The FTSE Finish Line - August 3 - 2023

FTSE BoE & BT Sour Sentiment

The FTSE 100 index faced further downward pressure due to the decline of two prominent companies on Thursday. Telecom firm BT Group and consumer staples major Unilever both fell, with their shares trading ex-dividend. BT Group's stock dropped by 5.5%, while Unilever's shares experienced a 1.8% decrease.Among the various FTSE 350 indexes, the pharmaceuticals and biotech sector saw the most significant decline, falling close to 2% and leading the overall market declines.

Budget carrier Wizz Air also faced a considerable setback, losing 5.8% after warning of a slower capacity growth rate.Aero-engineer Rolls-Royce Holdings experienced a 1.7% fall after the company's CEO mentioned that the early stages of its transformation program were delivering strong improvements. However, he also stated that the rate of improvement might not be sustained at the same level. Amidst the broader decline, communications infrastructure firm Helios Towers was a standout performer, surging 6.9%. This boost in Helios Towers' stock came after the company tightened its full-year 2023 guidance to the upper end of its forecast range, signalling positive market sentiment towards the company's prospects.

On the fundamental front The Bank of England (BoE) has implemented a 25bps rate hike, with a warning that borrowing costs are expected to remain elevated for the foreseeable future. Surprisingly, the response from equity markets was largely optimistic, particularly benefiting homebuilders and the real estate sector. Initially, there was a sense of relief among traders who had anticipated a more substantial 50bps rate increase. This relief likely contributed to the initial positive market reaction. However, as the trading session progressed, some indices moderated and pared back some of the initial gains. Overall, the rate hike's impact on equity markets appears to have been complex, with multiple factors influencing the market's behaviour. The real estate and homebuilding sectors, in particular, seemed to benefit from the rate hike, potentially due to the signal of a robust economy and increased demand for properties. Nonetheless, cautiousness and vigilance prevail as investors closely monitor the central bank's guidance on future rate movements and its impact on the broader market.

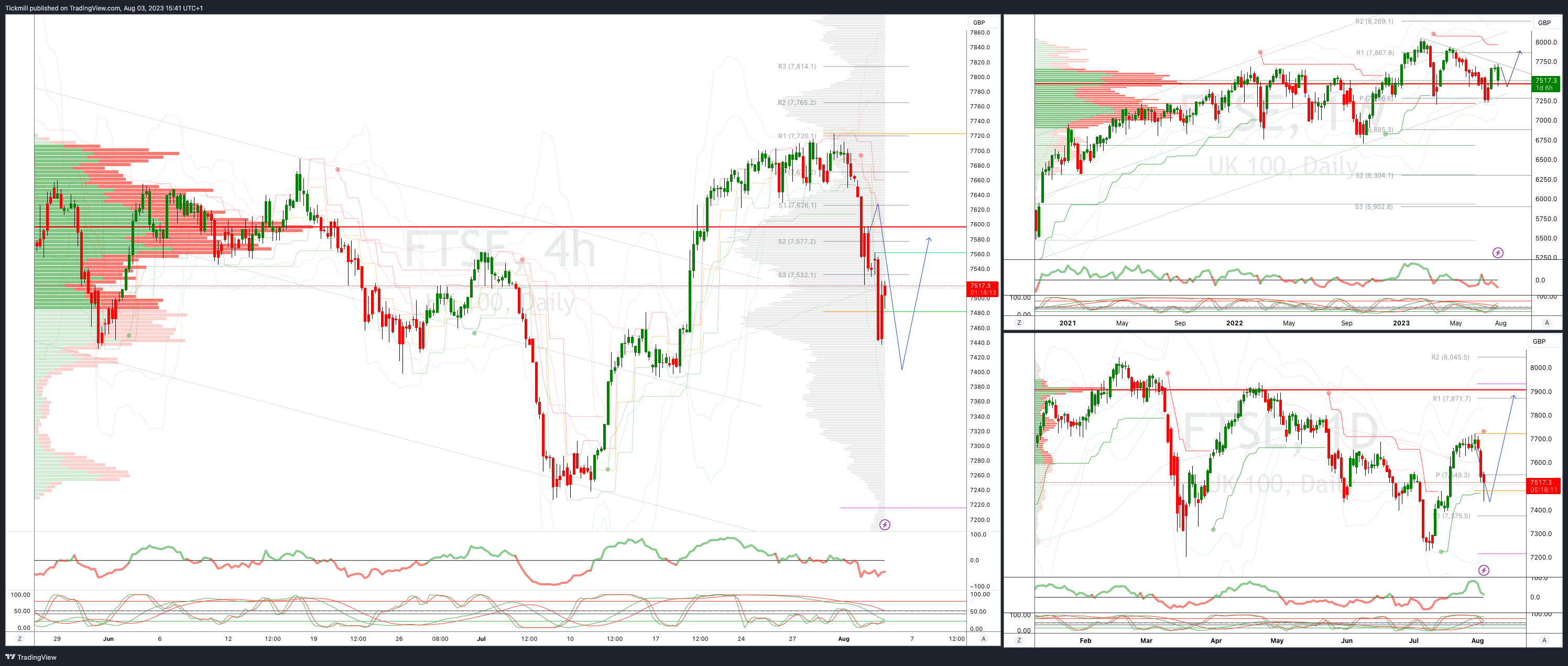

FTSE Intraday Bullish Above Bearish below 7650

Below 7550 opens 7400

Primary support is 7400

Primary objective 7750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!