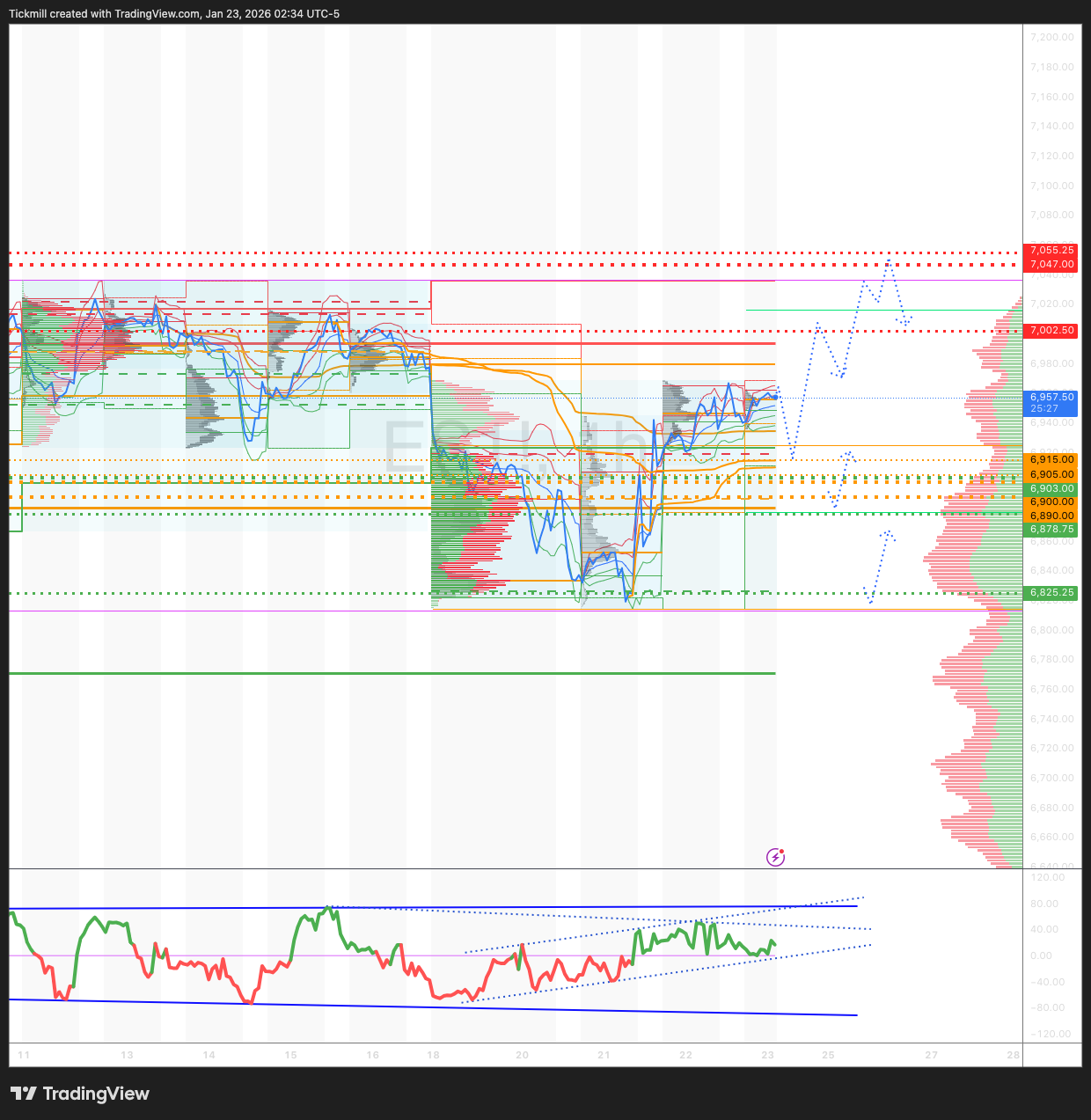

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6900/6890

WEEKLY RANGE RES 7047 SUP 6903

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

The area around the SPX aggregate gamma flip is at 6940. While the upside gamma is pronounced, it has somewhat smoothed since last week's vertical surface. The index has more leeway to rise. Based on the most recent analysis (Friday AH), the steep surface develops around 7030.

