The FTSE Finish Line - August 9 - 2023

FTSE Glencore Reversal Leads Bluechips Higher

On Wednesday, the UK blue chip FTSE100 experienced an upward surge of 0.59% primarily driven by a recovery in the mining sector. The day saw a flurry of positive earnings reports, notably from Coca-Cola HBC, BP, and Glencore, contributing to the gains in the blue chip index. Notably, beverage stocks exhibited a rise of 0.8%, with Coca-Cola HBC's shares increasing by 1.3% following the company's revision of its annual revenue target in an upward direction.

Miners also enjoyed a climb of 0.8%, despite a series of less optimistic economic indicators emerging from China. This ascent was supported by a rise in metal prices, even against a backdrop of a weaker dollar. Among the mining entities, Glencore, a significant player in the industry, claimed the top position on the leaderboard with a robust day-on-day return of 2.94%.

The banking sector mirrored this positive trend, witnessing a rise of 0.8% in their stock values. This rebound comes after a previous decline of 1.5% in the preceding session. The improved global sentiment was attributed to Italy's government adopting a more accommodating stance toward a new banking levy. Barclays, in particular, achieved a 1.65% gain during the trading session.

However, not all sectors fared equally well. British water companies, including Severn Trent and United Utilities, faced declines of 2.3% and 3.3% respectively. These drops were precipitated by news that six British water companies are confronting lawsuits valued at over £800 million ($1 billion), as revealed by a law firm.However, leading the negative side of the ledger and sitting at the bottom of the table is Hiscox whose shares experienced a notable decline of nearly 7% during morning trading in response to the company's recent earnings announcement. The report revealed a pre-tax profit of $264.8 million for the first half of the year.

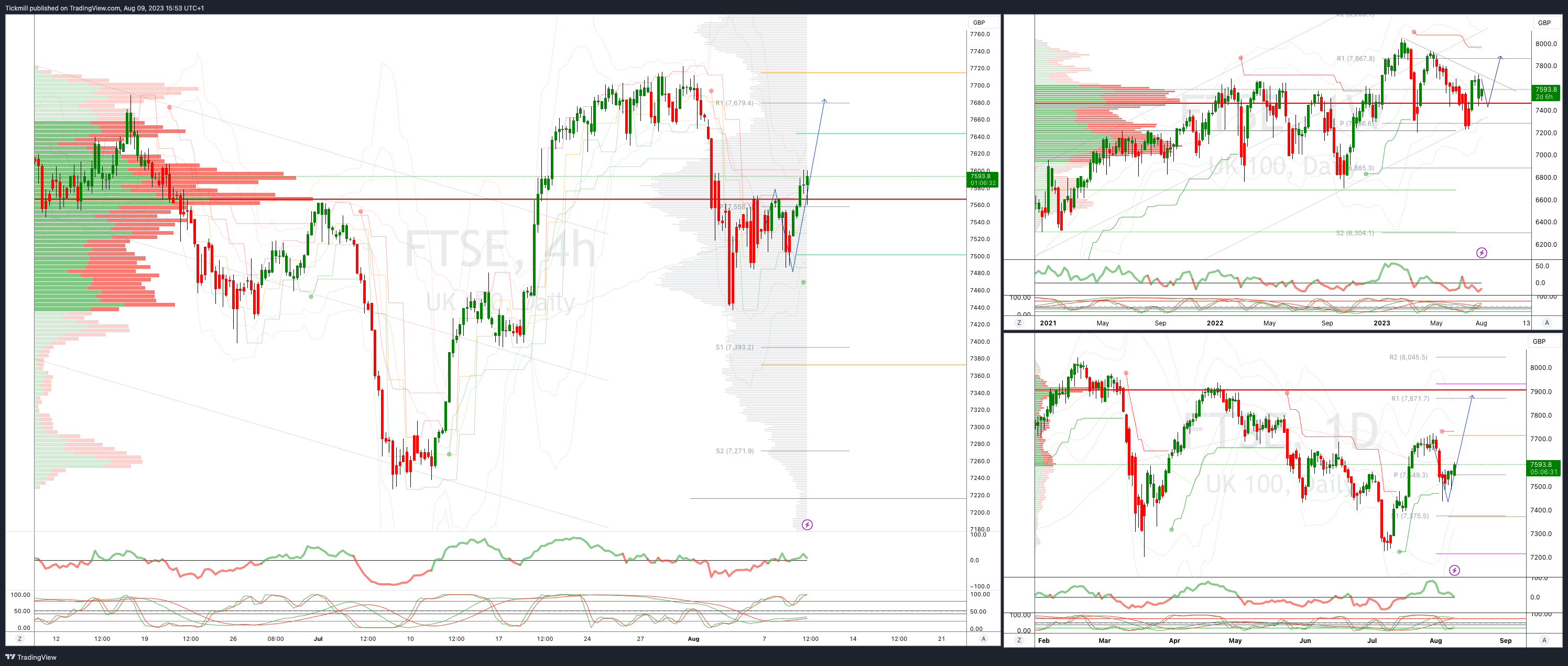

FTSE Intraday Bullish Above Bearish below 7650

Below 7550 opens 7400

Primary support is 7400

Primary objective 7750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!