The FTSE Finish Line: April 07 - 2025

The FTSE Finish Line: April 07 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

Monday's FTSE 100 fell to its lowest level in almost 14 months as recession concerns grew following U.S. President Trump's strong posture on enacting his all-encompassing tariff proposals, therefore upsetting world markets. The blue-chip FTSE 100 index fell 3.8% as of 1012 GMT, lowest level since February 2024. Sliding 4.1%, the domestically-oriented midcap index reached its lowest position since November 2023. Trump told reporters over the weekend that investors would have to take their medicine and he would not engage with China until the U.S. trade deficit was corrected. Beijing said that the markets have spoken in response to their reticent policies. Investors raised bets on the Bank of England lowering interest rates as economic uncertainty grew, therefore drastically lowering Monday's short-dated gilt yields. Compared with around 72 basis points on Friday, interest rate futures now predict about 88 basis points of declines to the BoE's benchmark rate by December—pricing in more than three quarter-point cuts. Though Federal Reserve Chair Jerome Powell said on Friday that the U.S. central bank authorities "don't need to be in a hurry" until economic direction becomes clearer, across the pond the U.S. futures markets reacted fast to price in over five quarter-point interest rate cuts this year. With UK energy businesses were badly affected, plunging 7.8% as oil prices dropped almost 4% amid recession concerns and OPEC+'s projected supply increase, all main industries traded in the red. After cutting its first-quarter LNG production estimate in response to bad Australian weather, Shell came out as one of the worst performers on the FTSE 100 losing 8.4%. After declaring a 26% drop in first-quarter pellet output following Ukraine's suspension of VAT refunds, which resulted in operational cutbacks, Ukraine-oriented miner Ferrexpo declined 4.8%. Data from mortgage lender Halifax shows that British house prices surprisingly dropped in March, the most recent indication of a market slowing down following a surge to acquire houses ahead of a tax benefit expiration.

Single Stock Stories & Broker Updates:

Shares of Shell, the world's largest liquefied natural gas trader, fell 8.7% to 2,273p as all FTSE 100 stocks declined. The company lowered Q1 LNG output to 6.4-6.8 million metric tons due to cyclones and maintenance, down from 6.6-7.2 million tons. Shell also cut Q1 upstream production forecast to 1.79-1.89 million boed from 1.75-1.95 million boed, and expects a $100 million exploration write-off for the quarter. Year-to-date, SHEL is up 0.2%.

Shares of London-listed miner Ferrexpo fell 8.8% to 43.6p amid a global market decline following U.S. tariff announcements. The company, part of the FTSE 100 index which is down 4.6%, reported a 26% drop in Q1 iron ore pellet production due to VAT refund suspensions affecting liquidity and operations. Panmure Liberum noted Q1 was strong in production since the Ukraine invasion, but sustainability is uncertain due to the VAT issue. FXPO indicated that increased production did not lead to better earnings because of high input costs and declining iron ore pellet premiums. Overall, the stock is down about 58.7% YTD.

