The FTSE Finish Line: April 22 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

The FTSE 100 in Britain rose on Tuesday, outperforming its global counterparts, following remarks from a Bank of England policymaker that improved investor confidence regarding U.S. tariffs. The FTSE 100 index was up by 1.9%%, while the midcap index remained mostly flat. BoE policymaker Megan Greene suggested that lower inflation is more likely in Britain due to U.S. President Trump's tariffs, as the UK’s choice not to impose reciprocal tariffs could position it as a hub for cheaper imports from Asia and Europe. This commentary is particularly timely, as global policymakers are balancing concerns about inflation with prospects for economic growth. The next monetary policy meeting for the BoE is scheduled for May 8, with the market anticipating a 100% likelihood of a rate cut. In contrast, some European stock markets fell on Tuesday after Trump's criticism of the Federal Reserve chair led to a selloff in U.S. assets, causing the pan-European STOXX 600 index to decline by 0.3%. Domestically, consumer staples gained 1.2%, with J Sainsbury leading the way, rising 2.8% after J.P. Morgan increased its target price for the stock. Tesco, the largest supermarket chain in Britain, saw a 2.3% rise. Additionally, an index tracking the UK's precious metal miners increased by 2.4%, reaching a three-year peak as gold prices briefly exceeded $3,500 per ounce, setting an all-time high. The homebuilders index rose for the fifth consecutive session, posting a 1.6% increase. Conversely, DCC posted the lowest performance on the blue-chip index after announcing the sale of its healthcare division to private equity firm Investindustrial Advisors, resulting in a 3.6% drop in its shares. Investors will be paying close attention to a speech by BoE Deputy Governor Sarah Breeden later in the day for further clarity on monetary policy. Last week, British Prime Minister Keir Starmer held discussions with U.S. President Donald Trump regarding trade and other topics, with Britain aiming to negotiate a deal following Trump's implementation of a 10% tariff on most British imports to the U.S., along with a higher 25% tariff on cars, steel, and aluminium.

Single Stock Stories & Broker Updates:

DCC shares fell 2.8%, making it the top loser on the FTSE 100, which is up 0.4%. The company plans to sell its healthcare division for £1.05 billion, below the expected £1.3 billion, equating to 21% of its market cap, according to Jefferies analysts. DCC Healthcare contributed about 13% of annual adjusted operating profit in 2024, expecting to generate net proceeds of about £945 million. DCC has declined 3% this year, while the FTSE 100 has risen 1.25%.

Shares of London-listed gold miners surged as gold prices hit a record high of $3,500 per ounce, driven by increased demand following President Trump's criticism of the Federal Reserve Chair. Notable gains include Fresnillo up 2.3%, Hochschild Mining up 4.5%, Caledonia Mining up 3.8%, Greatland Gold up 7.7%, and Resolute Mining up 9.2%. GoldStone Resources rose 6.5%.

Shares of the British consulting company Ricardo have decreased by as much as 2.2%, currently trading at 222 pence. The company anticipates that its trading will align with analysts' expectations for FY24/25, which reflects the effect of heightened market uncertainty on short-term orders. Analysts project that RCDO will report an operating profit of 21.4 million pounds ($28.66 million) and annual revenue of 373.7 million pounds, based on data gathered by LSEG. The company aims to achieve at least an additional 10 million pounds in cost savings for FY25/26. As of the last trading session, the stock has dropped approximately 46% year-to-date.

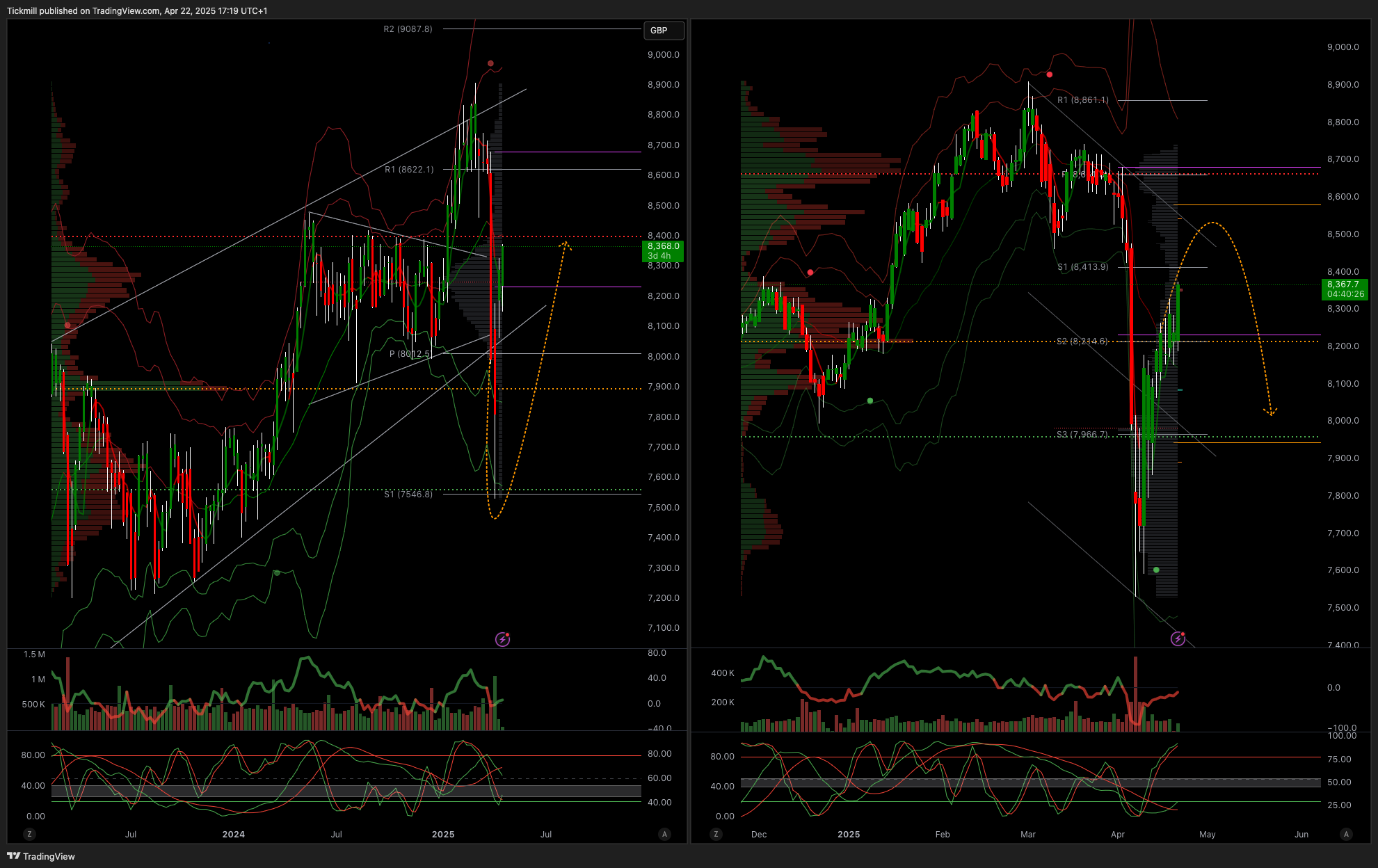

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 7600

Primary support 7500

Below 7400 opens 6850

Primary objective 8500

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!