The FTSE Finish Line: April 03 - 2025

The FTSE Finish Line: April 03 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

London shares dropped on Thursday as global investors shunned risky assets following U.S. President Donald Trump's announcement of aggressive reciprocal tariffs, heightening fears of a global economic slowdown. The blue-chip FTSE 100 index fell by 1%. Trump's tariff strategy, which includes a 10% baseline tax alongside increased duties targeting various trading partners, signals a departure from the decades-long trend of trade liberalisation. The initial 10% tariffs are set to take effect on April 5, with higher reciprocal rates commencing on April 9. Additionally, 25% tariffs on vehicle imports were implemented at midnight. Britain received relatively mild treatment in Trump’s tariff measures, facing the lowest import duty rate of 10%. London interpreted the ruling as recognition of its efforts to forge a new economic partnership with the United States, avoiding harsher retaliatory measures. Business Minister Jonathan Reynolds, however, warned that these tariffs pose "a threat" to the UK due to their potential impact on global trade, specifically highlighting risks to the nation's automotive manufacturing industry. In response, investors raised their expectations for interest rate cuts from the Bank of England, leading to a sharp drop in government bond yields. On Thursday, interest rate futures signalled approximately 62 basis points of reductions in the BoE's benchmark rate by December, up from around 54 basis points the previous day, reflecting market anticipation of two quarter-point cuts. Meanwhile, shares of UK utilities, often seen as a bond-like alternative due to their stable returns in uncertain economic conditions, surged by 3%, reaching a five-month high.

Single Stock Stories & Broker Updates:

GSK shares rose 2.1%, while AstraZeneca increased 1.8%, both among the top gainers on London's FTSE 100, which is down 1.2%. Trump excluded pharma from reciprocal tariffs, and the UK hopes for a quick reversal with a new AI and tech partnership. UK finance minister Rachel Reeves stated specific tariffs on UK exports matter less than the broader global demand. GSK is up ~6.3% and AZN ~7% this year.

Diageo Plc shares rose 3% as concerns over U.S. tariffs on spirits eased; the stock is the top gainer in the FTSE 100. Jefferies notes the heavy 200% tariff on EU imports seems avoided, though shares are still down ~19.3% YTD.

British REIT Primary Health Properties (PHP) rises 1.59% as it offers a sweetened £1.5 billion cash and stock takeover bid to rival Assura, with a new bid at 46.2 pence after Assura rejected its earlier 43 pence proposal in favor of a 49.4 pence bid from KKR-Stonepeak. PHP states AGRP would hold ~48% of the combined entity's share capital. AGRP has gained over 24% since February 13, while KKR-Stonepeak's first bid was on February 14. Analyst Oli Creasey notes the PHP bid is less competitive than KKR but may attract shareholders for a slightly lower price. PHP is up 1.67% this year, as of the last close.

Shares of Currys PLC rose 10.2%, becoming the top gainer on the FTSE mid-cap index. The retailer expects adjusted profit before tax for 2024/25 to be £160 million, up from previous guidance of £145-155 million, and anticipates a strong net cash position, with robust trading since early January. Other retailers like Tesco and Sainsbury's are up 1.1-1.4%. The stock has fallen ~6.31% this year.

Shares of Alphawave IP Group fell 1.7%. Jefferies upgraded the stock to "Buy" from "Hold" due to a potential Qualcomm bid, raising the price target to 160p from 108p, indicating a 17% upside. Qualcomm is considering an acquisition to enter the data center market. The average stock rating is "Buy" with a median price target of 162.5p. The stock has risen ~63% this year.

Shares of British money transfer firm Wise rose 6.2%, on track for its largest one-day pct gain since November 2024. The company expects 15-20% underlying income growth and a pretax profit margin at the upper end of its FY26 target range, with a medium-term margin of 13-16% and a strong income CAGR of 15-20%. WISE has fallen about 8% this year.