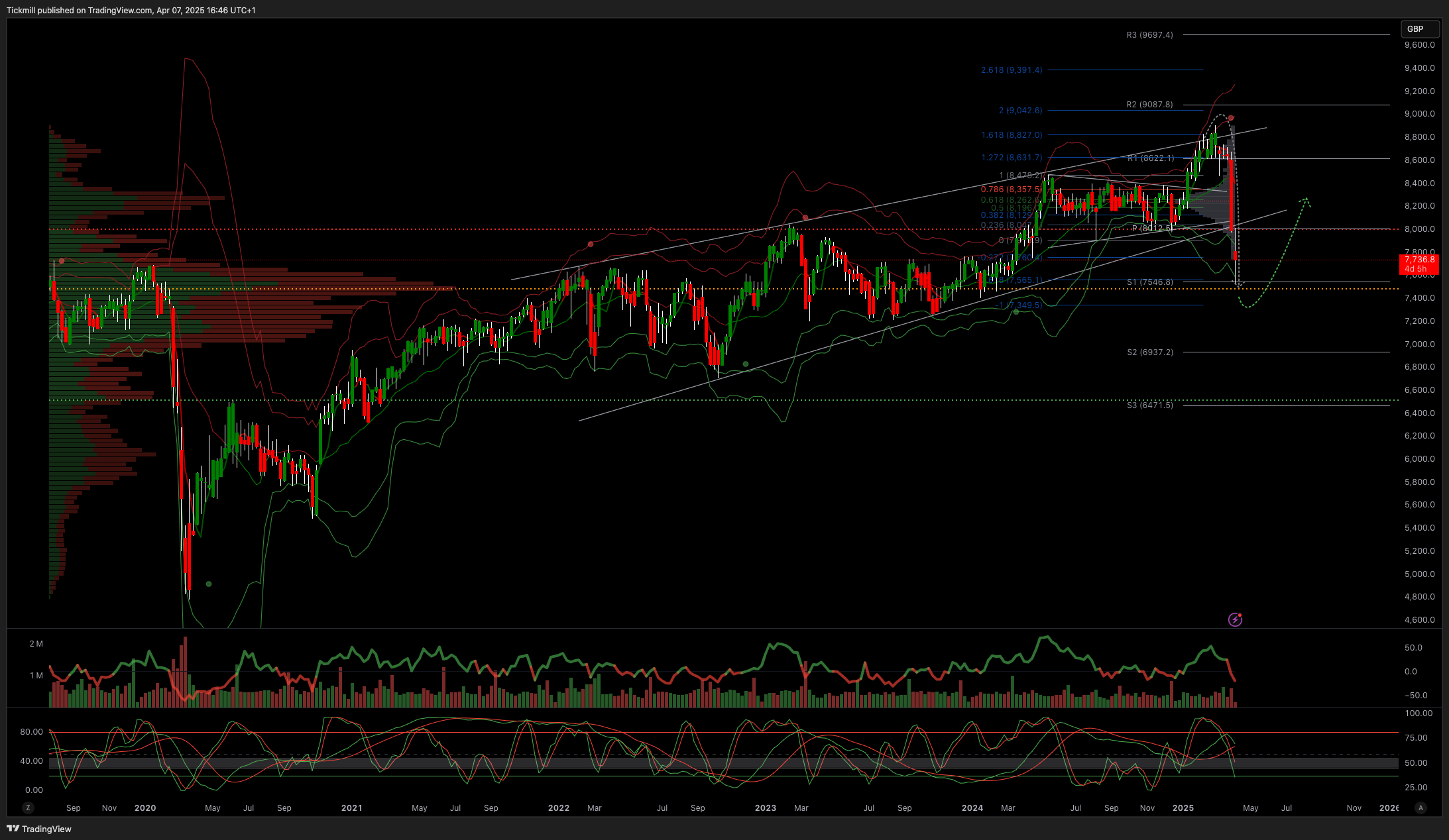

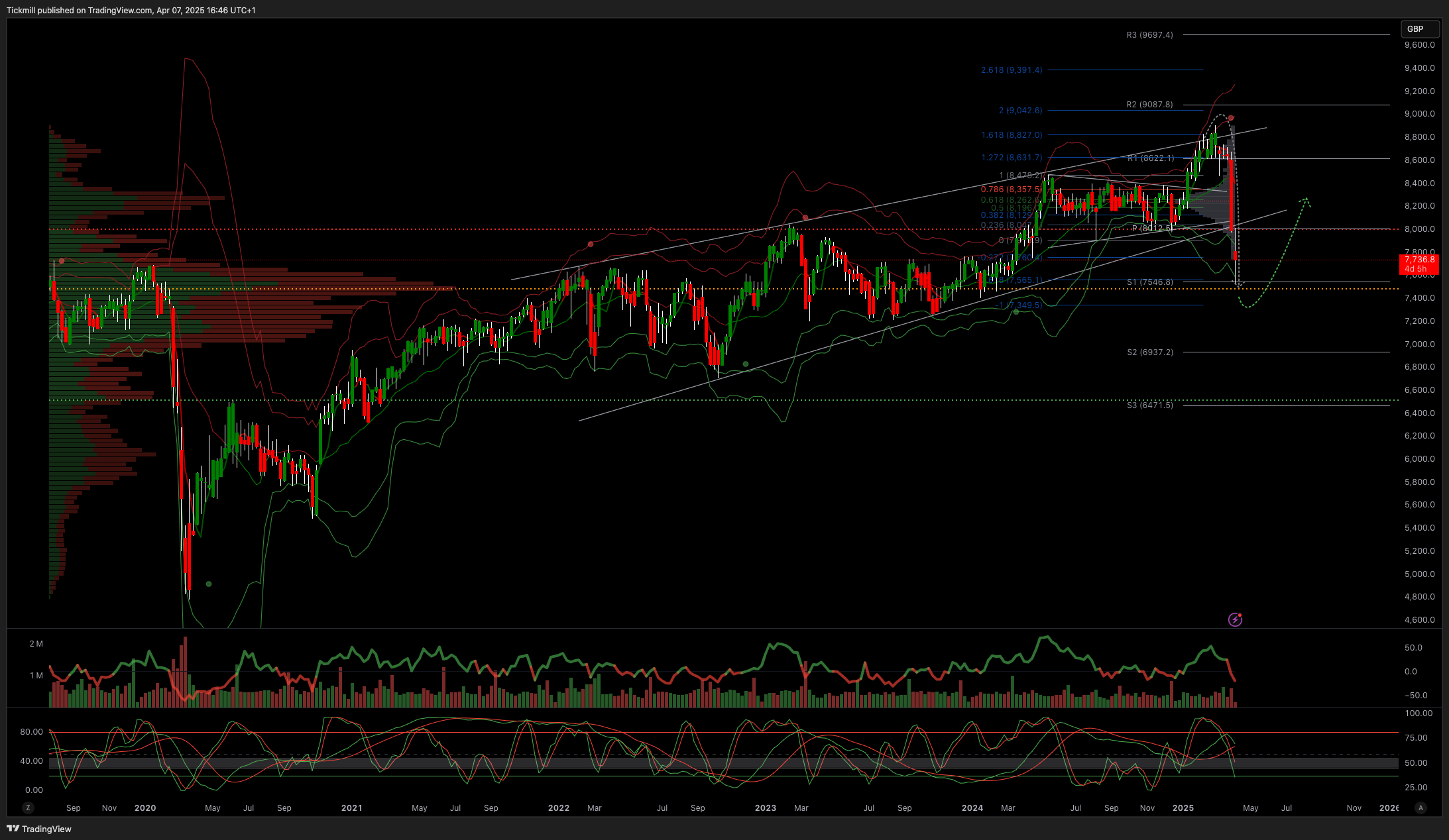

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8950

Primary support 7480

Below 7400 opens 7000

Primary objective 7487

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!