Will Fed/BOJ Divergence Drive Fresh USDJPY Selling?

JPY Back On Watch

The Japanese Yen has fallen out of the spotlight in recent weeks following the seismic shift we saw in JPY FX rates across the start of August. JPY strengthened sharply on the back of the BOJ slashing bond purchases and hiking rates at the July meeting. Those double measures from the BOJ, on the back of a dovish FOMC meeting in response to weaker US inflation, saw USDJPY cascading more than 11% lower over the month.

USDJPY Selling Eases for Now

Since the lows plumbed on August 5th, however, USDJPY selling has since dried up with the pair recovering almost 40% of the decline. Another key aspect of the sell-off was the ballooning fears over the US economy seen in response to a dramatically weaker US payrolls report for June, further driving support into JPY as the global carry-trade was unwound. However, with those fears since abating, JPY has come back under selling pressure.

Ueda Sticks to Tightening View

Speaking today, BOJ governor Ueda reaffirmed the bank’s commitment to tightening rates further if needed. Speaking in Japanese parliament, Ueda told lawmakers that the bank stands ready to act as necessary if the economy and price pressures continue to develop within the bank’s forecasts.

Powell in Focus

Against this backdrop, traders will now be watching for Powell’s comments in Jackson Hole. If we hear the Fed chief taking a more stridently dovish tone, this could well open the door to fresh downside in USDJPY, creating clear divergence between the Fed and BOJ.

Technical Views

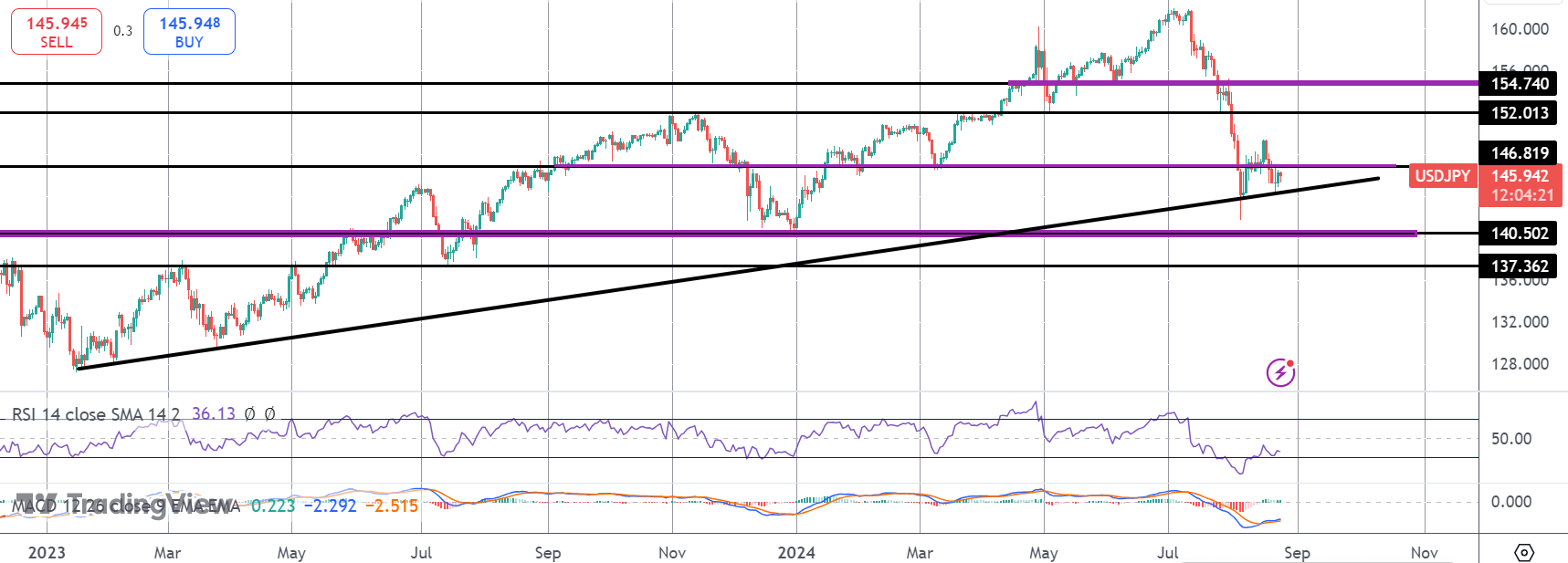

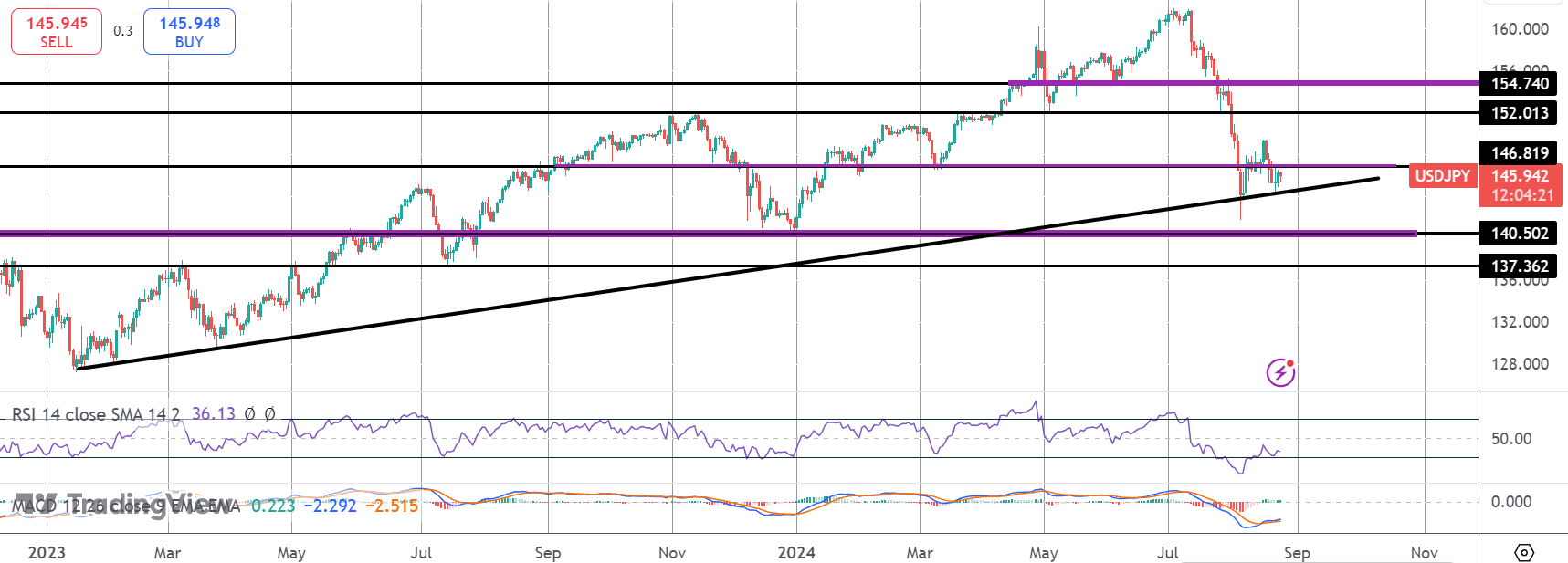

USDJPY

For now, the pair remains above the bull trend line from last year’s lows. While this holds, a fresh push higher is still viable if bulls can get back above 146.81 near-term, putting focus back on 152. Below the trend line, 140.50 will be next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.