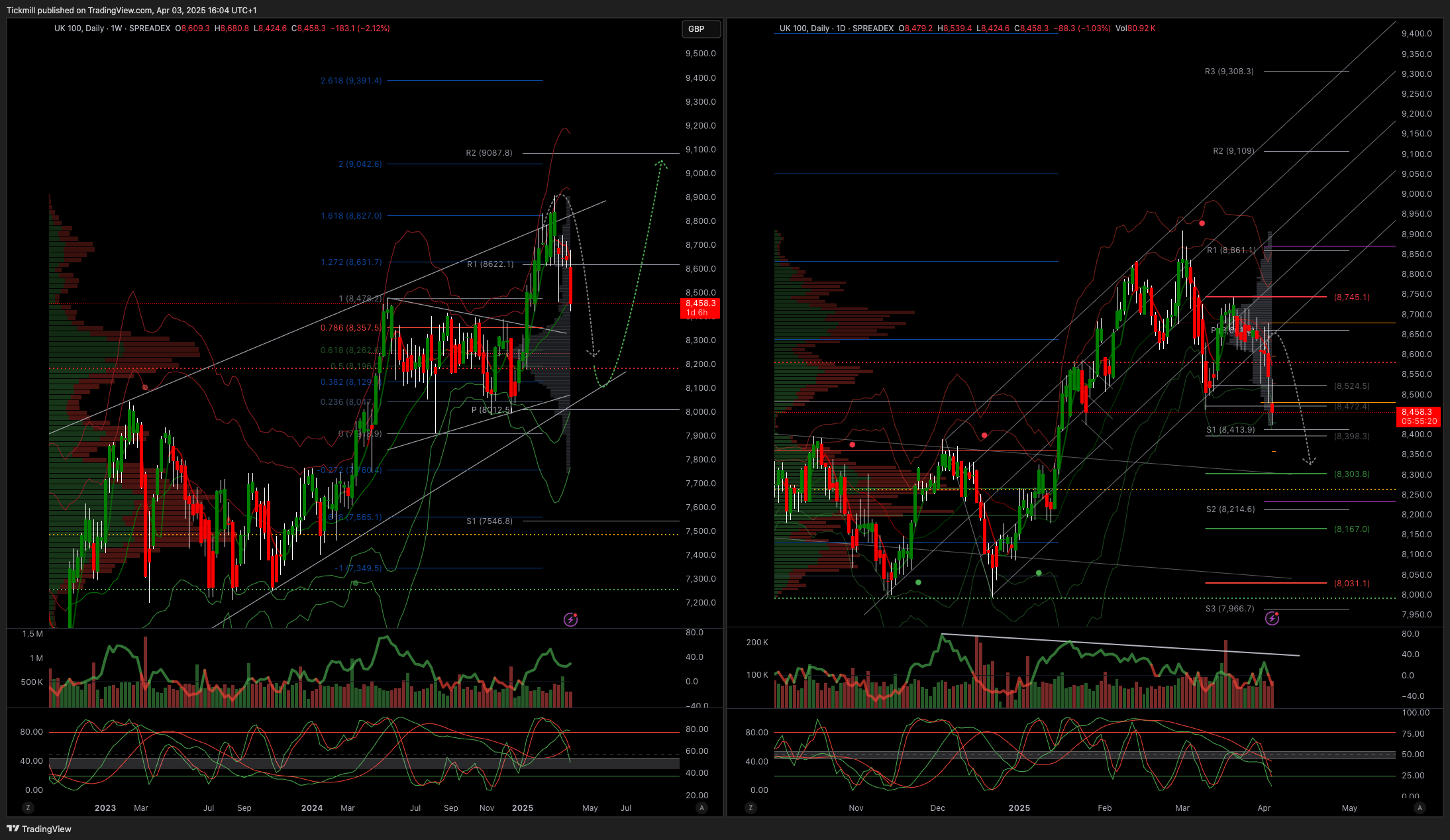

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8950

Primary support 8700

Below 8700 opens 8600

Primary objective 9050

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!