WEEKLY VWAP BULLISH 6969

MONTHLY VWAP BULLISH 6850

WEEKLY STRUCTURE – ONE TIME FRAMING DOWN - TBC

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

DAILY VWAP BEARISH 6901

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6925

DAILY BULL BEAR ZONE 6615/05

DAILY RANGE RES 7002 SUP 6890

2 SIGMA RES 7055 SUP 6825

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.47

TRADES & TARGETS

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY BEAR ZONE TARGET DAILY RANGE GAP FILL 6977> DAILY RANGE RES

SHORT ON REJECT/RECLAIM DAILY RANGE RES TARGET 6970

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “TAME”

S&P +55bps closing @ 6,913 w/ a MOC of $1.1bn to BUY. NDX +76bps @ 25,518. R2K

+75bps @ 2,718 and Dow +63bps @ 49,384. 18.2b shares traded across all US equity

exchanges vs ytd daily avg of 18.36b shares. VIX -728bps @ 15.66, WTI Crude -

193bps @ $59.44, US 10YR unch @ 4.25%, gold +175bps @ 4,917, dxy -45bps @

98.32 and Bitcoin -98bps @ $89,290.

The mkt has quickly turned away from the risk-off tone it adopted earlier in the

week, leaning into growthier, pro-risk stocks. Russell just outperformed the S&P 500

for the 14th consecutive session, we have data back to 1981 and this is the 2nd

longest streak of outperformance in our records, trails only one time in 1996 (that

time was 16 consecutive days). Flows/index stabilized in the absence of news.

Software finally caught a bounce (IGV +160bps), we saw a notable uptick of BUY

tickets on our desk (mix of LO and HF covering) in the group and hearing a growing

view that these names have extended too far to the downside. Reminder, positioning

here at record lows.

Our floor was a 5 on a 1-10 scale in terms of overall activity levels. Our floor finished -

1% for sale vs a 30-day avg of -142bps. LO flows finished balanced (demand in

industrials and financials) while HFs skewed -$1b net sellers with broad supply across

every sector though heavily concentrated in macro, tech, and Hcare.

DERIVS: Further normalization in spot and vol markets today as the S&P roughly

closed at the implied move this morning. In vol, the front end of the curve came in

notably and skew flattened across the curve. We see this as a continuation of the

market relaxing after Tuesday's selloff. Dealer gamma is being resupplied and we

estimate dealers at long gamma at spot and will get longer to the upside. Flows wise,

we saw buyers of short-dated optionality. On the micro front, we saw a massive

amount of tech downside go through the market ahead of tech earnings. We

anticipate short gamma problems in those names off the back of this flow.

Tomorrow's straddle went out at ~50bps. (TY Gail Hafif)

POST BELL:

INTC -5% ... Q1 Revenue & Margin guidance below street at midpoint. Tough setup

given squeeze into print, likely not good enough.

COF -4.5% ... PPNR miss from higher expenses looking hot (opex and marketing) ..

One of the fears here has been 'are they going to go on a spending spree' - will look

for more on this on the call. Announced deal with Brex half stock half cash.

ISRG +2% ... Stock up post mkt with their 4Q print, with the incremental likely the

gross margin guide of 67% to 68% (bracketing cons) – probably some angst around

this line heading into this formal print. Company had already preannounced

procedures/revs and procedure guidance for ’26 already. Call at 4:30pm.

CSX +5% ... Q4 EBIT small miss $1.11bn vs. $1.2bn as expected on lower revenue

$3.51bn vs. $3.54bn. Better margins with a new operationally focused CEO at the

help likely earns credibility tonight / tomorrow

AA +4% ... 4Q Revenue of $3.45 bn vs Street at $3.29 bn. 4Q EBITDA of $546 mn vs

Street at $528 mn. Expects 2026 total alumina production of 9.7-9.9 mn metric tons

(Street at 9.98 mn) and shipments of 11.8-12.0 mn metric tons. Sees aluminum

production of 2.4-2.6 mn metric tons vs Street at 2.41 mn. 1Q guidance: $30 mn

unfavorable impact to alumina adj EBITDA and $70 mn negative impact to adjusted

EBITDA at aluminum segment. 6% implied move. Call at 5 PM ET..

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!